Solar energy continues to gain significant traction as a reliable and sustainable power source. Many homeowners and businesses are considering transitioning to solar, seeking not only environmental benefits but also substantial financial advantages. Understanding the available incentives and how they affect your investment's payback period is crucial for making an informed decision.

Key Incentives for Solar Energy in 2025

Financial incentives play a pivotal role in making solar energy more accessible and affordable. These programs can significantly reduce the upfront cost of installation, accelerating your return on investment.

Federal Tax Credits

The Residential Clean Energy Credit, widely known as the federal solar Investment Tax Credit (ITC), has been a cornerstone of solar adoption. This incentive allows you to claim a percentage of your solar system's cost as a credit on your federal taxes. In 2025, homeowners can still claim 30% of eligible solar panel system costs. This credit applies to systems installed at your primary or secondary residence and includes solar panels, battery storage systems (with a capacity of 3kWh or higher), and installation costs.

However, a significant change has occurred for residential solar. The "One Big Beautiful Bill," signed into law in July 2025, officially ends the 25D federal solar tax credit for homeowners on December 31, 2025. This means that residential solar and battery systems must be installed and operational by this deadline to qualify for the 30% tax credit. If you cannot claim the full credit in one year, you can carry forward any unused credits to future tax years.

For commercial and utility-scale projects, the Investment Tax Credit (Section 48E) may be available through December 31, 2027. Projects that begin construction by July 4, 2026, might still be eligible for the tax credit if placed into service within four years, meaning by 2030. The Inflation Reduction Act (IRA) also introduced provisions allowing certain non-taxable entities, such as state and local governments, and rural electric cooperatives, to receive direct payments for these tax credits.

State and Local Programs

Beyond federal support, many states, municipalities, and utility companies offer a diverse range of solar incentives. These can include additional tax credits, upfront rebates, property tax exemptions, and sales tax exemptions. For instance, some states offer tax credits of up to 25% or 40% of installation costs. Property tax exemptions mean that the increase in your home's value from solar panels will not lead to higher property taxes. Sales tax exemptions can further reduce the purchase price of solar equipment. Due to the varied nature of these programs, checking specific offerings in your location is always beneficial.

Other Financial Mechanisms

Net metering is another common incentive, allowing solar owners to receive credits for excess electricity sent back to the grid. While terms can vary and have seen revisions in some areas, such as California, it remains a valuable mechanism for maximizing savings. Solar Renewable Energy Certificates (SRECs) also provide a way to earn income by selling credits for the clean electricity your system generates.

Understanding Solar Payback Speed

The payback period for solar panels refers to the time it takes for your energy savings to equal your initial investment. Once this period passes, you essentially receive "free" electricity for the remaining lifespan of your system, which can be 25 years or more.

Factors Influencing Payback Period

Several elements influence how quickly your solar investment pays for itself:

- Initial System Cost: The total cost of purchasing and installing your solar panels, inverters, and any batteries. In 2025, most U.S. homeowners pay between $15,000 and $40,000 for a full solar installation before tax credits.

- Electricity Rates: Higher and rising utility electricity rates mean greater savings from your self-generated power.

- Energy Consumption: Your household's electricity usage directly impacts how much you save by generating your own power.

- System Efficiency: The quality and efficiency of your solar panels and inverters determine how much electricity your system produces from available sunlight.

- Available Sunlight: Regions with more sunny days generally lead to higher energy production and faster payback.

- Incentives and Rebates: Federal tax credits, state rebates, and other local programs significantly reduce the net upfront cost, directly shortening the payback period.

Calculating Your Solar Payback

You can estimate your solar payback period using a straightforward calculation:

Solar Payback Period (Years) = (Total System Cost - Total Incentives & Rebates) / Annual Electricity Savings

For example, if a solar system costs $20,000, and you receive $6,000 in federal and state incentives, your net cost is $14,000. If your system saves you $2,000 on electricity bills annually, your payback period would be 7 years ($14,000 / $2,000 = 7). This calculation assumes stable electricity rates, but rising rates can further accelerate your payback.

Average Payback Periods

As of 2025, the average solar payback period for residential systems generally ranges from 6 to 10 years. Some sources indicate a national average of about 7.1 years. Homeowners in areas with high electricity costs or generous incentives often experience a shorter payback period. It is important to remember that the expiration of the 30% federal tax credit after December 31, 2025, could extend payback periods for systems installed later.

Financing Your Solar Investment

The initial investment in a solar energy system can be significant, but various financing options make it achievable for many.

Loan Options

Many homeowners choose to finance their solar power systems through loans rather than paying cash upfront. Common solar loan types include unsecured personal loans, home equity loans or lines of credit, and in-house financing from solar providers. These loans often feature lower interest rates than traditional loans. Community banks are increasingly offering flexible solar loan terms, including options up to 30 years, which can provide an alternative to traditional lenders. You remain eligible for the federal solar tax credit even when financing your system with a loan.

Leasing and Power Purchase Agreements (PPAs)

Alternatively, you can consider solar leases or Power Purchase Agreements (PPAs). With a solar lease, you pay a monthly fee to use the system. With a PPA, you pay for the electricity generated by the panels at a fixed rate, often lower than your utility's rate. While these options can eliminate upfront costs, they typically mean you do not own the system and, therefore, may not be eligible for the federal tax credit for homeowners. However, for commercial and TPO arrangements, the 48E tax credit may still apply to leased or PPA systems through 2027.

The Role of Energy Storage

Integrating energy storage solutions with your solar panels enhances your system's value significantly. Modern energy storage systems, featuring robust lithium iron phosphate (LiFePO4) batteries, offer high performance, safety, and reliability. These systems capture excess solar energy generated during the day for use at night or during grid outages, reducing reliance on the utility grid and increasing energy independence.

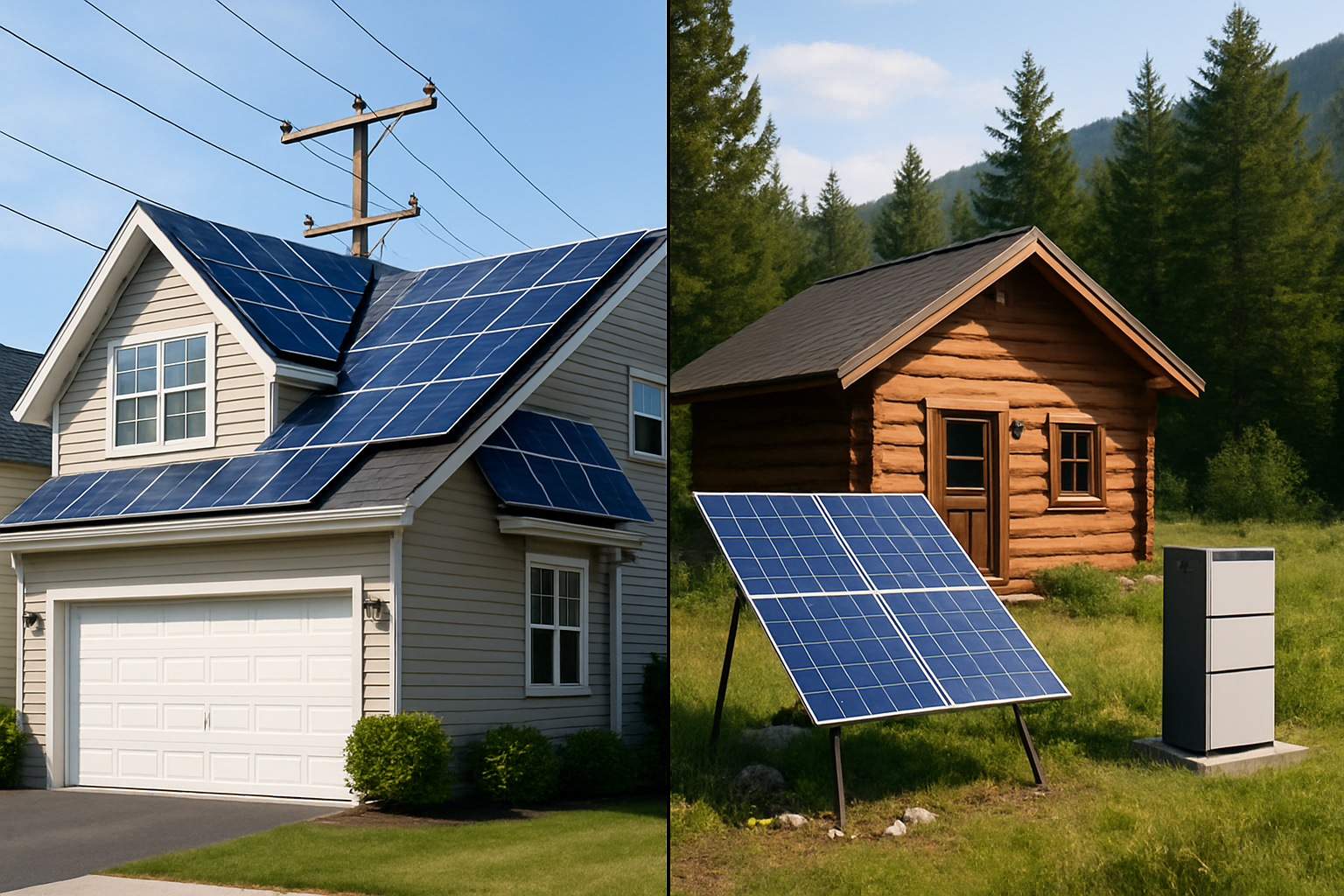

Integrated home energy storage systems often combine these advanced lithium batteries with hybrid inverters and solar panels, providing a comprehensive solution. This setup allows you to maximize self-consumption of your solar power, potentially further shortening your payback period by reducing the amount of electricity you purchase from the grid. For off-grid needs, solutions are available for homes, farms, and remote cabins, ensuring consistent power supply.

Maximizing Your Solar Savings

To ensure you get the most out of your solar investment, consider these practical steps:

- Choose the Right System Size: An accurately sized system meets your energy needs without overproduction, optimizing your savings.

- Optimize Energy Usage: Adjusting your consumption habits to align with solar production times can enhance your self-sufficiency and reduce reliance on grid power.

- Regular Maintenance: Keeping your solar panels clean and ensuring your system operates efficiently helps maintain peak performance and energy generation.

- Monitor Incentives: Stay informed about changes in federal, state, and local incentive programs to ensure you capitalize on all available benefits.

The Evolving Landscape of Solar Energy

The solar industry is dynamic, marked by continuous innovation and policy shifts. Investment in clean energy, particularly solar PV, has seen remarkable growth. In 2023, solar PV investments surpassed capital directed towards oil production for the first time. This trend highlights a significant shift in energy investment priorities.

Governments across regions are setting ambitious renewable energy targets. The European Union, for example, has revised its binding renewable energy target to at least 42.5% by 2030, with an aspiration to reach 45%. The EU also aims to increase its installed solar capacity to 380 GW by 2025 and 750 GW by 2030. While policy support is strong, challenges like permitting times remain a focus for governments and investors to ensure timely project deployment.

Your Path to Energy Independence

Embracing solar energy offers a clear path to reducing electricity bills, decreasing your environmental impact, and achieving greater energy independence. The availability of solar incentives in 2025, particularly the federal tax credit before its residential expiration, presents a compelling opportunity. By understanding these financial mechanisms, exploring suitable financing options, and considering advanced energy storage systems, you can confidently invest in a reliable and scalable energy solution for your home or business. Taking action now allows you to secure substantial savings and contribute to a more sustainable energy future.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.