Energy costs feel unpredictable today. Many businesses see sharp afternoon peaks, wide time-of-use gaps, and tighter uptime needs. A LiFePO4 lithium battery turns that chaos into a plan. You store cheap power, release it when rates rise, and keep key loads alive during outages. The aim is simple. Spend less, run steadier, and make payback visible.

What Is a LiFePO4 Lithium Battery for Business, and Why for Commercial Energy Storage?

LiFePO4 means lithium iron phosphate. It is a branch of the lithium battery family that suits fixed sites. The chemistry is stable under heat. The life cycle is long at common depths of discharge. The voltage window is predictable. These traits help managers plan costs with fewer surprises.

Key Properties That Matter

High cycle life supports daily use. Strong thermal stability keeps the risk low under thermal stress. A flat discharge curve provides steady output. Standardized racks and clear service access make on-site O&M simpler.

Why It Fits Business Use

Uptime and safety come first at a facility. A LiFePO4 lithium battery keeps the risk lower during charge and discharge. It also holds performance across many cycles. That supports a clean total cost of ownership model.

How Do LiFePO4 Commercial Energy Storage Systems Reduce Business Energy Costs?

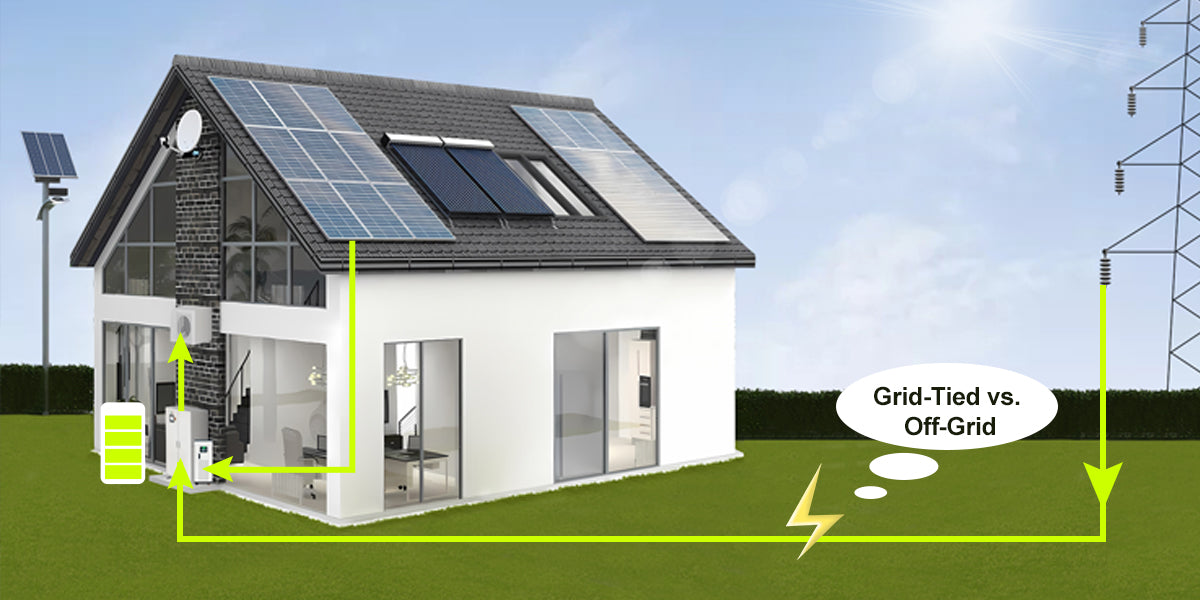

A storage system saves money by changing when and how you use grid energy. It also protects revenue during brief or long outages. The logic is clear. Charge when rates are low. Discharge when rates are high. Control spikes that create demand charges. An Energy Management System (EMS) schedules the lithium battery to hit the most valuable hours.

| Saving Lever | Inputs You Control | Primary Outcome |

| Time-of-Use Arbitrage | Charge off-peak, discharge on-peak | Lower energy line item |

| Peak Shaving | Dispatch at load spikes | Lower demand line item |

| PV Self-Consumption | Store midday PV for late-day use | Higher solar value |

| Backup For Critical Loads | Maintain essential circuits | Lower outage-related loss |

A well-tuned system learns your load shape. The result is a steady cut in bills and a calmer operations team.

Where Does a LiFePO4 Battery for Business Deliver the Best ROI?

Return improves when price signals are strong and load spikes are short. Look at your bill and daily graph. If the on-peak window is intense, storage earns its keep fast. If the site has fast spikes, shaving even a few minutes can move the demand charge.

Common High-Value Profiles

- Retail or food service with afternoon HVAC ramps

- Cold storage with compressor inrush spikes

- Small manufacturing with batch equipment starts

- EV charging sites that create short, tall peaks

Practical Signals to Check

- Large gap between off-peak and on-peak rates

- Demand charges that dominate the bill

- Solar production that exceeds daytime on-site use

In these cases, LiFePO4 storage matches the need for quick and repeatable dispatch.

How to Estimate LiFePO4 Battery ROI for Business

Managers want clarity on payback. Here is how to estimate LiFePO4 battery ROI for business without guesswork. Keep the math simple and traceable.

Step 1: Gather Interval and Tariff Data

Export 15-minute load data for at least one year. Collect energy rates, demand rules, and any time windows. Add solar production if you have PV.

Step 2: Set Technical Assumptions

Define battery usable capacity, power rating, round-trip efficiency, max depth of discharge, and limits per day. Your inverter and EMS should match these values.

Step 3: Build a Dispatch Rule

Create a rule that charges during the lowest-price blocks and discharges during the highest blocks. Add a peak shaving trigger at a chosen kW ceiling. Keep it simple for the first pass.

Step 4: Calculate Savings

Sum the kWh moved into high-price periods. Apply the rate difference. Then calculate the reduced peak demand using the new max interval. Add outage loss avoided if the backup value is material.

Step 5: Compare Against Costs

Add capital cost, warranty term, and any service fee. Divide by expected cycles within the warranty horizon. If financing, use the monthly payment and tax effects. The output is payback in years and a simple IRR range.

The plan works when savings recur every month, and the model is easy to audit. Keep a one-page worksheet so finance and operations can align.

What Size LiFePO4 Battery Does Your Business Need?

Right-sizing protects returns. Too small and savings stall. Too large and capital sits idle. Set a target peak cut and the hours you plan to cover.

Power Versus Energy

- Power rating covers the tallest spike you plan to shave

- Energy capacity covers the duration of the peak or outage

Simple Sizing Flow

- Choose a target kW cap for demand control.

- Measure typical spike length in minutes.

- Convert minutes and kW into required kWh.

- Adjust for round-trip efficiency and desired depth of discharge.

- Add a buffer for seasonal extremes.

Autonomy for Backup

Pick circuits that matter most. Size for the longest likely outage at those loads. The battery can stay charged and switch in about 10 to 20 ms when the grid fails. Premium designs reach around 4 to 6 ms.

Which Commercial Solar Batteries, Inverters, and EMS Pair Best with LiFePO4?

System design drives savings as much as chemistry. The battery, inverter, PV, and software must act as one. Check ratings, communication, and safety features. Keep the design clean to avoid bottlenecks.

AC vs DC Coupling

| Aspect | AC-Coupled | DC-Coupled |

| Integration | Easier retrofit on existing PV | Tighter link between PV and battery |

| Conversion Steps | More conversions in some flows | Fewer conversions in PV-to-storage |

| Control | Good for mixed assets across panels | Good for new builds and deep control |

EMS and Communications

Pick an EMS that reads your tariff windows and interval data. It should control the battery with setpoints for both energy shifting and peak caps. Look for clear logs, open protocols, and remote updates.

Practical Checks Before You Buy

- Inverter power matches peak shaving goals

- Battery C-rate supports required ramp speed

- Site protection and disconnects meet code

- Commissioning plan includes tariff validation

The right stack keeps savings on track and keeps operations simple for staff.

How to De-Risk and Scale: Warranty, Safety, Service, and Multi-Site Rollout

Clarity lowers risk. Contract terms should match real operating profiles. A solid rollout plan creates wins you can repeat across sites.

Warranty and Lifecycle

A workable warranty reads like a plan, not a slogan. It states a term in years and a cycle allowance, then explains what usable energy remains at the end in both percent and kilowatt-hours. Clear exclusions and response times help teams act fast when something breaks. When performance reports map directly to the warranty triggers, review meetings stay calm and short.

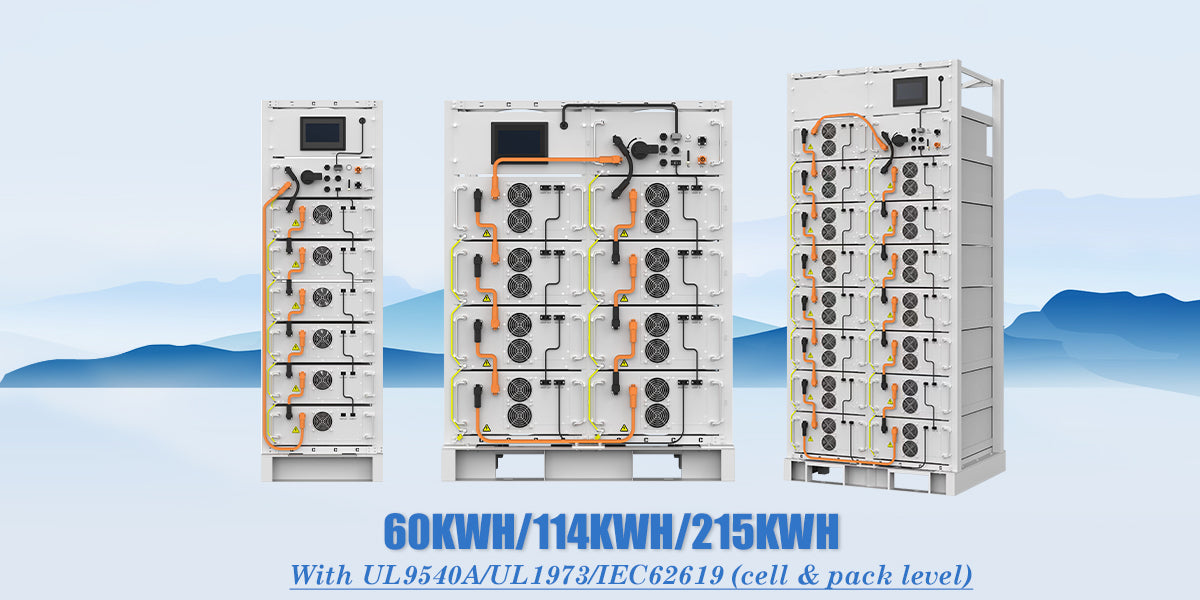

Safety and Compliance

Safety grows from design and routine. The LiFePO4 lithium battery system should carry recognized test standards and a defined fire protection approach. Room drawings that show spacing, zoning, and ventilation make inspectors and staff confident. Short quarterly drills keep shutdown and restart procedures fresh, and the compliance packet belongs beside the main disconnect.

Service and Monitoring

Good service becomes visible in data. Remote diagnostics and event logs let an engineer answer most questions without a truck roll. Finance needs a monthly summary that a non-engineer can read in two minutes. An EMS with secure updates and an audit trail keeps changes traceable, while a small on-site spares kit turns a minor fault into a quick fix.

Multi-Site Playbook

Strong programs start small and repeat well. Two sites with clear price signals create a clean pilot. After three billing cycles, savings on paper should match savings on the bill. The same design then moves to look-alike sites under one EMS view, and a quarterly review keeps dispatch rules aligned with seasons and tariffs.

Turning Volatile Bills Into Predictable Costs With LiFePO4 Battery ROI

A calmer bill is possible. Store low-cost energy. Release it during high-value periods. Hold your peak under control. Keep core circuits alive during grid events. Those moves work because a LiFePO4 lithium battery is stable, repeatable, and easy to plan around. The payoff is steady. The method is auditable. The outcome is a path to reduce business energy costs with fewer surprises.

FAQs

Q1. How do I avoid long utility interconnection delays?

File an interconnection request early. Use the utility standard package. Request Fast Track screening. Match inverter settings to export limits. Share one line drawings and protection studies upfront. Hire an engineer familiar with the utility.

Q2. Can a LiFePO4 system coexist with a standby generator?

Yes. Use an automatic transfer switch and clear source priority. Set a minimum state of charge for black starts. Add no backfeed logic. Coordinate frequency and voltage windows with the generator.

Q3. Can the battery earn from demand response programs?

Often yes. Enroll through an aggregator. Confirm telemetry specs, metering, and event notice times. Reserve state of charge for events. Model revenue against cycle wear. Use simple rules during the early months.

Q4. Who owns the data, and how do I access it?

Keep ownership in the contract. Require API access, webhooks, and CSV exports. Ask for SSO and role control. Store raw interval data in your cloud for audits, reports, and long-term analysis.

Q5. How do I report emissions benefits from storage?

Use hourly grid emissions factors from your utility or EPA eGRID. Multiply the shifted kWh by those factors. Document method in policy. Keep calculator sheets and logs to support external reviews.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.