Solar brings big claims and bigger numbers. You see ads promising “free power” and “2-year payback.” You also hear critics say it never pays back. The truth sits in the middle. This piece strips out the noise. You will see the real drivers behind solar energy costs, the solar payback period, and how to judge a solar investment return with confidence.

Myth vs Fact: What Really Drives Solar Energy Costs

Fact: The cost to generate solar power has fallen dramatically

Claims that “solar is always expensive” are outdated. Global analysis shows utility-scale PV generation costs falling sharply over the past decade. The global weighted-average LCOE (levelized cost of electricity) for utility-scale PV fell to about $0.049/kWh in 2022—an 80–90% drop since 2010, driven by better modules, larger projects, and learning-by-doing. According to IRENA’s Renewable Power Generation Costs in 2022, this puts new solar in a very competitive range in many markets.

| Year | LCOE (USD/kWh) | Source |

|---|---|---|

| 2010 | ~0.40–0.45 | IRENA |

| 2022 | ~0.049 | IRENA |

Fact: Soft costs still matter—and can be reduced

Hardware is only part of solar energy costs. Permitting, inspection, interconnection, customer acquisition, and financing add up. Streamlined processes can shave weeks and hundreds of dollars off a residential project. A U.S. program in Chicago standardized permits and cut wait times, highlighting how cities can lower soft costs and speed adoption, as documented by the U.S. Department of Energy (EERE Success Story—Chicago Solar Express).

Fact: Local conditions change the math

Local retail electricity rates, solar resource, roof orientation, and policy all affect your bottom line. Higher electricity prices and clear net billing or net metering rules typically improve savings. For background on solar’s role in the power system and how rate structures interact with variable renewables, see the International Energy Agency’s System Integration of Renewables and the U.S. Energy Information Administration’s overview of solar.

Myth: “Solar Payback Takes Decades”

Fact: Payback depends on a handful of variables

Payback is not a fixed number. It depends on:

- Installed price per watt (equipment + soft costs)

- Annual production (kWh per kW), driven by sun hours and system losses

- Your retail rate and rate design (flat, tiered, or time-of-use)

- Self-consumption vs export credits, and any incentives

- Degradation (often ~0.25%–0.8% per year for modern modules)

- O&M and inverter replacement over 20–25 years

- Financing terms (loan rate, tenure)

In many markets, payback falls in the 5–10 year range for well-sited homes. In lower-sun or low-rate areas, it can be longer. In high-rate areas with strong sun, it can be shorter. For context on cost drivers and deployment at scale, see the IEA’s Technology Roadmap - Solar Photovoltaic Energy and Solar Energy Perspectives.

Illustrative payback scenarios

The table below shows two simple, transparent examples. Figures are illustrative and will vary by site.

- System size: 6 kW rooftop PV

- Installed price: $2.5/W (total $15,000)

- Incentive case includes a 30% credit on system price ($4,500)

- Annual production:

- Sunny region: 1,400 kWh/kW-year → 8,400 kWh/year

- Moderate region: 1,100 kWh/kW-year → 6,600 kWh/year

- Self-consumption/export credit assumed equal to retail rate for simplicity

- O&M ignored in payback for simplicity; include it in full ROI analysis

| Scenario | Retail rate (USD/kWh) | Annual production (kWh) | Annual bill savings (USD) | Net upfront (USD) | Simple payback (years) |

|---|---|---|---|---|---|

| Sunny + higher-rate | 0.25 | 8,400 | 2,100 | $10,500 (with 30% credit) | ~5.0 |

| Moderate + mid-rate | 0.15 | 6,600 | 990 | $15,000 (no incentive) | ~15.2 |

These examples show how sun and tariff assumptions swing results. Your numbers should come from a site-specific production estimate and your actual tariff schedule. For up-to-date solar basics and policy information, see U.S. DOE: Solar Energy.

Myth: “Batteries Always Ruin Returns”

Fact: Storage shifts value, and the use case matters

Adding batteries changes where value comes from. In daytime-flat tariffs with generous export credits, a battery may add limited bill savings. In time-of-use tariffs, a right-sized battery can move solar kWh from midday to evening peaks, increasing avoided cost. Storage also boosts backup capability. These non-energy benefits—resilience, outage protection—carry value many households accept, even if simple payback extends.

Grid studies show that flexibility—storage, demand response, and transmission—reduces costs as solar shares grow. That system-wide value is clear in modeling of variable renewables integration by the IEA (System Integration of Renewables).

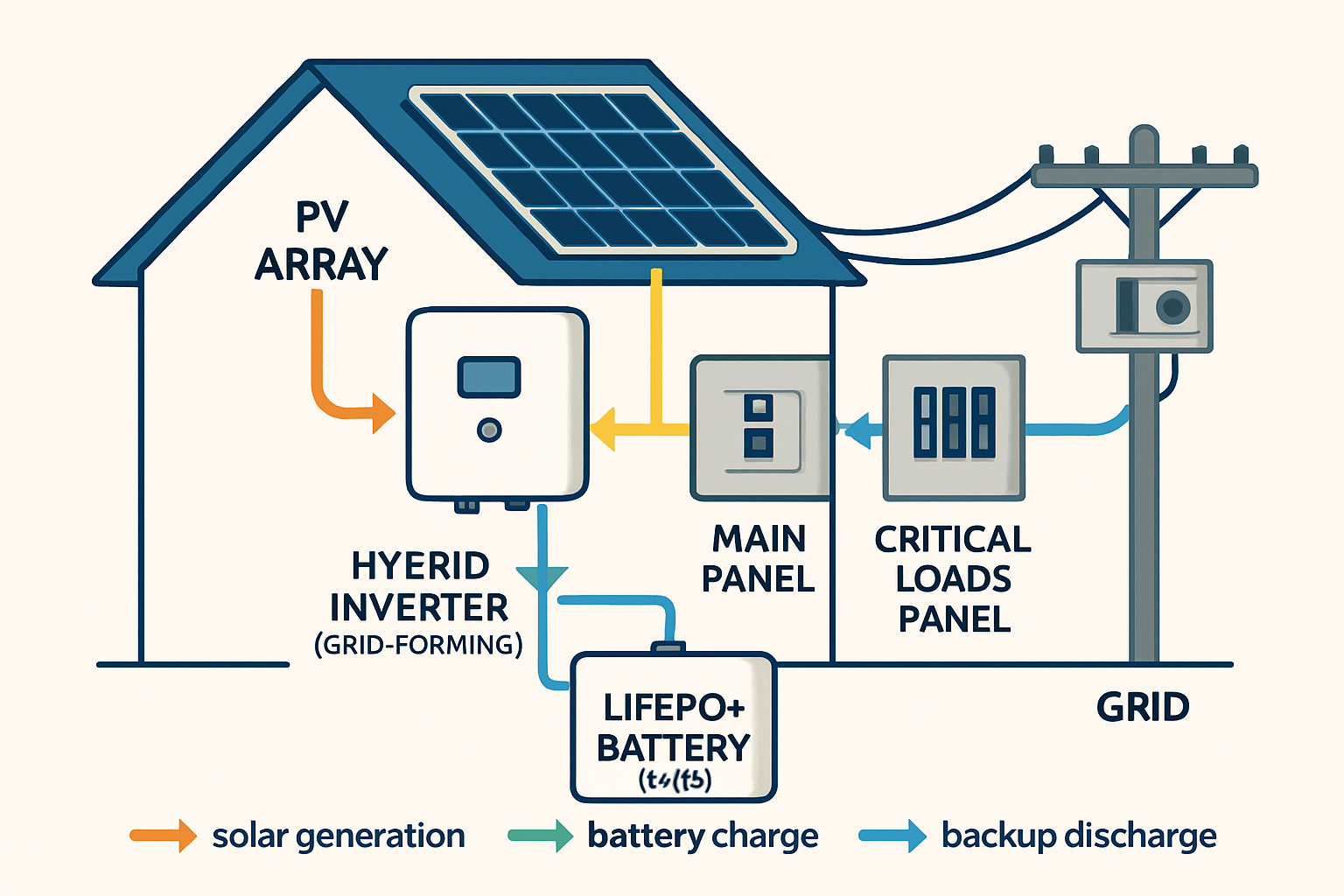

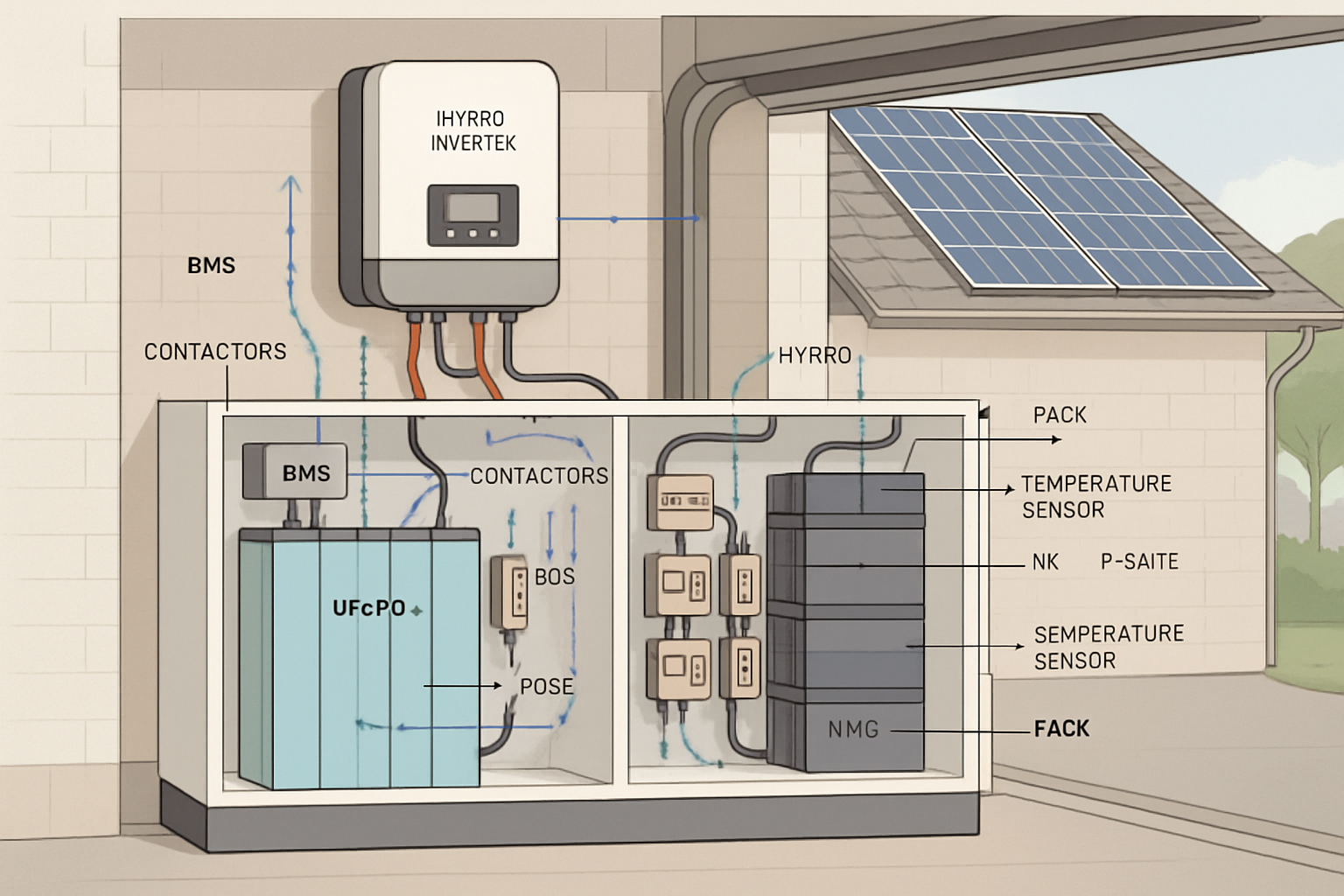

Technology note: LiFePO4 and hybrid ESS

- LiFePO4 batteries offer stable chemistry, long cycle life, and robust thermal performance—well-suited to daily cycling in home ESS.

- Hybrid systems that integrate battery, solar inverter, and controls simplify installation. They support both self-consumption optimization and backup.

- Size storage to the evening peak window, not the total daily load. Many homes benefit from 5–15 kWh paired with a hybrid inverter, but exact sizing depends on appliances and peak demand.

Myth: “Solar Only Works with Generous Subsidies”

Fact: Solar is often competitive on pure cost—and smart policy cuts friction

Utility-scale solar is frequently at or below the cost of new fossil alternatives on a levelized basis. That shifts arguments from “can it compete” to “how do we integrate it efficiently.” Policy still matters. Clear interconnection rules, fair export valuation, and streamlined permitting remove soft costs and risk. California’s experience shows how solar deployment can grow under strong renewable targets, time-of-use pricing, and enabling policies, even without technology carve-outs, as noted in IEA’s Solar Energy Perspectives.

For households, incentives shorten payback, but fundamentals—local rates and sun—drive most of the value. DOE’s overview of solar programs and the history of soft-cost reduction efforts provide helpful context (EERE: Chicago Solar Express; DOE Solar Energy).

Calculate Payback the Right Way

Use NPV and IRR, not just simple payback

Simple payback is easy to explain, but it ignores energy output after the payback year and the time value of money. That can mislead buyers and cause them to underinvest in long-lived assets. This critique is not new; it has been stressed in international analysis of solar economics and decision bias in thermal projects by the IEA (Barriers to Technology Diffusion). A better approach:

- Net present value (NPV): Discount future cash flows (bill savings minus O&M) at your financing rate or hurdle rate.

- Internal rate of return (IRR): The discount rate that makes NPV zero. Compare to safe alternatives.

- Levelized cost of energy (LCOE): Useful for comparing generation options; ensure consistent assumptions.

Practical steps to build a solid case

- Collect 12 months of bills and identify your tariff structure, tiers, and any seasonal TOU periods.

- Get a site-specific production estimate that accounts for azimuth, tilt, shading, and inverter loading ratio.

- Request line-item quotes showing equipment, labor, and soft costs. Ask how permitting and interconnection timelines affect price.

- Model degradation and expected inverter replacement. Include O&M (cleaning, monitoring, service visits).

- If adding storage, model TOU arbitrage and backup value separately. Avoid oversizing batteries for economics.

Where Storage-Integrated Systems Fit

Use cases that can improve solar investment return

- High TOU spread: Shift midday solar to evening peaks with a right-sized LiFePO4 ESS and hybrid inverter.

- Low export credit: Increase self-consumption by storing midday surplus for evening use.

- Reliability needs: Farms, small businesses, and remote homes value backup. Outage costs avoided can justify storage.

- Off-grid sites: Cabins or agricultural loads benefit from integrated off-grid solar solutions that combine PV, inverter, and battery for energy independence.

In all cases, choose a scalable architecture. Start with a PV array and hybrid inverter, then add LiFePO4 battery modules as needs grow.

Common Pitfalls and How to Avoid Them

- Assuming “average sun.” Use site shading analysis and local weather data.

- Ignoring rate changes. Model TOU and seasonal pricing. EIA’s resources on electricity and solar can help frame your assumptions (EIA solar overview).

- Overweighting upfront incentives. Focus on lifetime value and NPV.

- Forgetting soft costs. Ask how permitting and interconnection affect price and timeline (EERE case).

- Oversizing batteries. Tie capacity to your evening load and TOU window.

Key Takeaways

- Solar energy costs have fallen sharply, and many projects are competitive on generation cost alone (IRENA).

- Payback is driven by installed price, sun, and your tariff. In good conditions, a 5–10 year solar payback period is realistic.

- Storage changes value streams. It can improve returns under TOU rates and adds resilience, especially with safe, long-life LiFePO4 batteries.

- Use NPV and IRR, not just payback, to judge solar investment return. This aligns with best practice noted in international analyses (IEA).

- Policy and processes matter. Streamlined permitting and integration practices lower costs and help the grid accommodate more solar (IEA; DOE Solar Energy).

References and Further Reading

- IRENA: Renewable Power Generation Costs in 2022

- IEA: System Integration of Renewables

- IEA: Solar Energy Perspectives

- IEA: Technology Roadmap - Solar Photovoltaic Energy

- IEA: Barriers to Technology Diffusion (Solar Thermal)

- EIA: Solar Explained

- DOE/EERE: Chicago Solar Express

- U.S. DOE: Solar Energy

We build lithium battery systems, hybrid inverters, and integrated home ESS with a focus on reliability and scalability. That helps households and small businesses cut bills and gain energy independence, without the hype—just clear numbers and practical engineering.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.