In our analysis of distributed energy projects, we find that the success of a residential solar investment hinges on accurately forecasting its energy yield. While many factors contribute to this, one metric stands above all others as the primary input for any financial model: **Peak Sun Hours (PSH)**. Understanding PSH is not just a technical exercise; it's the fundamental step in quantifying the "fuel" available to your solar asset, and therefore, its potential revenue stream and return on investment.

Deconstructing Peak Sun Hours from an Analyst's Viewpoint

From a technical standpoint, a Peak Sun Hour is the equivalent of one hour of solar irradiance at an intensity of 1,000 W/m². In financial terms, it's the core unit of energy input that your system can convert into a valuable output (kWh). The total annual PSH for a location dictates the maximum potential of any solar project sited there.

Several key variables influence a location's PSH, and understanding them is crucial for risk assessment:

- Geographic Location: Latitude is the primary determinant. We use solar irradiance maps, often based on data from sources like the U.S. National Renewable Energy Laboratory (NREL), as the starting point for any serious project analysis.

- Seasonality: PSH is not a static figure. It varies significantly between summer and winter. A proper financial model must account for this seasonal fluctuation to accurately project monthly savings and cash flow.

- Weather and Climate: Cloud cover is the most significant source of production variability. Historical weather data for a location allows us to model the probable range of annual energy production, not just a single average number.

Applying Peak Sun Hours to System Sizing and Performance Modeling

Once the available solar resource is quantified, we can use it to size a system that meets specific financial and energy goals. The calculation for determining the required system size is a foundational step in project design.

The Sizing Formula: A Tool for Financial Forecasting

The basic formula connects energy demand to the required asset size:

System Size (kW) = (Average Daily Energy Demand in kWh) / (Average Daily Peak Sun Hours)

However, in our professional models, we never use this simple formula alone. We must apply a **System Derating Factor** to account for real-world performance losses. This factor, typically between 0.75 and 0.85, is a composite of several inefficiencies:

- Temperature losses (panel efficiency decreases as temperature increases)

- Soiling losses (from dust, pollen, or snow)

- Wiring and inverter conversion losses

- Light-induced degradation and age

Factoring in these losses is the difference between a realistic financial projection and one that is overly optimistic and bound to disappoint.

An Applied Example:

Let's model a scenario for a household requiring 30 kWh per day in a location with 4.5 PSH.

- Daily Energy Demand: 30 kWh

- Peak Sun Hours: 4.5

- System Derating Factor (assumed): 0.80

Required System Size (kW) = 30 kWh / (4.5 PSH * 0.80) = 8.33 kW

This calculation shows that an 8.33 kW system is the required asset size to meet the target load under these specific, modeled conditions.

The Business Case for Storage: Mitigating Solar Variability

The primary challenge with solar energy, as the International Energy Agency (IEA) notes, is its variability. While the daily and seasonal patterns are predictable, moment-to-moment output fluctuates with weather. From an investment perspective, this variability introduces risk.

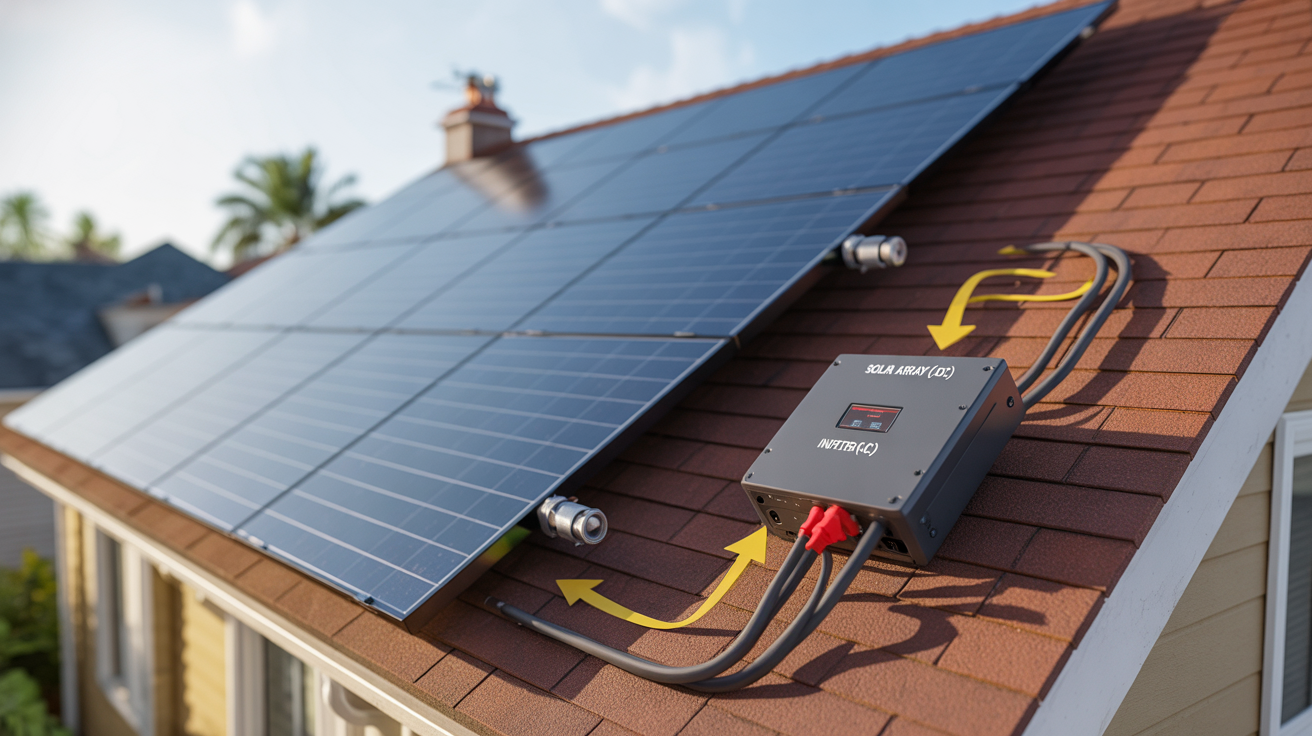

This is where energy storage becomes a critical enabling technology. An energy storage system (ESS) allows a homeowner to "firm" the output of their solar asset. It captures excess energy generated during periods of high solar irradiance (midday) and dispatches it during periods of low or no generation (evening and night). This has two key financial benefits:

- Maximizes Self-Consumption: It ensures the energy you generate is used on-site, which is often more valuable than exporting it to the grid at a lower credit rate.

- Enables Rate Arbitrage: In markets with Time-of-Use (TOU) rates, storage allows you to avoid purchasing expensive grid power during peak evening hours, creating a direct and measurable economic return.

By pairing a solar array with storage, you transform a variable power generator into a dispatchable energy asset, significantly de-risking the investment and increasing its overall value.

Conclusion: PSH as the Bedrock of a Bankable Solar Project

In summary, Peak Sun Hours are far more than a simple technical metric. They are the fundamental input for every stage of a solar project's analysis—from initial sizing and technology selection to long-term financial modeling. Accurately assessing the solar resource at a given location is the first and most critical step in designing a system that will deliver reliable power and a predictable return on investment for years to come.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.