5 Costly Mistakes When Reading Global Solar Targets

Over the years working with developers and policy makers worldwide, I’ve seen many excited plans built around headline solar targets — but excitement alone can lead to big errors. Global targets like those published by IEA or IRENA are vital, yet if you misinterpret them, you risk underestimating costs, delays, or regulatory challenges. Below are five common mistakes, plus insights from field experience and up-to-date data that help avoid them.

Mistake 1: Ignoring the “Soft Costs”

Hardware — solar panels, inverters, frames — often grab headlines, but non-hardware expenses (permits, labor, inspections, customer acquisition, financing) can make up a large proportion of total project cost. For U.S. residential systems, SEIA / Wood Mackenzie data shows soft costs ≈ 65% of the total. :contentReference[oaicite:3]{index=3}

When global targets assume uniform cost declines, they often overlook how local soft cost barriers — inefficient permitting, high labor rates, lengthy inspections — erode profit margins and push back timelines.

Mistake 2: Overlooking Supply Chain Risks

Targets often assume smooth scaling of module, cell, and polysilicon production. But I’ve seen projects delayed by weeks or months when supply chokepoints — shipping, policy restrictions, component shortages — emerge. These delays ripple across costs and can make ambitious GW goals harder to reach than projections imply.

Mistake 3: Equating Capacity (GW) with Actual Energy Generation (GWh)

“1,000 GW installed” sounds impressive, but what matters for stakeholders is how many GWh of power are produced, reliably. Solar irradiance variation, weather, module efficiency, downtime — all pull generation down from the theoretical. Capacity factor and performance ratio are crucial metrics.

For example, a 1 MW plant in Arizona might see ~6.5 kWh/m²/day irradiance, generating ~2,100 MWh/year (capacity factor ~24%), whereas the same MW in a cloudy northern region could generate ~900 MWh/year (~10% capacity factor). These numbers are illustrative but grounded in regional performance data. :contentReference[oaicite:4]{index=4}

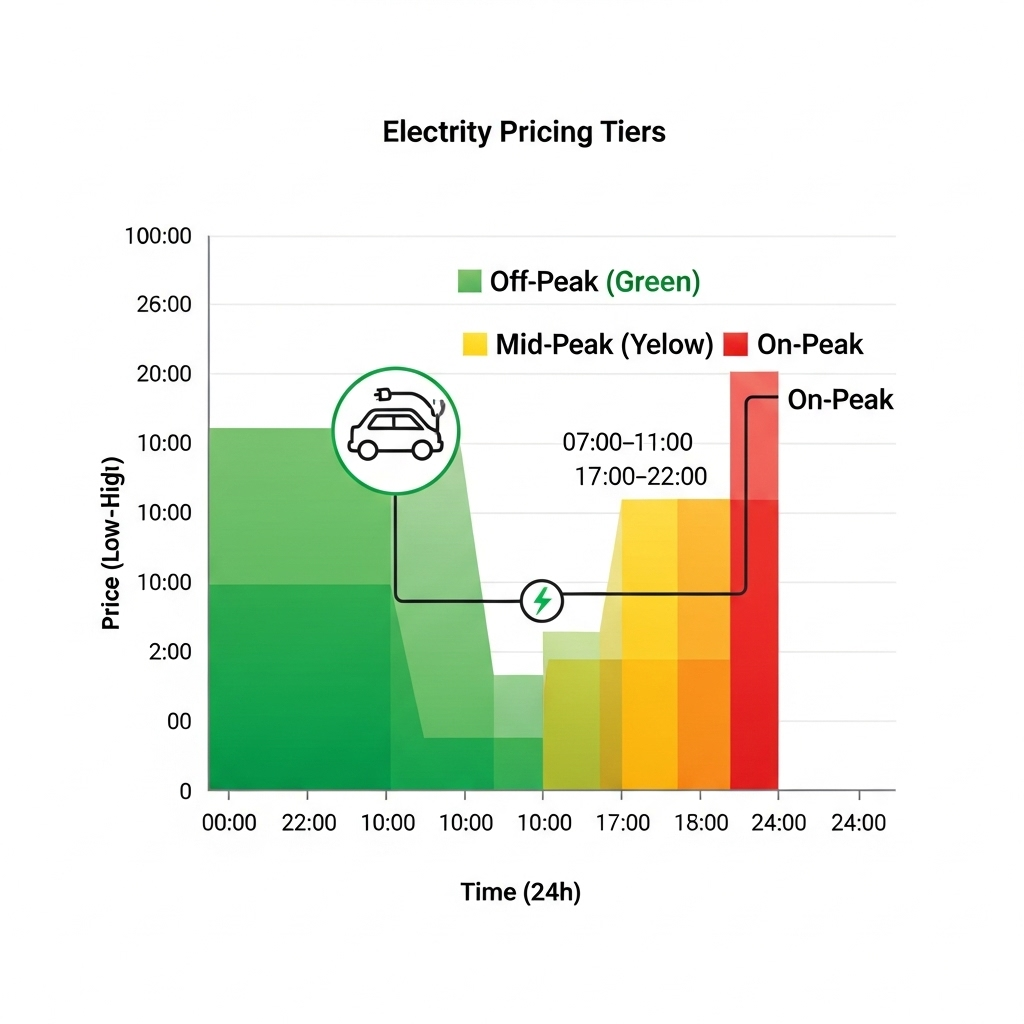

Mistake 4: Underestimating Grid Integration and Flexibility Needs

High penetration of solar causes fluctuations (the “duck curve”), voltage and frequency control issues, and demands for storage or demand response. I’ve seen utility-scale projects underbudget storage or omit ramp-rate constraints, only to have interconnection delayed or curtailed. Effective grid integration depends on flexibility, storage, and policies that accommodate variability.

Mistake 5: Neglecting Policy & Financial Frameworks Behind Targets

Targets are just numbers until backed by strong policy, incentives, stable regulation, and financing. Countries with clear auction systems, tax incentives, streamlined permitting processes tend to exceed deployment goals. I’ve worked on projects where the difference of one policy incentive or tax credit determined whether the target became reality or remained aspiration.

Putting It All Together: Smarter Planning with Realism

Global solar targets can serve as powerful guides — but the headline GW value is just one piece of the puzzle. To avoid being blindsided, I always start planning with local soft cost estimates, map supply chain dependencies, use actual capacity factors for projected generation, assess grid flexibility needs, and align policy/finance environment. When you layer this realism on top of ambition, your solar investments are more likely to succeed — not just in theory, but in practice.

References for Reliable Data

- IEA Technology Roadmap: Solar Photovoltaic Energy

- DOE: Solar Soft Costs Basics

- NREL: Installed System Cost Analysis

- IEA PVPS: Trends in Photovoltaic Applications 2024

Disclaimer: This article reflects my project-level observations and published research. It is for educational purposes only and not financial advice. Check local data, regulations, and policy when making decisions.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.