Investing in solar energy brings substantial long-term benefits, from reducing electricity bills to enhancing energy independence. However, achieving a swift return on your solar investment requires careful financial planning. Many homeowners and businesses encounter common budgeting mistakes that can significantly extend their system's payback period. Understanding these pitfalls will help you make informed decisions, ensuring your solar transition is both smooth and financially rewarding.

Underestimating Upfront Costs and System Sizing

The journey to solar energy begins with understanding the initial investment. While solar panels are a primary component, they represent only a portion of the total cost. Overlooking other necessary expenses can lead to unexpected budget shortfalls and delay your system's financial return.

Beyond the Panels: Hidden Expenses

Solar panel arrays are a significant investment, often ranging from thousands to tens of thousands of dollars before incentives. For instance, a residential solar installation in the U.S. can cost between $15,000 and $40,000 before tax credits, with an average cost per watt around $2.75–$3.25.

Beyond the panels themselves, you must account for installation labor, which can make up around 7% of total expenses. Other "soft costs" include system design, engineering, project management, and essential permitting fees, which could account for approximately 28% of costs. If your roof requires repairs or upgrades before installation, these add to the overall expense. Additional equipment, such as high-performance lithium batteries for energy storage or advanced inverters that convert direct current (DC) to alternating current (AC), also contribute to the total investment. These components, while increasing upfront costs, enhance system efficiency and resilience. The International Energy Agency (IEA) notes that high upfront expenses can deter potential investors looking for short payback times, despite the long-term benefits offered by solar heating and cooling systems. Renewable Energy Essentials: Solar Heating and Cooling

The Importance of Correct System Sizing

Properly sizing your solar energy system is crucial for optimal performance and payback. An undersized system may not meet your energy demands, meaning you still rely heavily on grid electricity. Conversely, an oversized system represents an unnecessary upfront expense that takes longer to recoup. Your system's size should align with your current and projected electricity consumption. Integrating a robust home energy storage system, featuring high-performance lithium iron phosphate (LiFePO4) batteries, allows you to store excess solar energy generated during the day. This stored energy can then power your home during peak evening hours or outages, reducing reliance on the grid and maximizing your solar investment. Our integrated ESS solutions, which combine lithium batteries, hybrid inverters, and solar panels, are designed for seamless energy management and enhanced independence.

Overlooking Financial Incentives and Financing Options

The initial cost of solar can be substantial, but numerous financial incentives exist to make solar energy more accessible and accelerate your payback. Failing to explore these options or choose appropriate financing can significantly delay your return on investment.

Maximizing Available Incentives

Government incentives can dramatically reduce the net cost of your solar installation. The federal solar tax credit, also known as the Investment Tax Credit (ITC), is a significant incentive, allowing you to claim a percentage of your system's cost as a credit against your federal income taxes. Currently, this credit is 30% for systems placed in service before January 1, 2026., For an average $28,000 system, the ITC could reduce the cost by $8,400, bringing it down to $19,600. Beyond federal programs, many states and local governments offer additional rebates, property tax relief, or Solar Renewable Energy Certificates (SRECs) that provide income for the solar power you generate. Researching and leveraging these incentives can significantly shorten your payback period. For example, the Department of Energy's SunShot Initiative supported technologies that reduced installation costs by shaving off $0.28 per watt, making solar more affordable and maximizing taxpayer investment. EERE Success Story—California: SunShot-Supported Technology Maximizes Taxpayer's Investment

Navigating Financing Challenges

Securing appropriate financing is another critical aspect of solar budgeting. While high upfront costs can be a barrier, various financing models exist. Historically, a lack of frameworks for evaluating the creditworthiness of smaller companies and consumers has limited financing for rooftop solar projects. Women working in the rooftop solar sector Governments can strengthen measures by increasing preferential credit lines from public financial institutions and developing innovative business models with electricity regulators and utilities. Women working in the rooftop solar sector Loan guarantees, for instance, can reduce investor and banker risks, helping innovative projects secure funding and lower the cost of capital. Solar Energy Perspectives

Here is a comparison of common solar financing options:

| Financing Option | Initial Outlay | Ownership | Impact on Payback | Pros | Cons |

|---|---|---|---|---|---|

| Cash Purchase | Highest | Full | Fastest Payback | Maximizes savings, full control, eligible for all incentives. | Requires significant upfront capital. |

| Solar Loan | Low to Moderate | Full | Moderate Payback | Own the system, benefit from incentives, fixed monthly payments. | Interest accrues, requires credit approval. |

| Solar Lease | None or Low | Third-party | No Direct Payback (Savings) | No ownership, predictable monthly payments, maintenance included. | No ownership of incentives, limited long-term savings. |

| Power Purchase Agreement (PPA) | None | Third-party | No Direct Payback (Savings) | Pay only for generated electricity, no maintenance, no upfront cost. | No ownership of incentives, savings tied to electricity consumption. |

Ignoring Long-Term Factors and Future Planning

A solar energy system is a long-term asset. Neglecting future considerations, such as your residency plans or ongoing system performance, can undermine the financial benefits you expect.

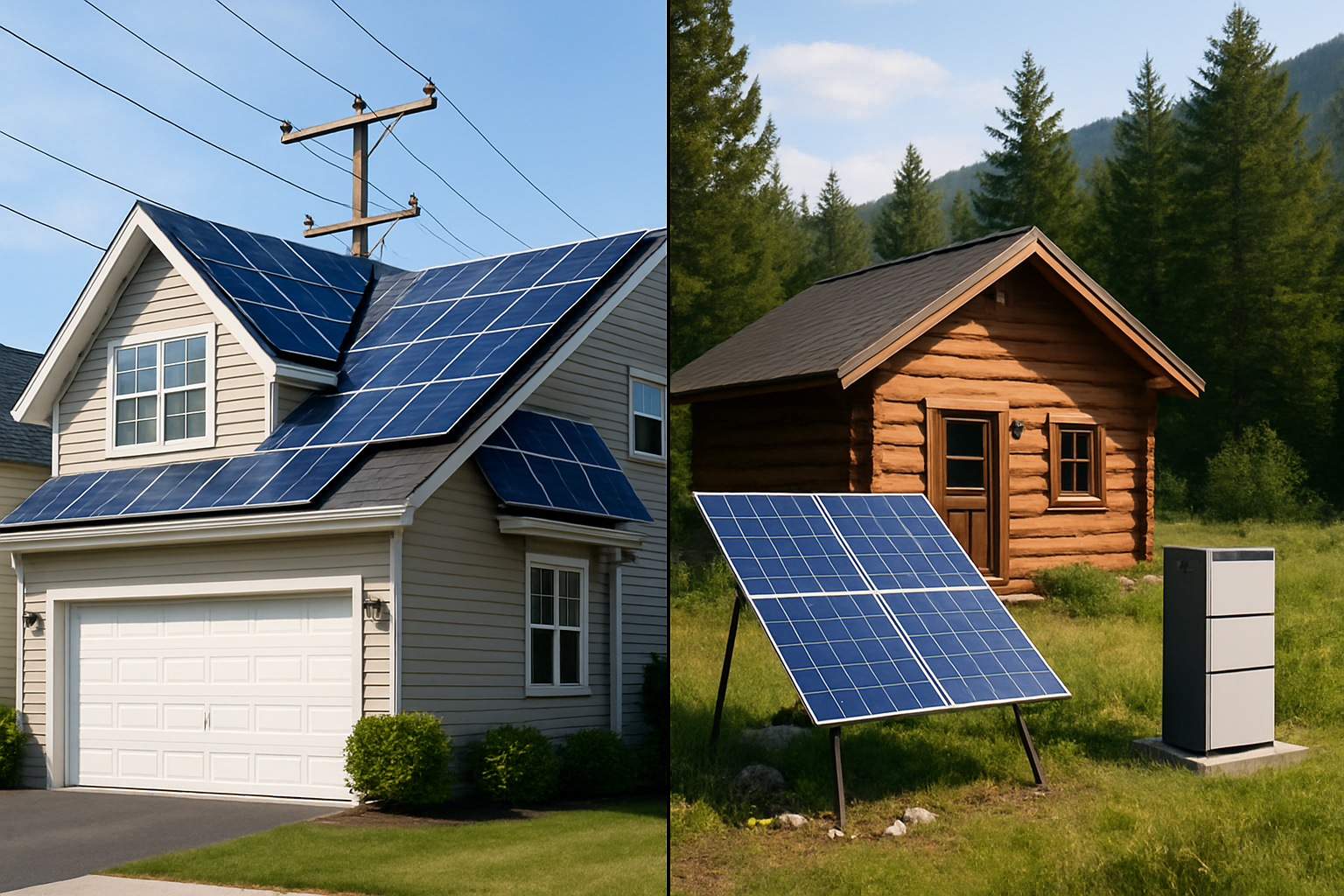

Residency Plans and Investment Return

While solar panels offer significant long-term savings on electricity bills, the payback period, which is the time it takes for savings to equal the initial investment, can vary. On average, solar systems may not pay for themselves for at least four years, although this depends on the specific system. If you anticipate moving soon after installation, you might not fully recoup your investment through energy bill savings. However, homes with pre-installed solar panels often sell at a higher price and faster than those without. Studies suggest solar-equipped homes can sell for 4.1% more on average. Newer research indicates that homes with owned solar panels could sell for 5% to 10% more than comparable non-solar homes. This increased property value can be a substantial benefit if selling is part of your long-term plan, effectively contributing to your investment return.

Maintenance and System Longevity

Maintaining your solar energy system is key to its longevity and consistent performance. While solar panels typically require minimal maintenance, ensuring components like inverters and battery systems function optimally is vital. High-quality components, such as durable lithium iron phosphate batteries and reliable solar inverters that efficiently convert DC to AC, contribute to a system's 25-30+ year lifespan., Regular checks and professional servicing help maximize energy production, ensuring your system continues to deliver expected savings and a faster return on your investment. Our commitment is to provide reliable and scalable energy solutions that stand the test of time, helping you achieve true energy independence.

Achieving Energy Independence

Effective financial planning is paramount for maximizing the benefits of your solar energy system and achieving a swift payback. By accurately accounting for all costs, leveraging available financial incentives, and considering long-term factors, you can ensure your solar investment yields significant returns. Careful planning empowers you to harness solar power efficiently, reduce your energy expenses, and take a confident step towards lasting energy independence with reliable, high-performance solutions.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.