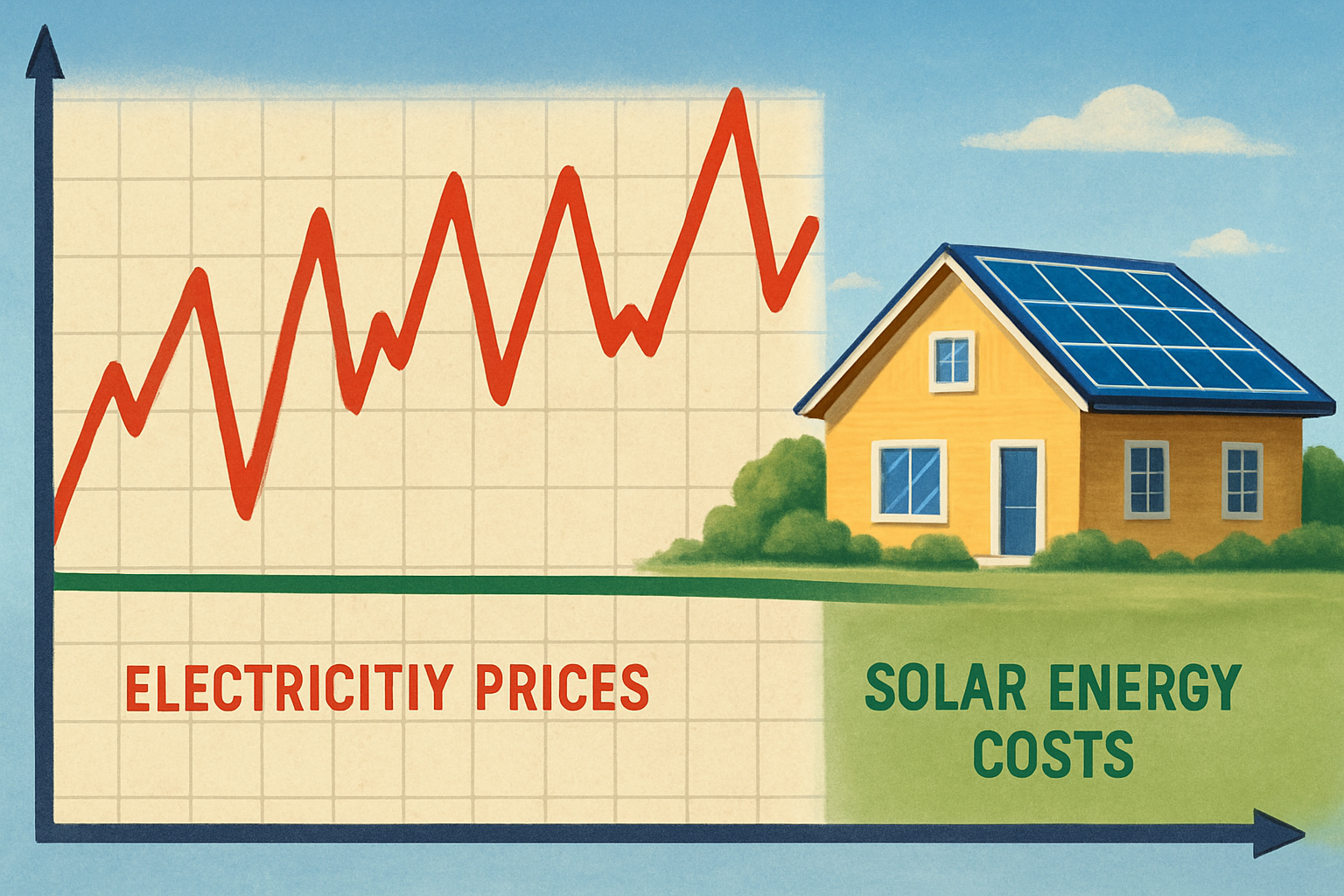

As you consider solar energy for your home, understanding how you get credited for the electricity you generate is crucial. Net metering and Time-of-Use (TOU) rates are two primary mechanisms influencing your electricity bill savings. While their fundamentals remain, their application and profitability are evolving. You might wonder: do these policies still offer significant financial benefits for solar owners? We will examine the current landscape, dispel common myths, and highlight practical strategies to ensure your solar investment continues to deliver long-term value.

Understanding Net Metering and Its Evolution

Net metering has been a cornerstone of residential solar adoption for many years. It allows you to send excess solar electricity back to the grid and receive credits on your bill, often at the full retail electricity rate. This system is straightforward: your meter effectively spins backward when you produce more than you consume, and you only pay for your "net" electricity consumption.

What Is Net Metering and How Did It Work?

Under traditional net metering, the electricity you generate and export to the grid offsets the electricity you pull from the grid. If your solar panels produce more power than your home uses over a billing period, you typically receive a credit that rolls over to the next month or is paid out annually. This simple mechanism made solar highly attractive, providing a clear path to reducing or even eliminating your electricity bills. It was considered "attractive, easy to understand and administer," and in many regions, allowed crediting excess energy for subsequent periods.

Challenges and Policy Shifts

While effective for jump-starting local solar markets, net metering has faced scrutiny as solar adoption grew. Utilities expressed concerns that compensating solar owners at the full retail rate might not accurately reflect the true value of the exported electricity to the grid, which includes generation, transmission, and distribution costs. This has led to policy shifts in various regions. For instance, some areas have explored "value-of-solar" (VOS) tariffs, where producers are remunerated for all energy produced, whether self-consumed or injected, while paying for all energy consumed, whether self-produced or drawn from the grid. Other jurisdictions have moved towards "net billing" schemes, where compensation for exported electricity is based on a wholesale rate or a specific export rate, rather than the full retail rate. This means you might receive less for the power you send back to the grid than you pay for the power you draw from it. The International Renewable Energy Agency (IRENA) highlights that net billing schemes compensate based on the value of kWh consumed or injected, allowing consumers to pay low prices when charging and receive high prices when discharging.

Deciphering Time-of-Use (TOU) Rates

Time-of-Use (TOU) rates change the price of electricity based on the time of day, day of the week, and season. Electricity is more expensive during peak demand periods (e.g., late afternoon and evening) and cheaper during off-peak hours (e.g., overnight and midday).

What Are TOU Rates and How Do They Work?

TOU rates are designed to encourage consumers to shift their electricity usage away from periods of high demand, thereby reducing strain on the grid and potentially avoiding the need for expensive peak power plants. For example, you might pay significantly more for electricity consumed between 4 PM and 9 PM compared to electricity consumed in the middle of the night. This structure is implemented in various forms, including real-time pricing and critical peak pricing in some European countries.

Impact on Solar Owners

For solar owners, TOU rates introduce a new layer of complexity. Your solar panels typically produce the most electricity during midday, which might be an off-peak period with lower electricity prices. This means the excess electricity you export during these hours might be credited at a lower rate than the electricity you consume during peak evening hours when your solar production has declined or ceased. This scenario can reduce the overall financial benefit of your solar system if you are not strategically managing your energy use.

The Role of Energy Storage in Modern Solar Economics

With the evolution of net metering and the prevalence of TOU rates, energy storage systems (ESS) have become increasingly vital for maximizing the profitability and utility of solar installations. Our home energy storage systems, which integrate high-performance and reliable lithium iron phosphate batteries, hybrid inverters, and solar panels, offer a comprehensive solution.

Bridging the Gap: Storage and TOU

An energy storage system allows you to capture and store the excess solar energy generated during the day, particularly during off-peak or lower-value TOU periods. You can then discharge this stored energy during peak TOU periods when electricity prices are higher. This strategy, often referred to as "arbitrage," significantly enhances your savings by reducing the amount of high-priced electricity you need to draw from the grid. IRENA notes that for a battery to benefit from price differentials, net billing schemes are required, allowing consumers to pay low prices when charging and receive high prices when discharging.

Furthermore, an ESS increases your self-consumption of solar energy. Instead of exporting valuable power at low rates, you use more of your own generated electricity. This maximizes the return on your solar investment and lessens your dependence on utility rate structures. For example, if your solar panels produce 10 kWh during off-peak hours, storing this energy to use during a 5 kWh peak demand period means you avoid purchasing expensive grid electricity during that time.

Enhanced Resilience and Value

Beyond financial optimization, an integrated ESS provides invaluable energy independence and resilience. In the event of a grid outage, your stored energy can power essential loads in your home, ensuring continuity and comfort. This backup power capability is a significant advantage, particularly in areas prone to grid instability. Our off-grid solar solutions, for instance, are designed to provide complete energy independence for homes, farms, and remote cabins, ensuring reliable power even without grid access.

The addition of an ESS also acts as a long-term hedge against future electricity rate hikes. By generating and storing your own power, you gain more control over your energy costs for decades to come. As the Levelized Cost of Electricity (LCOE) for solar PV has shown volatility but remains competitive against fossil fuels, investing in solar with storage provides a robust financial hedge.

Long-Term Savings and Future Outlook

Despite changes to net metering and the complexities of TOU rates, solar energy, especially when paired with storage, continues to offer substantial long-term savings and benefits.

Calculating True Savings

When evaluating your solar investment, look beyond simple bill credits. Consider the avoided costs of purchasing grid electricity, the value of energy independence, and the hedge against future rate increases. The "World Energy Investment 2023" report indicates that capital spending on new generation continues to set records, driven by strong solar performance, with China alone adding over 100 GW of solar PV capacity in 2022. This global expansion reflects the enduring economic viability of solar. While the average LCOE for solar PV in Europe increased by 30% between early 2021 and late 2022, absolute values remain low, and capital cost pressures are expected to ease.

The benefits are further amplified by supportive policies. For instance, the Inflation Reduction Act in the United States includes significant financial support for low-emission technologies, including tax credits for solar PV and storage. Similarly, the European Union has raised its renewable target for 2030 to a minimum of 42.5% of final energy consumption, signaling strong policy backing.

Navigating Policy Changes

Staying informed about local and regional energy policies is important. Regulations surrounding net metering and TOU rates can vary significantly by utility and state. Engaging with a knowledgeable solar provider can help you understand the specific rules in your area and design a system that maximizes your financial returns under current and anticipated future conditions. Our years of experience in the solar industry, focusing on reliable and scalable energy solutions, enable us to help you achieve energy independence effectively.

A Path Forward

The landscape of solar compensation is indeed evolving, moving beyond the simpler days of traditional net metering. However, this evolution does not diminish the financial viability of solar energy. Instead, it highlights the increasing importance of strategic energy management and the integration of energy storage systems. By combining solar panels with a robust battery solution, you gain the power to optimize your energy usage, leverage TOU rate differentials, and secure predictable electricity costs for decades. This integrated approach ensures your investment in solar continues to pay dividends, providing true energy independence and significant long-term savings for your home.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. You should consult with a qualified professional for advice tailored to your specific situation.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.