Opting for an off-grid solar power system offers a host of advantages, including energy independence, a smaller environmental footprint, and the potential for long-term financial savings. While the initial outlay for solar panels, batteries, inverters, and other necessary components can be substantial, the prospect of eliminating monthly electricity bills makes it an attractive option for many. A thorough Return on Investment (ROI) analysis is essential to determine if this long-term financial benefit outweighs the upfront costs.

The Financial Equation of Off-Grid Solar

The primary financial benefit of an off-grid solar system is the elimination of recurring electricity bills. By generating your own power, you are no longer subject to the fluctuating prices of traditional energy sources. This is a significant advantage, particularly as the cost of electricity from the grid continues to rise.

Initial Investment vs. Long-Term Savings

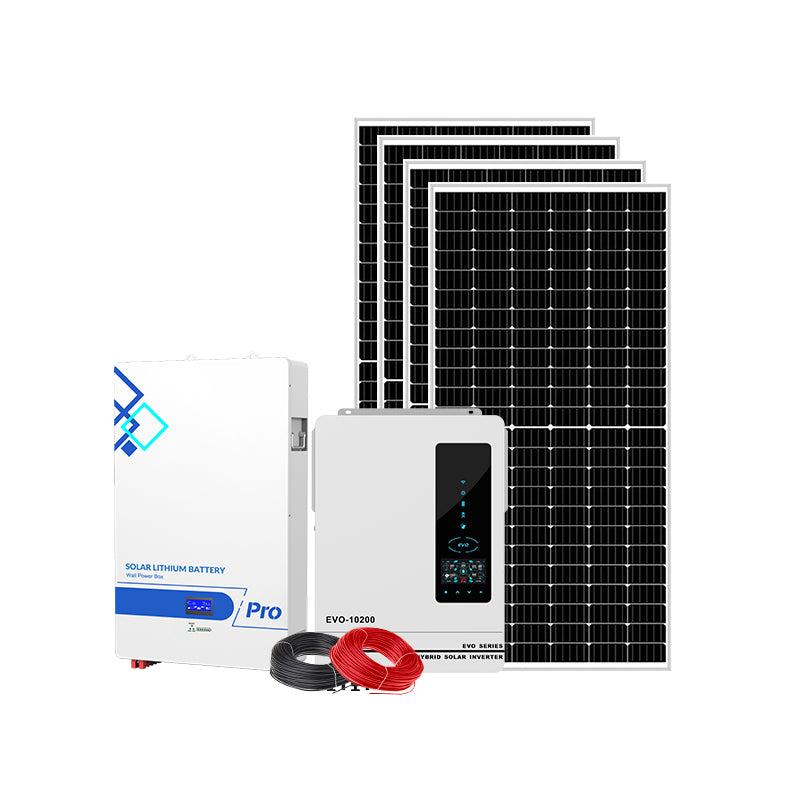

The initial investment for an off-grid solar system can be significant. Costs can range widely depending on the size and complexity of the system, but a complete setup for a residential property can cost anywhere from $30,000 to $65,000 or more. This includes the cost of solar panels, batteries for energy storage, inverters to convert electricity for household use, and installation. Specifically, solar panels can range from $3,500 to $35,000, batteries from $2,000 to $16,000, and inverters from $3,000 to $13,000. For a 10 kW system, you might expect to pay around $20,180 for the panels alone.

Despite these high upfront costs, the long-term savings can be substantial. By generating your own electricity, you can significantly reduce or even eliminate your reliance on the grid, leading to considerable savings over the system's lifespan. With proper maintenance, solar panels can last 25 years or more, while batteries typically have a lifespan of about 10 years. Many governments also offer incentives, such as tax credits and rebates, which can help to offset the initial investment.

Calculating Your Return on Investment (ROI)

To determine the financial viability of an off-grid solar system, it is crucial to conduct a thorough ROI analysis. This involves considering the initial investment, ongoing maintenance costs, and the projected savings from no longer paying for electricity. The payback period, or the time it takes for the savings to equal the initial investment, is a key metric in this analysis. A shorter payback period is generally more favorable. For example, if a system costs $10,000 and saves you $2,500 per year on electricity bills, the ROI would be four years.

Several factors can influence the ROI of an off-grid solar system:

- Geographic Location: The amount of sunlight a location receives, known as solar irradiation, directly impacts the energy potential of a solar system. Areas with more sunlight will generate more electricity, making the investment more cost-effective.

- Energy Consumption: Your household's energy needs will determine the required size and capacity of the solar system, which in turn affects the overall cost.

- Government Incentives: Tax credits, rebates, and other government incentives can significantly reduce the upfront cost of a solar system, thereby improving the ROI.

- System Maintenance: While generally low, ongoing maintenance costs for cleaning panels and potential battery replacement should be factored into the ROI calculation.

Studies have shown that off-grid solar systems can be a cost-effective solution, especially in remote areas where extending grid infrastructure is expensive. In some cases, the cost of producing electricity from an off-grid PV system can be lower than purchasing it from the conventional grid. Ultimately, the decision to invest in an off-grid solar system depends on a careful analysis of these factors and your long-term financial and energy goals.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.