Investing in solar energy represents a significant step towards energy independence and reduced utility costs. A crucial consideration for anyone evaluating this transition is the "solar payback period." This metric indicates how long it takes for the savings generated by a solar energy system to offset its initial investment. While the concept is simple, the calculation and expectations differ significantly for homeowners and businesses.

Understanding these differences helps you make informed decisions, whether you are aiming to power your home or optimize your company's operational expenses. This article provides a comprehensive look at solar payback periods, detailing the factors that influence them for both residential and commercial applications.

Understanding the Solar Payback Period

The solar payback period is the time it takes for your solar energy system to generate enough savings to cover its upfront cost. Think of it as your break-even point. Once you reach this point, the electricity your system produces is essentially free, leading to substantial savings over the system's lifespan. Calculating this period involves considering the total system cost, projected energy bill savings, and any available incentives.

Why does this matter? A shorter payback period means you start realizing pure financial gains from your solar investment more quickly. This metric helps quantify the return on your investment, highlighting how long it takes for solar savings, combined with incentives, to cover the initial outlay.

Residential Solar Payback: A Homeowner's Approach

For homeowners, the decision to go solar often involves a blend of financial savings, environmental aspirations, and a desire for energy security. The residential solar payback period typically ranges from 6 to 10 years, though this can vary from 3 to 12 years based on specific circumstances. For instance, homeowners in areas with high electricity costs or generous solar incentives often experience a shorter payback.

Factors Influencing Residential Payback

- Electricity Rates: High electricity rates mean greater savings from solar, which shortens your payback period. For example, the national average residential retail electricity price in the U.S. was around 16.63 cents per kilowatt-hour in 2024, a notable increase from 2014.

- System Cost: The total cost of your solar panel installation, including equipment and labor, directly impacts the payback period.

- Solar Irradiation: The amount of sunlight your home receives annually plays a significant role in how much electricity your panels generate.

- Incentives and Rebates: Federal incentives, such as the Investment Tax Credit (ITC), and state-specific rebates or Solar Renewable Energy Certificates (SRECs) can substantially reduce the upfront cost.

- Energy Consumption: Homes with higher electricity usage tend to see faster paybacks because they offset more expensive grid electricity with their own solar power.

- Financing Options: Whether you pay with cash or use a solar loan affects your total investment cost and, consequently, your payback period.

Homeowners often evaluate their solar investment based on achieving a net cumulative positive cash flow relative to purchasing electricity. This approach considers factors like median income, household population density, electricity rates, average annual solar irradiation, average mortgage interest rates, and current installed PV capacity at the ZIP code level.

Our home energy storage systems, which integrate lithium batteries, hybrid inverters, and solar panels, help homeowners maximize their solar benefits. By storing excess solar energy, you can use it during peak hours when grid electricity is more expensive, further reducing your bills and enhancing your energy independence. Our off-grid solar solutions provide complete energy autonomy, ideal for homes or farms seeking full independence from the utility grid.

Commercial Solar Payback: A Business Strategy

Businesses approach solar investments with a focus on Internal Rate of Return (IRR) and long-term cash flow analysis, often over a 30-year period. The adoption of commercial solar is gaining momentum as businesses seek to reduce operating costs and enhance sustainability. Commercial solar panel systems often have shorter payback periods compared to residential installations, primarily due to higher energy consumption levels and economies of scale.

Key Metrics and Influencing Factors for Businesses

- Internal Rate of Return (IRR): This financial metric helps businesses assess the profitability of an investment over time. Projects with higher IRRs are generally more attractive. Some commercial solar installations have demonstrated an IRR of 18%.

- 30-Year Cash Flow Analysis: Businesses perform detailed financial modeling to project savings and returns over the long term, considering all costs and benefits.

- Installation Costs: Similar to residential, the initial investment directly affects the payback period. Larger systems can sometimes benefit from lower material and installation costs per unit, which translates to enhanced energy savings.

- Energy Consumption and Savings Potential: Businesses typically have higher energy demands, meaning greater potential for savings by generating their own electricity. For example, large industrial facilities often see the shortest payback periods due to their substantial energy use.

- Government Incentives and Tax Breaks: Commercial projects benefit from federal incentives like the Investment Tax Credit (ITC), which can cover a significant portion of system costs. Businesses may also leverage depreciation benefits.

- Electricity Costs and Trends: Rising utility rates make solar an increasingly cost-effective solution, as the savings become more substantial.

- Operational and Maintenance Costs: These ongoing expenses are factored into the financial analysis, though they are often minimal compared to traditional energy sources.

Our lithium iron phosphate (LiFePO4) batteries offer high performance and reliability for commercial energy storage, ensuring businesses have access to consistent power. Our advanced solar inverters efficiently convert solar power for business operations, contributing to optimal system performance and faster returns.

Comparing Residential and Commercial Solar Investments

While both residential and commercial solar investments aim for financial benefit, the decision-making processes and the scale of impact differ. Homeowners prioritize direct bill savings and increased property value, while businesses focus on broader financial metrics, operational efficiency, and long-term strategic advantages.

| Feature / Metric | Residential Solar | Commercial Solar |

|---|---|---|

| Primary Goal | Bill reduction, energy independence, environmental impact | Cost reduction, ROI, sustainability, energy security |

| Key Financial Metric | Net cumulative positive cash flow | Internal Rate of Return (IRR), 30-year cash flow analysis |

| Typical Payback Range | 6-10 years (average 7.1 years in 2025) | 3-10 years (often shorter due to scale) |

| Influencing Factors | Median income, household density, electricity rates, solar irradiation, incentives, system size, roof characteristics, financing | Installation costs, energy consumption, utility rates, incentives (ITC, depreciation), financing, operational costs, ability to sell excess power |

| Impact of Storage | Enhanced resilience, peak-shaving, increased home value | Demand charge reduction, backup power, smart tariff savings, increased resilience |

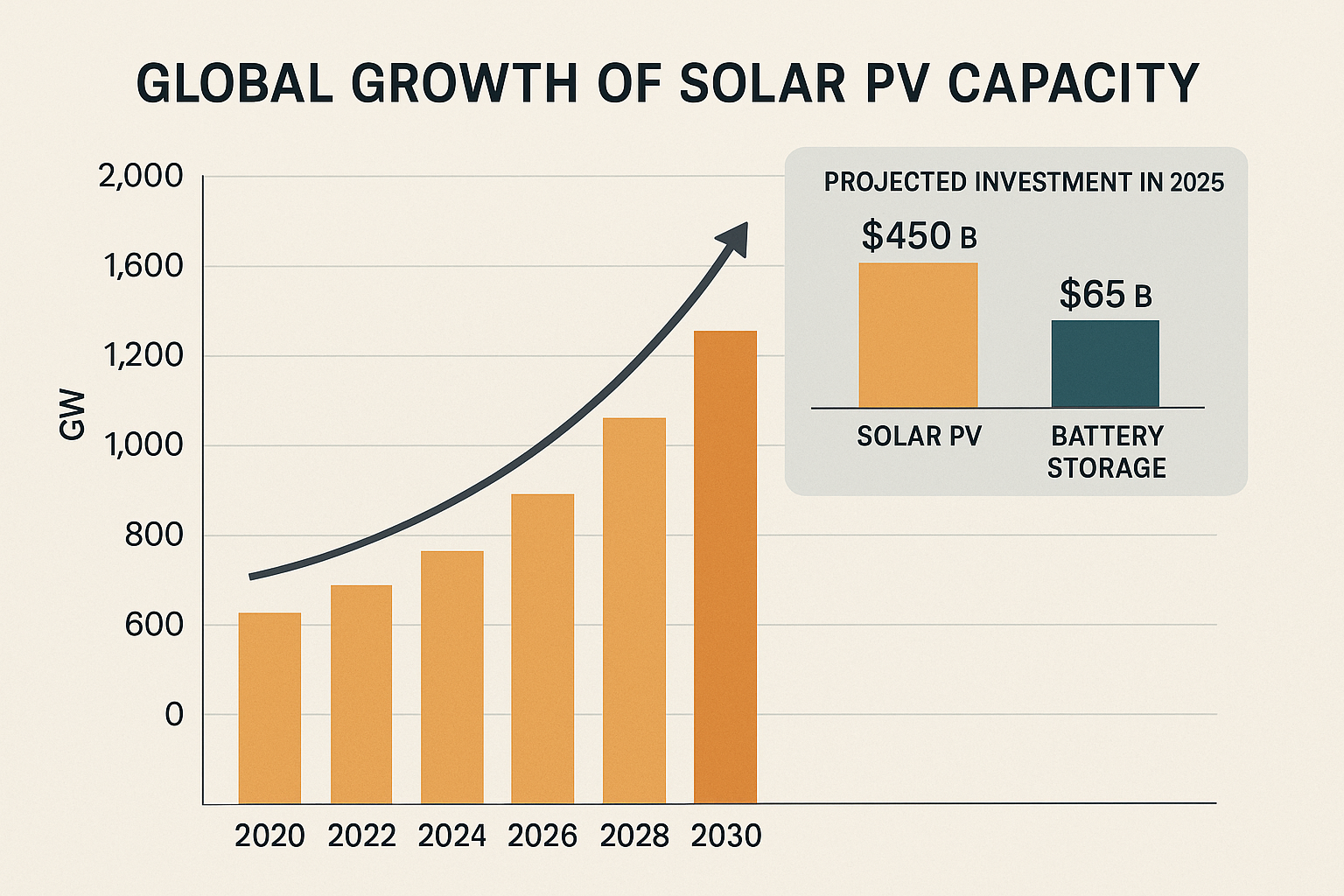

The International Energy Agency (IEA) noted that solar is now the cheapest electricity in history, having become cheaper than coal and gas in most major countries. The International Renewable Energy Agency (IRENA) reported a remarkable 90% decrease in the global weighted average Levelized Cost of Electricity (LCOE) for solar PV between 2010 and 2023. This ongoing cost reduction continues to make solar an attractive investment for both homes and businesses. Solar PV investment surpassed all other power generation technologies combined in 2023, showcasing its global appeal.

Maximizing Your Solar Investment

Regardless of whether you are a homeowner or a business, several strategies can help optimize your solar payback period and overall investment returns:

- Leverage Incentives: Stay informed about federal, state, and local tax credits, rebates, and other programs. For example, the federal ITC can significantly reduce upfront costs.

- Optimize System Sizing: Ensure your solar system is appropriately sized to meet your energy needs without overproduction, maximizing savings.

- Consider Energy Storage: While adding battery storage may slightly extend the initial payback period for solar alone, it offers substantial benefits. Batteries allow you to store excess solar energy for use during peak pricing hours or grid outages, reducing reliance on the grid and enhancing energy independence. This also provides backup power, a critical benefit for both homes and businesses.

- Monitor Electricity Rates: In regions with volatile or rising electricity prices, solar becomes more valuable as it hedges against future cost increases.

- Choose Reliable Components: High-quality solar panels and inverters ensure efficient energy production and long system life, contributing to sustained savings. Our high-performance, safe, and reliable LiFePO4 batteries and solar inverters are designed to maximize your system's efficiency and longevity.

Studies show that solar panels increase home value, which can help recoup costs even if you move before your calculated payback period.

Achieving Energy Independence

The journey to energy independence is a compelling reason for many to adopt solar power. The solar payback period is a vital financial metric, offering a clear path to recouping your investment. For residential users, this means significant savings on electricity bills and increased property value. For businesses, it translates to reduced operating costs, enhanced sustainability, and a more resilient energy supply.

The solar industry continues to grow at a historic pace, with solar PV accounting for a substantial portion of new renewable energy capacity additions globally. The decreasing costs of solar technology, as highlighted by organizations like IRENA and the IEA, make solar an increasingly attractive and accessible option. By carefully considering the factors that influence payback and embracing integrated energy solutions, you can achieve substantial financial returns and contribute to a more sustainable future.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.