This expanded EEAT-enhanced guide builds on IEA, DOE/NREL, and utility/finance data to explain why PV project budgets often deviate from expectations. It focuses on hidden risks—supplier quality, tariffs, and foreign exchange—but also examines financing, permitting, and labor challenges. It provides context, examples, and strategies to improve resilience.

Table of Contents

- Supplier Quality Risks and Due Diligence

- Tariffs, Trade Policies, and Cost Inflation

- Foreign Exchange (FX) Risks in Global Projects

- Other Hidden Cost Drivers

- Comprehensive Strategies for Resilient Projects

- Frequently Asked Questions

- References and Tools

1) Supplier Quality Risks and Due Diligence

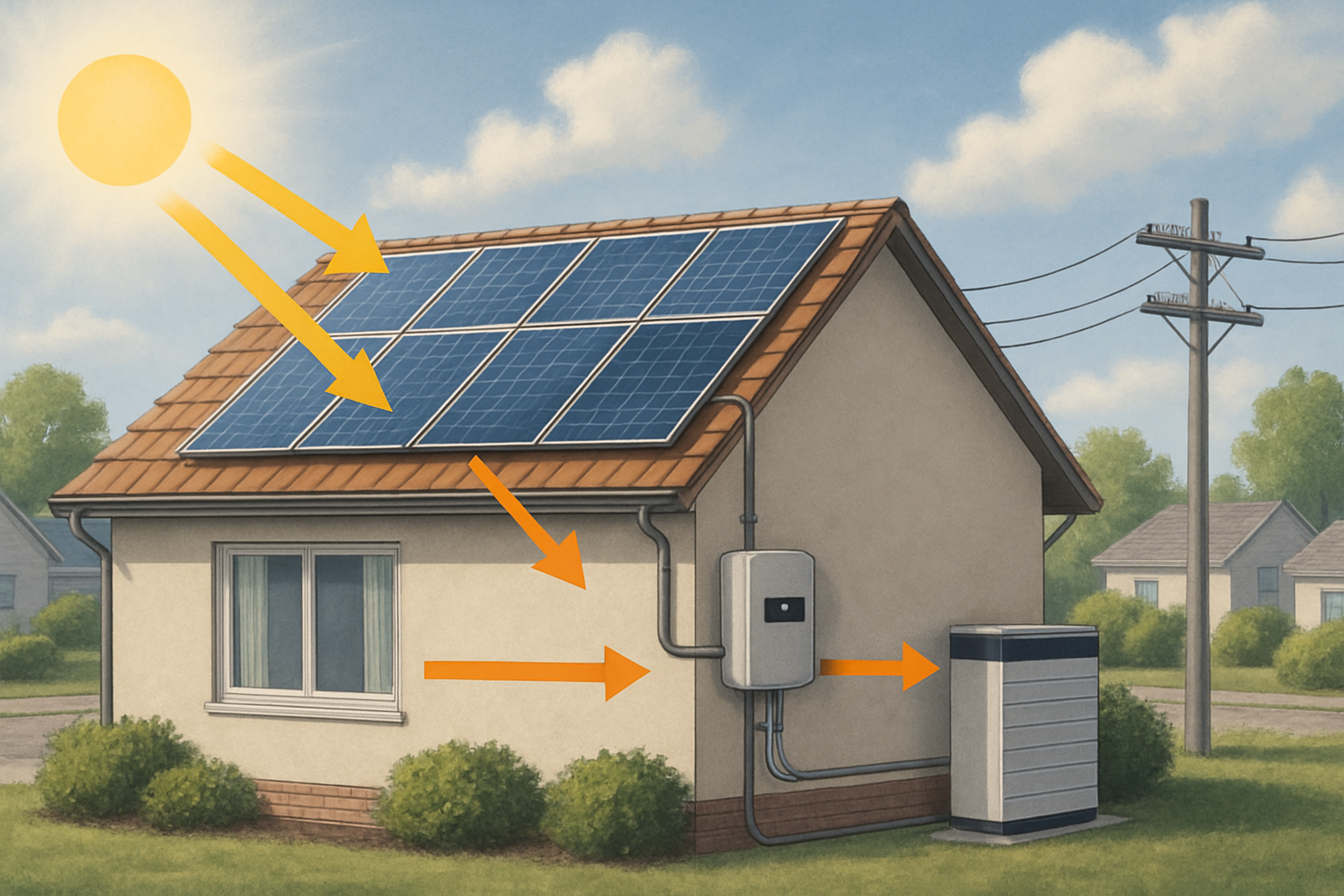

The foundation of project performance lies in component quality. Developers tempted by low-cost offers often face reduced yields, warranty claims, and reputational risks. Poor-quality modules, for example, may suffer from potential-induced degradation (PID), hot spots, or early delamination. Substandard inverters can fail under grid disturbances. These failures not only cut output but can also trigger costly downtime and debt service challenges.

Best practices include: requiring IEC/UL certifications, commissioning third-party lab tests, and implementing ongoing quality inspections. Investors and lenders increasingly demand evidence of supplier track records, making due diligence a prerequisite for financing.

Advanced lithium iron phosphate (LiFePO4) batteries, with high cycle life and safety margins, exemplify how component selection affects long-term stability. Choosing bankable suppliers mitigates hidden operational expenses and strengthens financial models.

2) Tariffs, Trade Policies, and Cost Inflation

Tariffs and trade barriers are among the most unpredictable drivers of solar costs. For instance, global module prices, which fell for a decade, reversed after 2020, rising 20% by late 2022 due to tight material markets and labor constraints【60†source】. Even as polysilicon costs declined and manufacturing expanded in Asia, tariffs continued to distort pricing. Developers importing equipment into the U.S. or EU face duties that can shift total installed costs significantly.

Regional legislation adds another dimension. The European Union’s proposed Net Zero Industry Act seeks to manufacture 40% of its clean energy equipment domestically by 2030【60†source】. While this may strengthen local industry, it also reshapes global supply chains. Similar dynamics appear in the U.S., where the Inflation Reduction Act (IRA) links tax credits to domestic content. For developers, such policies create both opportunity and uncertainty.

Risk mitigation measures: diversify suppliers across regions, maintain alternative procurement pathways, and stress-test budgets against multiple tariff scenarios. Engaging trade experts or monitoring WTO filings can provide early signals of change.

3) Foreign Exchange (FX) Risks in Global Projects

PV projects often involve cross-border flows: equipment purchased in USD or EUR, debt serviced in foreign currency, and revenue earned in local currency. Currency mismatches magnify risk. For emerging markets, depreciation against the dollar increases the effective cost of imported modules and raises repayment burdens【60†source】. In extreme cases, this can push projects into distress.

Example: A project budgeted at $50 million in local currency may balloon by 10–20% if the domestic currency weakens substantially during procurement. Without hedging, these shifts can wipe out expected margins.

Mitigation strategies: deploy hedging instruments (forwards, swaps, options), structure contracts in stable currencies, and establish reserves. Conservative project finance models should test sensitivity to ±15–20% FX swings to ensure debt service coverage ratios remain intact.

4) Other Hidden Cost Drivers

Rising Capital Costs and Financing

Base rate hikes in 2022 and beyond increased borrowing costs worldwide. The IEA notes that LCOE for solar PV and wind rose in 2022 for the first time in years, though still more attractive than fossil-based generation【60†source】. Projects reliant on leverage face higher interest expenses, compressing returns.

Permitting Delays

Permitting bottlenecks across Europe and Asia hold back gigawatts of planned capacity【60†source】. Long queues inflate development costs by extending project timelines. Delays also erode IRR (internal rate of return), as revenues are postponed while costs accumulate.

Labor Shortages

The renewable sector faces competition for skilled electricians, technicians, and engineers. Shortages elevate wages and extend timelines. Developers should include labor sensitivity analyses in financial models to capture this risk.

5) Comprehensive Strategies for Resilient Projects

To navigate these risks, developers must treat budgeting as a dynamic process. Strategies include:

- Supplier management: rigorous audits, diversified sourcing, and long-term partnerships with proven vendors.

- Trade vigilance: monitor evolving tariff policies; integrate scenario planning into budgets.

- Financial hedging: lock FX rates; secure interest rate hedges when feasible.

- Regulatory engagement: maintain dialogue with permitting bodies; anticipate local requirements.

- Human capital planning: invest in training or partnerships to ensure skilled labor supply.

Resilience also requires transparent documentation: quality certificates, loan covenants, warranty terms, and insurance endorsements. These records not only manage risk but also reassure investors and lenders of project robustness.

6) Frequently Asked Questions

Q: Why are supplier audits so important?

A: Because early failures or performance shortfalls directly reduce project cash flows. Audits provide assurance that manufacturing processes and materials meet required standards.

Q: How do tariffs affect LCOE?

A: Tariffs inflate upfront capex, which directly feeds into higher LCOE. For projects with thin margins, even modest tariffs can undermine competitiveness.

Q: What’s the best way to plan for FX risk?

A: Model worst-case scenarios and set aside reserves. Use professional hedging instruments when project scale justifies the cost.

Q: How can developers manage permitting delays?

A: Engage authorities early, track local queue times, and incorporate potential delays into IRR and payback models.

Disclaimer: This guide is educational and does not constitute legal, tax, or investment advice. Always consult licensed experts and monitor official regulatory updates.

7) References and Tools

- IEA: Solar Energy Perspectives — https://www.iea.org/reports/solar-energy-perspectives

- IEA: World Energy Investment 2023 — https://www.iea.org/reports/world-energy-investment-2023

- NREL: PV Finance and Cost Modeling Resources

- EU Net Zero Industry Act Overview

- U.S. Inflation Reduction Act (IRA) domestic content rules

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.