In our analysis of the residential solar market, we see the 10kW system emerging as a key benchmark. It often represents the tipping point where a home transitions from simply offsetting its electricity bill to becoming a true energy "prosumer," especially in the context of increasing electrification. However, the question isn't just whether a 10kW system is "enough," but rather, under what conditions does it represent the optimal financial investment? This analysis breaks down the key factors from a project economics standpoint.

Step 1: Moving from Bills to a Strategic Load Profile

The starting point for any energy project is a rigorous understanding of demand. Simply averaging your last 12 utility bills is a rudimentary first step, but it's insufficient for making a 25-year investment decision.

A more sophisticated approach involves creating a **load profile**. We look at monthly and, ideally, daily consumption patterns. Does your peak usage occur in the summer afternoons, driven by air conditioning, or is it more evenly distributed? This profile is critical because it determines how much of your solar generation will be self-consumed versus exported to the grid. The financial value of these two actions can differ significantly based on your utility's net metering or compensation policies.

Crucially, this profile must be forward-looking. In our view, the largest driver of future residential load growth is the **electrification of transportation and heating**. A single electric vehicle can add 3,000 kWh or more to your annual consumption. A 10kW system, which might seem oversized for your current needs, could be perfectly sized for a future that includes an EV and a heat pump.

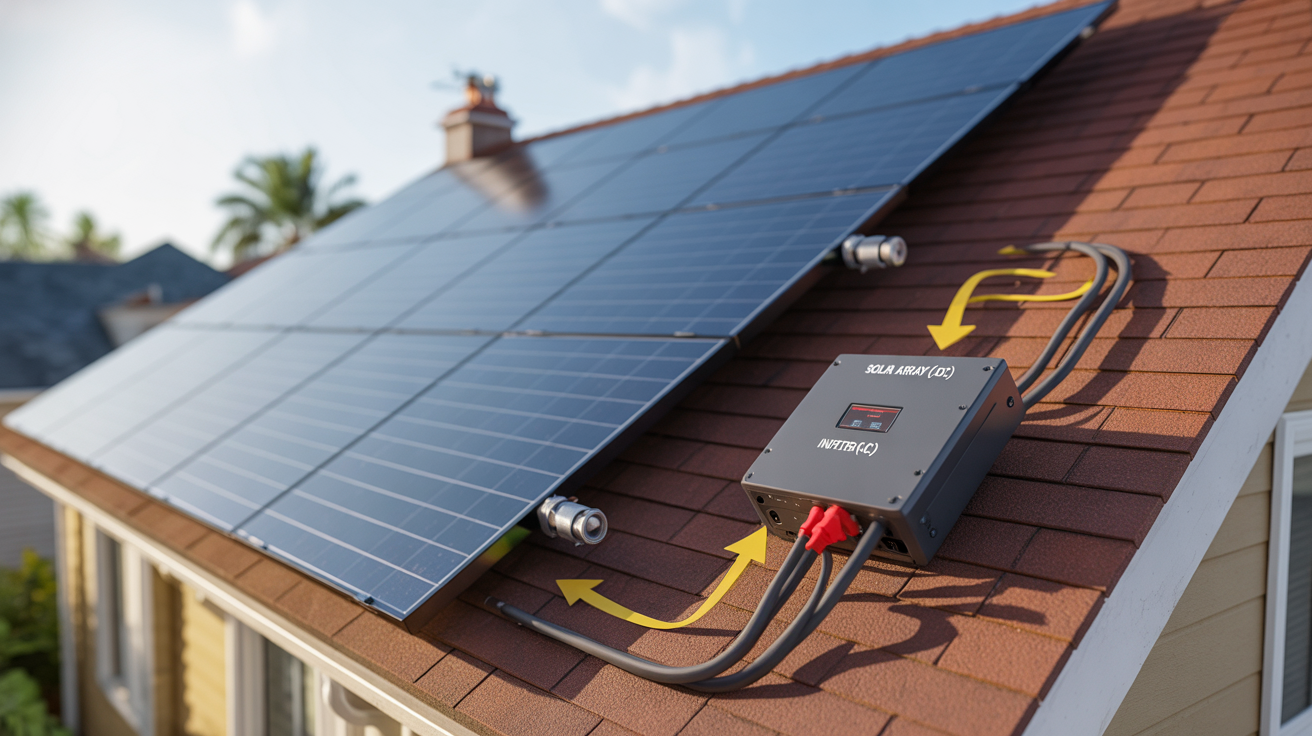

Step 2: Assessing the 10kW System as a Generating Asset

A 10kW system's nameplate rating is its output under ideal laboratory conditions. Its actual performance as a generating asset depends on several real-world variables.

A well-sited 10kW system in a high-irradiance location (like the Southwestern U.S.) might generate 14,000-15,000 kWh annually. In a less sunny region (like the Northeast), that same system might only produce 11,000-12,000 kWh. This geographic variance is the single most important factor in determining the asset's output. Data from sources like NREL is essential for accurate production modeling.

The number of panels is a simple calculation (e.g., 25 panels at 400W each), but the actual annual energy yield is what matters for ROI. This yield is influenced by:

- Site-Specific Factors: Roof orientation, tilt, and any shading will directly impact the system's capacity factor.

- System Derating: Real-world losses from heat, dust, wiring, and inverter inefficiency typically reduce a system's output by 15-20% compared to its nameplate rating.

- Annual Degradation: Panel output degrades over time, usually at a rate of 0.5% per year, which must be factored into long-term financial projections.

Step 3: The Role of Energy Storage in Value Stacking

For a 10kW system, energy storage is less of an add-on and more of a strategic tool for "value stacking"—extracting multiple benefits from the same asset.

Pairing a large solar array with an energy storage system (ESS) unlocks two primary value streams beyond simple self-consumption:

- Resilience: The ability to power essential loads during a grid outage. For larger homes, this is a significant driver of adoption.

- Economic Arbitrage: In markets with Time-of-Use (TOU) electricity rates, a battery allows a homeowner to store cheap solar energy generated midday and use it during expensive evening peak hours, directly increasing the value of every kWh produced.

The decision to add storage, and how to size it, is an economic one that depends entirely on your utility's rate structure and your personal valuation of backup power.

The Verdict: A Checklist for the 10kW Threshold

From our analytical perspective, a 10kW system is likely a strong financial fit if you meet several of the following criteria:

- High Baseline Consumption: Your annual electricity usage is consistently above 12,000 kWh.

- Clear Electrification Path: You have firm plans to acquire an EV, install a heat pump, or add other significant electrical loads within the next 1-3 years.

- Favorable Geography and Site: You live in a region with high solar irradiance and have a large, unshaded, south-facing roof area.

- Supportive Utility Policies: Your utility offers full retail rate net metering or has high TOU rate differentials that make energy storage economically attractive.

- Goal of High Self-Sufficiency: Your primary driver is not just cost savings but a high degree of energy independence and resilience.

Ultimately, a 10kW system is a significant power plant on your roof. Approaching the decision with a clear-eyed analysis of your load, the asset's potential performance, and the local market conditions is the best way to ensure it delivers on its promise for the next 25 years.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.