Determining the return on investment (ROI) for a commercial off-grid solar installation is a more complex undertaking than for a standard grid-tied system. The calculation shifts from a simple comparison against utility electricity rates to a broader assessment of value against the alternatives for powering a remote property. This guide outlines the crucial factors to consider for a comprehensive financial analysis.

Key Factors Influencing Off-Grid ROI

A successful ROI calculation for an off-grid system hinges on accurately assessing costs, understanding the alternatives, and factoring in all financial incentives.

Initial Investment & Installation Costs

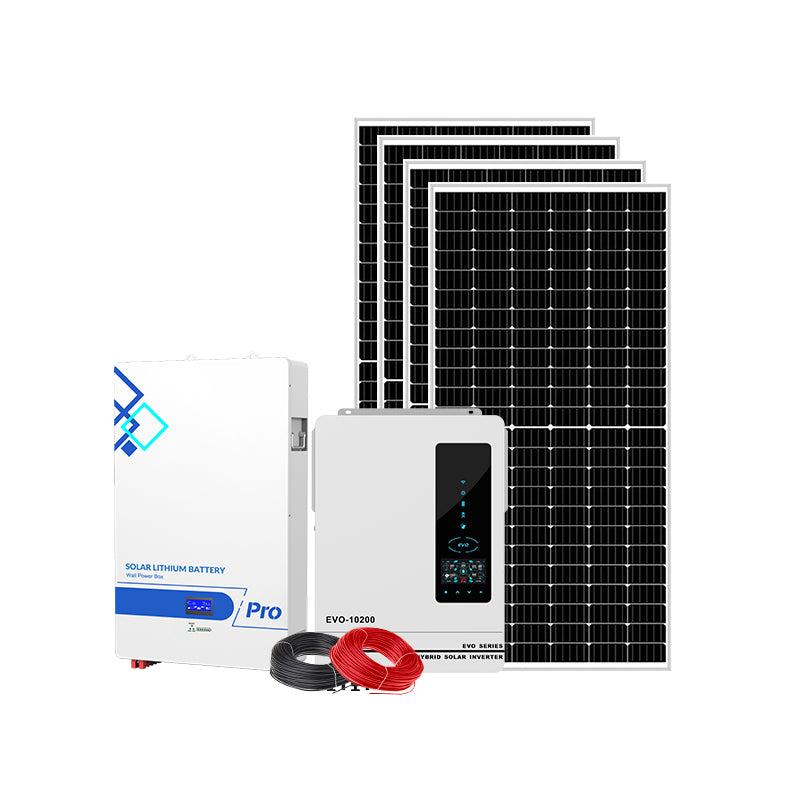

The upfront capital expenditure is a primary component of any ROI calculation. For an off-grid commercial project, this includes the cost of solar panels, inverters, mounting hardware, labor, and necessary permits. However, the most significant additional cost compared to grid-tied systems is the battery bank.

Because off-grid systems must be entirely self-reliant, a robust battery energy storage system is non-negotiable. As noted by GreenCoast, solar panels only generate power when the sun is shining, but your business needs power around the clock. Battery banks store this energy for nighttime use or during periods of low sunlight. The cost of these batteries, which have a shorter lifespan than solar panels (typically 3-7 years for lead-acid and 10-15 for lithium-ion), and their eventual replacement must be factored into the total cost of ownership.

Operating Expenses

Beyond the initial setup, several ongoing costs will affect your system's long-term profitability. According to GreenCoast, key operating expenses to include in your financial model are:

- Operations and Maintenance (O&M): This includes routine cleaning of panels, system check-ups, and eventual inverter or battery replacements.

- Insurance: Protecting your significant investment against damage or unforeseen events is crucial.

- Property Taxes or Land Leases: Depending on your location and ownership structure, these can be recurring annual costs.

The Value Proposition: Comparing Against Alternatives

For grid-tied systems, ROI is measured against the savings on electricity bills. For off-grid systems, the value is measured against the cost of alternative power sources. In many remote locations, there are two primary alternatives:

- Grid Extension: The cost of running new utility lines to a remote property can be prohibitively expensive, potentially running into tens or even hundreds of thousands of dollars depending on the distance from the nearest grid connection. An off-grid solar system becomes financially viable when its total lifetime cost is less than the cost of this grid extension.

- Fossil-Fuel Generators: The other common alternative is a diesel or gas generator. While the initial purchase price may be lower, the ongoing costs of fuel, maintenance, and the operational hassle make them a costly long-term solution. An off-grid solar system provides price stability, as the "fuel" (sunlight) is free.

Financial Incentives and Additional Returns

Several financial mechanisms can significantly improve the ROI of your commercial off-grid installation.

Tax Credits and Depreciation

A major financial benefit for businesses in the United States is the Federal Investment Tax Credit (ITC). As highlighted by Sun Solar Electric, the ITC can reduce the upfront cost of your solar system by 30%, directly impacting your initial investment and shortening the payback period. Furthermore, businesses can often benefit from accelerated depreciation schedules for their solar assets, providing additional tax advantages as mentioned by GreenCoast.

Non-Financial Returns

Beyond direct monetary gains, there are other valuable returns. Energy independence provides resilience against blackouts, ensuring business continuity. Additionally, investing in solar can enhance a company's brand image and attract environmentally conscious customers, a benefit that Sun Solar Electric points out can be a valuable differentiator in the marketplace.

Putting It All Together: The Payback Period

While the average payback period for a general commercial solar installation is often cited as 8 to 12 years, the timeline for an off-grid system is highly specific to the project's circumstances. The payback is achieved when the cumulative savings from avoiding the costs of grid-extension or generator operation surpass the net cost of the solar installation. By carefully analyzing the initial investment, ongoing operational costs, and the full value of available incentives and alternative power costs, a business can gain a clear picture of the long-term financial benefits and robust return on investment offered by an off-grid solar solution.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.