Adopting solar energy is a strategic decision for homeowners and businesses aiming for energy independence and long-term financial benefits. Understanding the economic viability of a solar investment requires careful cost modeling, particularly estimating the payback period. This article provides a comprehensive approach to evaluating solar projects, leveraging insights from authoritative sources like the International Energy Agency (IEA) to help you make informed decisions.

The Foundations of Solar Investment Evaluation

Calculating the true value of a solar energy system goes beyond its initial purchase price. You need to consider how quickly your investment generates enough savings to cover its cost. This is where the concept of the payback period becomes central.

Defining Payback Period in Solar Projects

The payback period represents the time it takes for your solar energy system to generate enough savings to offset its original cost. For residential systems, this typically involves calculating the number of years until the net cumulative cash flow becomes positive, considering factors such as electricity bill savings, incentives, and system size. The average residential solar payback period in the U.S. generally ranges from 6 to 10 years, though this varies based on location, electricity rates, and available incentives.

For commercial projects, the evaluation often uses more sophisticated financial metrics, such as the Internal Rate of Return (IRR), based on a 30-year cash flow analysis to determine the payback period.

Key Metrics for Cost Assessment

Beyond the upfront expenditure, a thorough assessment includes operational and maintenance (O&M) costs and the rate of system degradation. For energy storage systems, a critical metric is the Levelized Cost of Storage (LCOS). Estimating LCOS for stand-alone energy storage projects presents complexities. Its economic viability depends on the system’s operational profile within a specific electricity market, its response to price signals, and its performance of functions such as energy arbitrage and frequency regulation. Each application influences the battery’s charge-discharge cycles, degradation rates, and revenue streams, making a universal cost metric challenging to derive. ,

The revenue requirement framework offers a transparent baseline for assessing storage costs, abstracting from specific applications and decoupling cost estimation from market behavior. This framework fully accounts for capital expenditures, O&M costs, and their timing.

Leveraging IEA Data for Accurate Modeling

Data-driven decisions are crucial for successful solar investments. Organizations like the IEA provide valuable insights into global energy trends and cost developments, helping you benchmark your project's potential.

The Role of Data in Solar Economics

The International Energy Agency (IEA) consistently monitors and reports on renewable energy trends. Their analyses confirm solar power's leading position in the global energy transition. Solar photovoltaic (PV) capacity accounted for a significant portion of renewable energy additions in 2023.

According to the IEA, solar power is now considered a very cost-effective electricity source. Utility-scale solar projects have seen substantial cost reductions, making them highly competitive.

Factors Influencing Solar System Costs

The total cost of a solar system involves various components, including hardware (solar panels, inverters), installation fees, permits, and other related expenses.

For residential solar adoption, factors such as median income, household population density, electricity rates, average annual solar irradiation, and average mortgage interest rates play a role in estimating penetration.

The IEA highlights that a significant decrease in solar PV module spot prices, nearly 50% in 2023, has been a key driver for increased investment and deployment. This trend is expected to continue with global manufacturing capacity expanding. ,

Consider the following factors that influence your solar payback period:

- Initial System Cost: This includes panels, inverters, mounting, and labor. Incentives and rebates reduce this upfront cost.

- Local Electricity Rates: Higher rates translate to greater savings, shortening the payback period. ,

- Solar Incentives: Federal tax credits, state rebates, and net metering programs significantly reduce installation costs. ,

- Energy Consumption: Homes or businesses with higher electricity use benefit more from solar, as they offset more grid usage.

- System Performance: Efficient panels and optimal system sizing ensure maximum energy production over time.

Practical Steps for Payback Period Calculation

Calculating your solar payback period involves a straightforward process, allowing you to project your financial returns.

Gathering Essential Data

To calculate your solar payback, you need to gather specific data points:

- Total System Cost: Obtain quotes for the solar panel system, including equipment and installation.

- Available Incentives: Determine federal tax credits, state rebates, and local utility programs that reduce your net cost.

- Annual Electricity Usage: Review your past electricity bills to determine your average monthly or annual consumption in kilowatt-hours (kWh).

- Current Electricity Rate: Note the cost per kWh you currently pay your utility.

- Solar Energy Production Estimate: Your solar installer can provide an estimate of how much electricity your proposed system will generate annually based on your location's solar irradiance.

Step-by-Step Calculation Methodology

A simple way to estimate the payback period is to divide the net cost of the solar installation by the estimated annual savings from solar. For example, if an installation costs $20,000 and the estimated annual savings are $2,400, the payback period would be approximately 8.3 years ($20,000 / $2,400). ,

For more detailed financial analysis, especially for commercial projects, methods like Net Present Value (NPV) and Internal Rate of Return (IRR) offer a more comprehensive view of profitability over the system's lifetime. These calculations account for the time value of money and ongoing operational costs.

Our company offers integrated energy solutions that directly influence these calculations. Our home energy storage systems combine high-performance lithium iron phosphate (LiFePO4) batteries with hybrid inverters and solar panels. This integration simplifies installation and optimizes energy management, leading to more predictable savings and a faster return on your investment.

Enhancing Solar Investment Value with Storage

Integrating energy storage with solar PV systems significantly enhances their value, providing greater energy independence and resilience.

The Synergy of Solar and Energy Storage

Hybrid systems, which combine solar PV with battery storage, are increasingly common. These systems enhance grid flexibility and reduce curtailment by allowing electricity to be shifted to periods of higher demand or market value.

Our lithium iron phosphate (LiFePO4) batteries are a core component of these solutions. They are known for their high performance, safety, and reliability, offering a longer cycle life and superior thermal stability compared to other battery chemistries. , , ,

The benefits of combining solar with storage extend to increased self-consumption, backup power during outages, peak shaving, and protection against rising electricity costs. , ,

Calculating Storage Integration Payback

While the LCOS calculation can be complex due to varying operational profiles and market signals, the overall impact of storage on your solar system's payback is generally positive. By enabling you to store excess solar energy for use when the sun is not shining or when electricity rates are higher, storage systems maximize the value of your generated power. This often leads to greater overall savings and a more resilient energy supply, accelerating the true return on your combined solar and storage investment. ,

The cost of lithium-ion battery energy storage systems (BESS) has reduced by approximately 80% over the last decade, with the LCOS for Li-ion BESS declining significantly as of early 2024. This trend makes storage an increasingly attractive addition to solar installations.

Advancing Your Solar Project with Reliable Solutions

Choosing reliable components and a comprehensive energy strategy is paramount for long-term success and energy independence.

The Importance of System Reliability

Reliable components ensure consistent energy production, which is fundamental to achieving your projected payback period. Our LiFePO4 batteries offer exceptional durability and require minimal maintenance, translating to higher uptime and sustained performance over their long lifespan. , ,

Solar inverters are another critical component, converting the direct current (DC) electricity generated by solar panels into alternating current (AC) electricity suitable for your home or the grid. , , , High-quality inverters are crucial for efficient energy conversion and overall system monitoring.

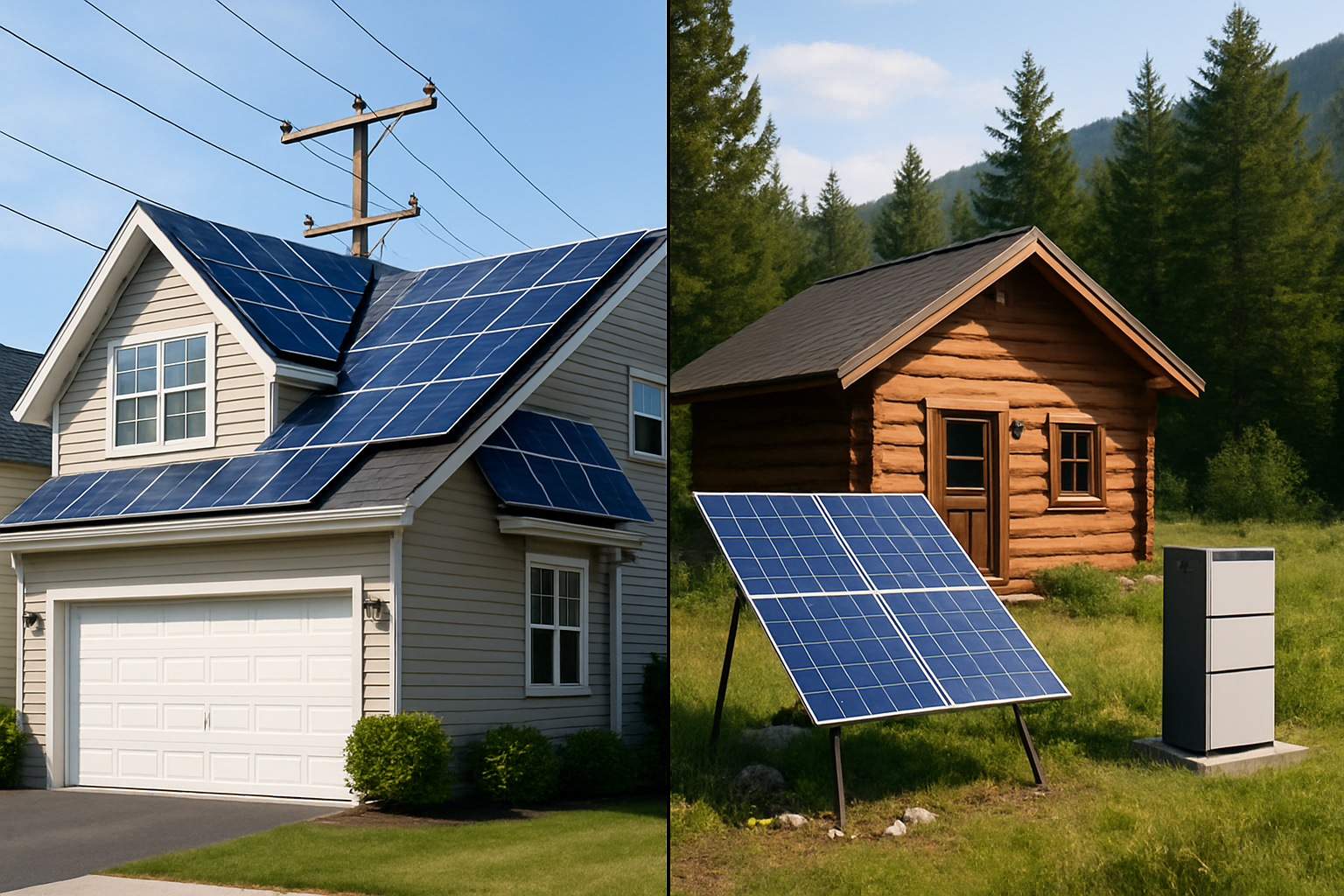

Tailored Energy Solutions

Our commitment is to provide reliable and scalable energy solutions that help you achieve energy independence. This includes not only integrated home energy storage systems but also off-grid solar solutions for diverse applications like homes, farms, and remote cabins. These tailored systems are designed to meet specific energy needs, ensuring that you gain maximum value and reliability from your solar investment.

Realizing Energy Independence

Investing in solar energy, particularly when coupled with modern energy storage solutions, represents a significant step towards a more sustainable and financially secure energy future. By applying robust cost modeling techniques and leveraging authoritative data, you can confidently estimate your project's financial returns. The ongoing advancements in solar and storage technologies, coupled with declining costs, continue to make energy independence an increasingly attainable reality for many.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.