Adding a battery to an existing solar system is a strategic move for many homeowners and businesses. You gain greater energy independence, enhance resilience against power outages, and potentially reduce electricity bills. This article will guide you through the financial considerations, helping you understand the costs, available incentives, and how to calculate your return on investment for a battery retrofit.

Understanding the Costs of a Battery Retrofit

The initial investment for a battery retrofit involves several components. Knowing these costs helps you budget effectively and evaluate the financial viability of your upgrade.

Key Equipment Costs

- Battery Storage System: The core of your retrofit is the battery itself. Lithium Iron Phosphate (LiFePO4) batteries are a popular choice due to their high performance, safety, and reliability. The cost varies significantly based on capacity (measured in kilowatt-hours, kWh) and manufacturer. While prices for small systems might start at around USD 1,100 per kWh, larger systems can see prices closer to USD 550 per kWh. According to the Medium-Term Renewable Energy Market Report 2016 by the IEA, these figures reflect a general range, though costs have seen trends of reduction over time as the learning curve for battery storage progresses.

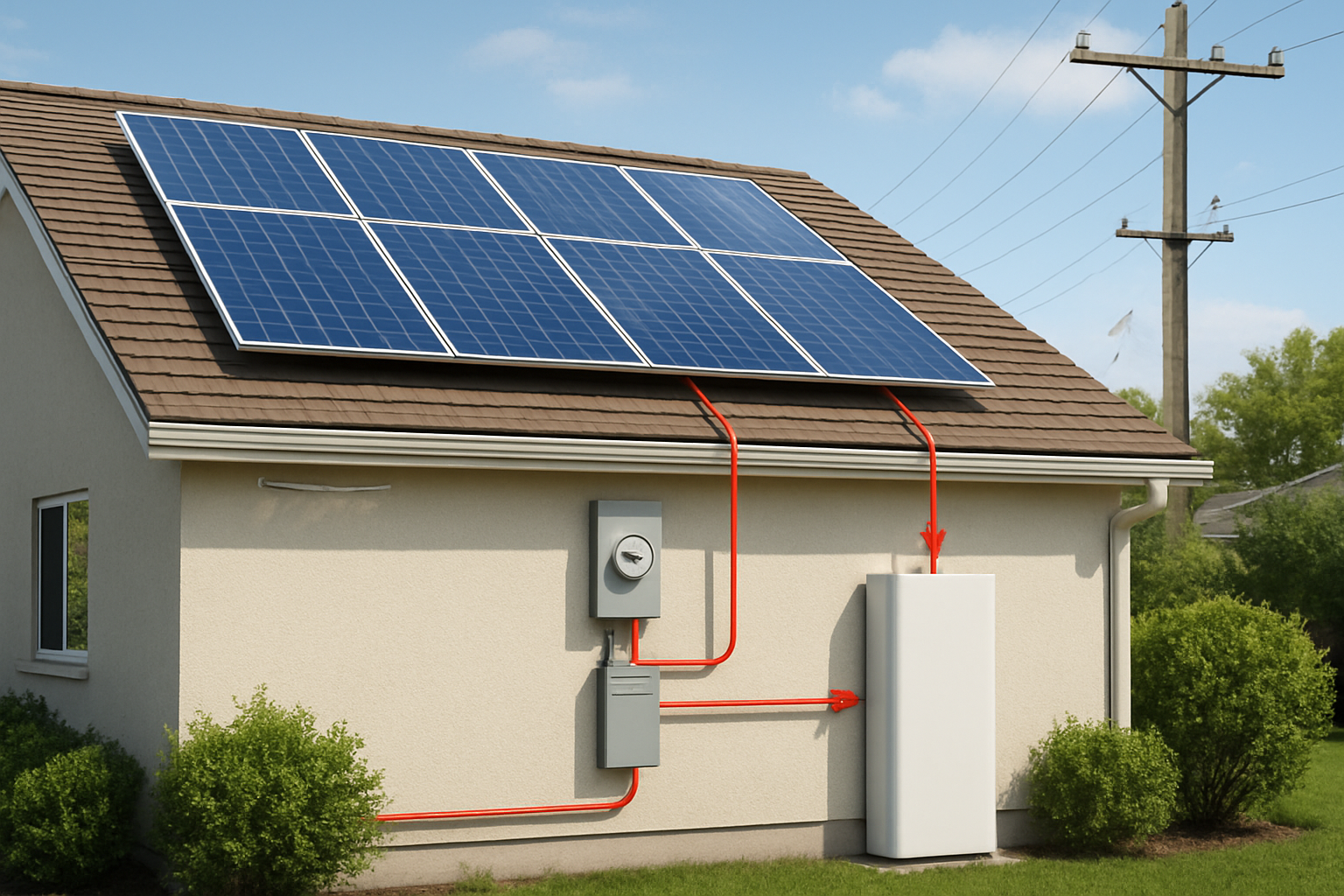

- Hybrid Inverter: If your existing solar system uses a string inverter, you will likely need to upgrade to a hybrid inverter. This device manages both solar power generation and battery charging/discharging, converting direct current (DC) from your solar panels and battery into alternating current (AC) for your home.

- Balance of System (BOS) Components: This category includes wiring, mounting hardware, disconnects, and other electrical components necessary for safe and efficient integration.

Installation and Soft Costs

Beyond the hardware, you will encounter costs related to installation and administrative processes.

- Labor: Professional installation ensures your system is safely and correctly integrated. Labor costs depend on the complexity of the installation and local rates.

- Permitting and Inspections: Local regulations require permits for electrical work and battery installations. These fees and the time involved in obtaining approvals are part of the overall cost.

- Electrical Upgrades: Your existing electrical panel might require upgrades to accommodate the new battery system, adding to the expense.

Incentives and Financial Support for Battery Storage

Various incentives can significantly offset the upfront cost of a battery retrofit, making the investment more attractive. These programs aim to accelerate the adoption of renewable energy and energy storage solutions.

Government Tax Credits and Rebates

Many governments offer financial incentives to encourage battery storage adoption. For instance, in the United States, the Inflation Reduction Act (IRA) provides tax credits for battery storage. The World Energy Investment 2023 report by the IEA highlights the IRA's approval, extending tax credits for solar PV and wind, and making investment tax credits available for battery storage.

You may qualify for a percentage of your system's cost as a tax credit, directly reducing your tax liability. Research federal, state, and local programs specific to your area.

Local and Utility Programs

Beyond federal incentives, many states, cities, and utility companies offer their own programs:

- State-level Rebates: Some states provide direct rebates for installing energy storage systems, which can be a significant upfront saving.

- Performance-Based Incentives: Certain programs may offer payments based on the energy your battery stores or discharges, particularly during peak demand periods.

- Virtual Power Plant (VPP) Participation: Some utilities offer incentives for homeowners to allow their batteries to be dispatched by the grid during high demand, effectively creating a "virtual power plant." This can generate revenue for you while supporting grid stability.

It is crucial to research and understand the eligibility requirements and application processes for these incentives before making your purchase.

Calculating Your Return on Investment (ROI)

Understanding the financial benefits of your battery retrofit requires a clear calculation of its return on investment. This helps you determine how quickly your investment will pay for itself through savings and potential earnings.

Energy Savings and Arbitrage

One of the primary financial benefits comes from optimizing your energy consumption. If you are on a time-of-use (TOU) electricity plan, you can charge your battery when electricity prices are low (e.g., during off-peak hours or when your solar panels are generating excess power) and discharge it when prices are high. This practice, known as energy arbitrage, significantly reduces your electricity bill.

The Renewable Power Generation Costs in 2024 report by IRENA notes that the economic viability of energy storage systems depends on their operational profile within a specific electricity market and their response to price signals, performing functions such as energy arbitrage and frequency regulation. Batteries add value by shifting electricity from times of high generation to periods of high demand or market value, enhancing grid reliability and reducing curtailment.

Value of Resilience and Backup Power

While harder to quantify in monetary terms, the value of having backup power during outages is substantial. Avoiding business interruptions, protecting sensitive electronics, and maintaining comfort during grid failures offers peace of mind and tangible benefits that can prevent losses.

Consider the cost of a single extended power outage for your household or business. The ability of your battery system to provide continuous power during such events represents a significant, albeit indirect, financial return.

Determining the Payback Period

The payback period is the time it takes for your energy savings and incentives to equal your initial investment. You can estimate it with this simplified formula:

Payback Period (Years) = Total Net Cost / Annual Savings

Where:

- Total Net Cost: Your total upfront cost minus all incentives (tax credits, rebates).

- Annual Savings: Your estimated annual reduction in electricity bills due to energy arbitrage, reduced peak demand charges, and any earnings from grid services.

Factors influencing your payback period include:

- Electricity Rates: Higher and more volatile electricity rates generally lead to faster payback.

- System Efficiency: A well-designed and efficiently operating system maximizes savings.

- Battery Lifespan: LiFePO4 batteries offer long cycle lives, ensuring many years of savings.

- Inflation: As electricity prices tend to rise over time, your annual savings in future years may increase, effectively shortening the real payback period.

| Factor | Impact on Payback Period | Notes |

|---|---|---|

| High Electricity Rates | Shorter | Maximizes savings from energy arbitrage. |

| Generous Incentives | Shorter | Reduces upfront net cost. |

| Efficient System Sizing | Shorter | Optimizes energy use and avoids oversizing. |

| Time-of-Use (TOU) Tariffs | Shorter | Enables profitable energy shifting. |

| Frequent Power Outages | Indirectly Shorter | Avoids costs associated with disruptions. |

Maximizing Your Retrofit's Financial Benefits

To ensure your battery retrofit delivers the best possible financial returns, consider these strategies.

Optimal System Sizing

Accurate sizing of your battery system is paramount. An undersized battery may not meet your backup needs or provide sufficient energy arbitrage opportunities. An oversized battery means higher upfront costs without proportionally increased benefits, extending your payback period.

Assess your daily energy consumption patterns, peak demand periods, and desired backup duration. A professional energy audit can help determine the ideal battery capacity for your specific requirements.

Smart Operational Strategies

How you operate your battery significantly impacts its financial performance.

- Energy Arbitrage: Program your system to automatically charge during low-cost periods and discharge during high-cost periods.

- Peak Shaving: Use your battery to reduce your demand from the grid during peak hours, avoiding high demand charges from your utility.

- Self-Consumption Optimization: Store excess solar energy generated during the day and use it at night, minimizing reliance on grid electricity.

The IRENA report also emphasizes that the full benefit of a battery depends on how it is operated within a specific electricity market, requiring detailed modeling of demand, supply, grid constraints, and market rules.

Long-Term Value and Maintenance

A well-maintained battery system will perform optimally for its entire lifespan, ensuring sustained savings. LiFePO4 batteries are known for their longevity and minimal maintenance requirements, but regular checks and firmware updates can enhance performance.

Consider the long-term value of reduced carbon footprint and increased property value. These benefits, while not always directly quantifiable in a simple payback calculation, add to the overall positive impact of your investment.

Your Path to Energy Independence

Retrofitting a battery to your existing solar system is a sound investment that offers both financial and practical advantages. By carefully analyzing the costs, leveraging available incentives, and strategically operating your system, you can achieve a favorable return on investment and enjoy the benefits of enhanced energy independence and resilience. The move towards hybrid systems combining solar PV and battery storage is increasingly deployed to enhance grid flexibility and reduce curtailment, as noted by IRENA's Renewable Power Generation Costs in 2024 report.

This information is for educational purposes only and does not constitute financial or legal advice. Please consult with a qualified professional for personalized recommendations.

Frequently Asked Questions

What is the average payback period for a solar battery retrofit?

The payback period varies significantly based on factors such as the initial cost, available incentives, local electricity rates, and your energy consumption patterns. It can range from a few years to over a decade. High electricity rates and generous incentives generally lead to a shorter payback period.

Are there any hidden costs I should be aware of?

Beyond the main equipment, consider potential costs for electrical panel upgrades, permitting fees, and professional installation labor. Always obtain detailed quotes that include all anticipated expenses to avoid surprises.

How do government incentives impact the ROI of a battery retrofit?

Government incentives, such as tax credits or rebates, directly reduce your net upfront cost. This lower initial investment shortens the payback period and significantly improves your overall return on investment, making the retrofit more financially appealing.

Can I earn money by selling excess battery power back to the grid?

Yes, in some regions, you can participate in programs that allow you to sell excess stored energy back to the grid, particularly during peak demand. This can generate additional revenue and further improve your ROI. Check with your local utility for available programs like net metering or virtual power plants.

Is a battery retrofit worth it if I don't experience frequent power outages?

Even without frequent outages, a battery retrofit offers substantial financial benefits through energy arbitrage (buying low, selling high or using stored power during peak rates) and reducing your reliance on grid electricity. The enhanced energy independence and reduced carbon footprint also provide significant value beyond direct monetary savings.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.