Investing in solar energy marks a significant step towards energy independence and a sustainable future. Homeowners and businesses often consider the return on investment (ROI) and the payback period as crucial metrics. These figures help evaluate the financial viability of a solar installation. While solar offers compelling long-term benefits, certain common pitfalls can undermine its economic appeal. Understanding these challenges and implementing effective solutions ensures your solar investment delivers its full potential.

Initial Cost Considerations and Planning Accuracy

A successful solar installation begins with precise planning and a clear understanding of financial commitments. Miscalculations here can significantly delay your payback period and reduce overall ROI.

Underestimating Up-front Expenses

The initial outlay for a solar energy system can be a deterrent for many potential investors. High up-front expenses are a significant economic barrier, as highlighted in a report by the IEA. This report notes that customers, particularly those with less wealth, often prefer immediate financial benefits over long-term savings, making the initial cost a real impediment. For instance, a solar box cooker in India, costing at least Rs.1500 (USD 32), faces resistance because the payment is upfront, even though the cost becomes negligible over 15 years or more. According to the IEA, the payback time criterion, while simple, often misleads investors by completely ignoring the economic life of an investment after its payback period. This criterion can lead to preferring a short-payback, short-lifetime investment over a longer-payback, more profitable one. The costs of capital represent a substantial share of the levelized cost for renewable energy technologies, which are inherently capital-intensive and require major initial investment with long returns, as detailed in an IEA report.

- Solution: Comprehensive Cost Analysis. Account for all expenses: equipment (solar panels, inverters, batteries), installation, permitting, and potential upgrades to your electrical system. Consider the long-term benefits that outweigh the initial investment. Our high-performance, safe, and reliable Lithium Iron Phosphate (LiFePO4) batteries offer extended lifespans, contributing to greater overall value and reducing the true cost of ownership. You gain a clearer picture of the total investment and its sustained returns.

Ignoring System Sizing and Design

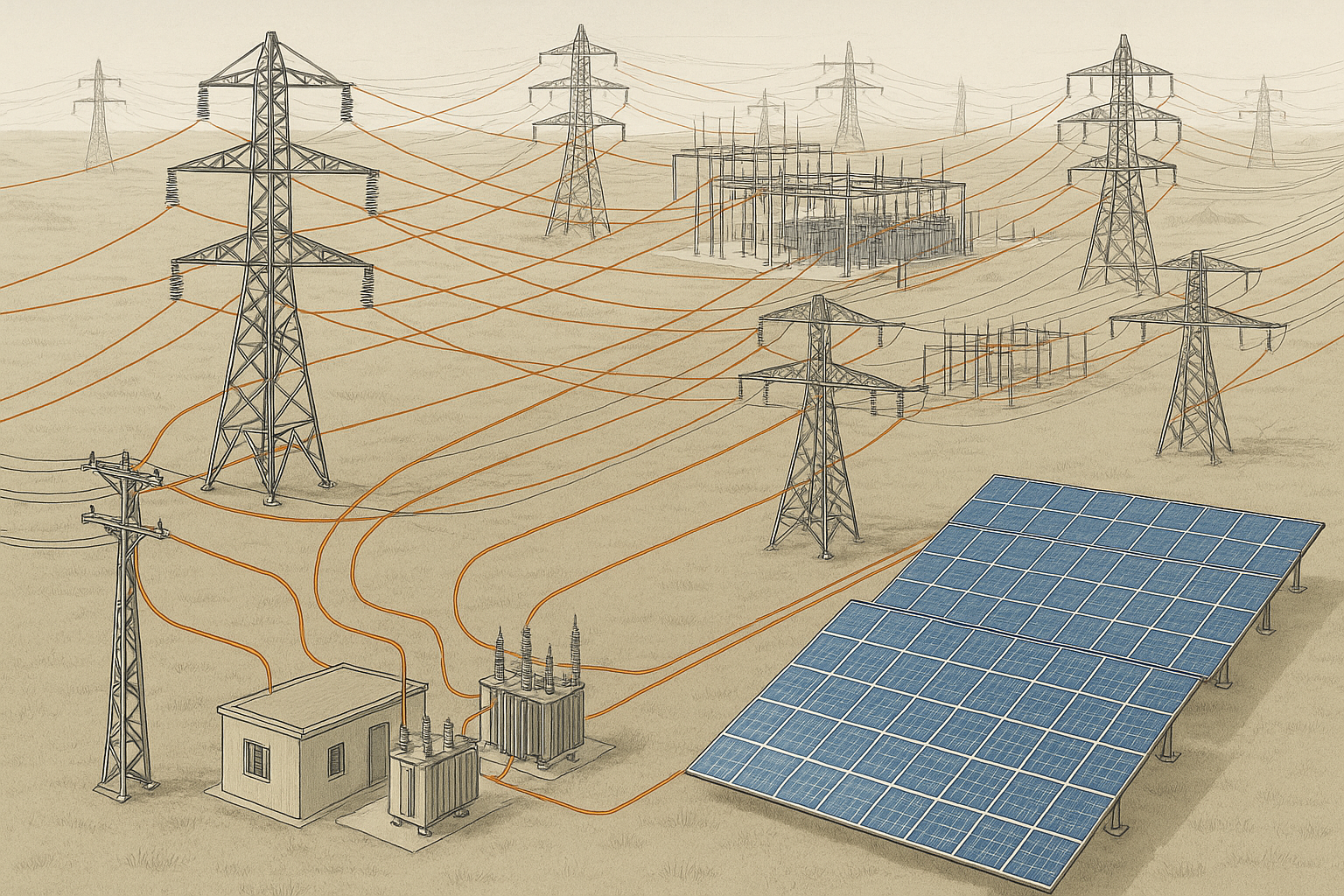

An improperly sized solar system, either too small or too large, will impact your ROI. An undersized system may not generate enough power to offset your electricity bills fully, forcing continued reliance on expensive grid power. This limits your savings and extends the payback period. Conversely, an oversized system incurs unnecessary capital costs for excess capacity you may not utilize, extending the payback period without proportional benefits. This wastes valuable resources and prolongs the time until you see a positive return.

- Solution: Professional Energy Assessment. A thorough assessment of your current and future energy consumption patterns is crucial. This helps design a system that precisely matches your specific needs, whether it is a grid-tied setup or a comprehensive off-grid solar solution for homes, farms, or remote cabins. Proper sizing ensures optimal energy generation and consumption, maximizing your self-consumption and accelerating your payback period. Expert design considers factors like roof space, shading, and local climate conditions to optimize panel placement and tilt.

Performance and Operational Considerations

The long-term performance and ongoing management of your solar system directly influence its profitability. Overlooking these aspects can lead to diminished returns and a slower path to energy independence.

Overlooking System Efficiency and Degradation

Solar panels experience a natural, gradual degradation in efficiency over time, typically a median rate of about 0.5% per year. This means a 20-year-old panel is still capable of producing about 90% of its original capability. Additionally, the efficiency of your solar inverter, which converts direct current (DC) from panels into alternating current (AC) for your home, significantly impacts overall system output. An inefficient inverter can waste a substantial portion of the power generated by your panels, directly reducing your system's productivity and extending its payback period.

- Solution: Quality Components and Monitoring. Invest in high-quality solar panels with low degradation rates and highly efficient solar inverters. Our solar inverters are engineered to maximize energy conversion, ensuring you capture as much power as possible from your panels. Regularly monitor system performance to detect any drops in efficiency early. A well-designed home energy storage system, integrating our robust lithium batteries and a hybrid inverter, can also enhance efficiency. It stores surplus energy generated during peak sunlight hours for use when the sun is not shining, reducing reliance on the grid during expensive peak times and increasing your self-sufficiency.

Neglecting Maintenance and Monitoring

While solar systems are generally robust, neglecting routine checks can lead to performance issues and reduced energy production. Accumulated dirt, dust, or debris on panels can significantly block sunlight, reducing output. Unnoticed wiring issues or minor component malfunctions can also compromise efficiency, leading to lost energy generation and a longer payback period.

- Solution: Regular Inspections and Cleaning. Keep panels clean from dirt, dust, and debris. Periodically inspect wiring and connections for any signs of wear or damage. Many modern systems offer remote monitoring capabilities, allowing you to track performance metrics, identify potential problems proactively, and receive alerts for anomalies. Proactive maintenance ensures your system operates at peak efficiency, maximizing energy yield and accelerating your payback. Consistent performance translates directly into consistent savings.

Financial and Policy Dynamics

The financial landscape and evolving policy environment play a crucial role in determining your solar ROI. Staying informed and leveraging available support is vital for optimizing your investment.

Miscalculating Incentives and Tariffs

Government incentives, such as tax credits, rebates, and feed-in tariffs, along with net metering policies, can significantly reduce the net cost of your solar system and enhance its financial returns. However, these policies can change over time, impacting future savings. Misunderstanding eligibility criteria or failing to account for policy sunset dates can lead to inflated ROI expectations. For example, some Indian states allow annual or monthly compensation periods for surplus generation, with remuneration for outstanding credit varying. The attractiveness of such a solution depends on the electricity tariff and may require additional subsidies for residential consumers. According to an IEA report, improvements could include shortening the period in which generation credits can be redeemed or introducing levies for banking and wheeling of electricity to balance consumer and utility interests.

- Solution: Stay Informed and Adapt. Research current federal, state, and local incentives thoroughly. Understand how net metering schemes operate in your region, including any limitations or changes. Adapt your financial projections to reflect potential policy shifts. Consulting with solar finance experts or reputable installers can help you navigate the complexities of available incentives and ensure you capture all eligible benefits.

Discounting the Time Value of Money

Focusing solely on a short payback period can be misleading and lead to suboptimal investment decisions. The payback time criterion completely ignores the entire economic life of an investment after it has paid for itself. This can be particularly unfavorable for long-lived investments like solar technologies, as noted in IEA analysis. For instance, a company might prefer an investment with a 2-year payback and a 3-year lifetime over one with a 3-year payback but a 10-year lifetime, even if the latter would be far more profitable over its full duration. Many enterprises, small or large, use this criterion for selecting—or rejecting—investments, often missing out on greater long-term profitability.

- Solution: Long-Term Financial Projections. Evaluate your investment using comprehensive metrics such as Lifetime Savings, Internal Rate of Return (IRR), and Net Present Value (NPV). These methods account for the full operational lifespan of your system and the long-term savings it generates, providing a more accurate picture of true profitability. Our energy solutions are designed for durability and extended performance, ensuring sustained benefits and significant financial returns well beyond the initial payback period. This holistic view helps you make a truly informed decision.

Overlooking Financing Options

The upfront capital intensity of renewable energy technologies, including solar, often necessitates significant initial investment with long return periods, as detailed in an IEA report. While banks, credit unions, and other lenders are increasingly offering loans for rooftop PV systems, significant barriers to accessing this growing market still remain for homeowners and businesses, according to an IEA technology roadmap. Efforts are underway to standardize contracts and underwriting processes, as well as educate lenders about the risks and rewards of the solar asset class. For example, NREL studies found that residential systems with solar loans could have a lower levelized cost of energy (LCOE) compared to systems with power purchase agreements (PPAs), due to the higher cost of capital in PPA transactions.

- Solution: Explore Diverse Financing. Research various financing avenues, including solar loans, leases, and power purchase agreements (PPAs). Each option has different implications for upfront costs, ownership, and long-term savings. Understand the terms and conditions of each to find the option that aligns best with your financial situation and risk tolerance. Many lenders now offer specialized solar financing products designed to make solar accessible. Our commitment to providing reliable and scalable energy solutions extends to helping customers understand how these options can facilitate their transition to energy independence.

Securing Your Energy Future

Maximizing your solar ROI and achieving a faster payback period involves a holistic approach. It requires careful planning, diligent maintenance, and an informed understanding of financial and policy landscapes. By addressing these common pitfalls, you position yourself for long-term energy independence and substantial financial savings.

With years of experience in the solar and energy storage industry, we specialize in providing reliable and scalable energy solutions. Our focus on lithium battery manufacturing, comprehensive energy storage systems, and integrated ESS development ensures you receive high-performance products tailored to your needs. From our robust lithium iron phosphate batteries to complete home energy storage systems and efficient solar inverters, we empower you to achieve true energy independence and unlock the full economic potential of your solar investment.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.