You have invested in a solar energy storage system (ESS), a powerful tool for energy independence. But are you getting the most financial benefit from it? Many system owners inadvertently leave money on the table because their system isn't correctly aligned with local utility export rules. The regulations governing how you are compensated for the excess energy you send to the grid can dramatically affect your savings.

By understanding these rules and configuring your ESS strategically, you can significantly boost your return on investment. This is not about complex technical work; it is about smart energy management. This text explains how to make your ESS work harder for you, turning a passive backup system into an active financial asset.

Why Export Rules Dictate Your Solar Profits

The financial success of your solar-plus-storage system hinges on the policies set by your local utility and government. These rules determine the value of every kilowatt-hour your system exports, creating either an opportunity or a financial hurdle.

From Net Metering to Net Billing: A Quick Recap

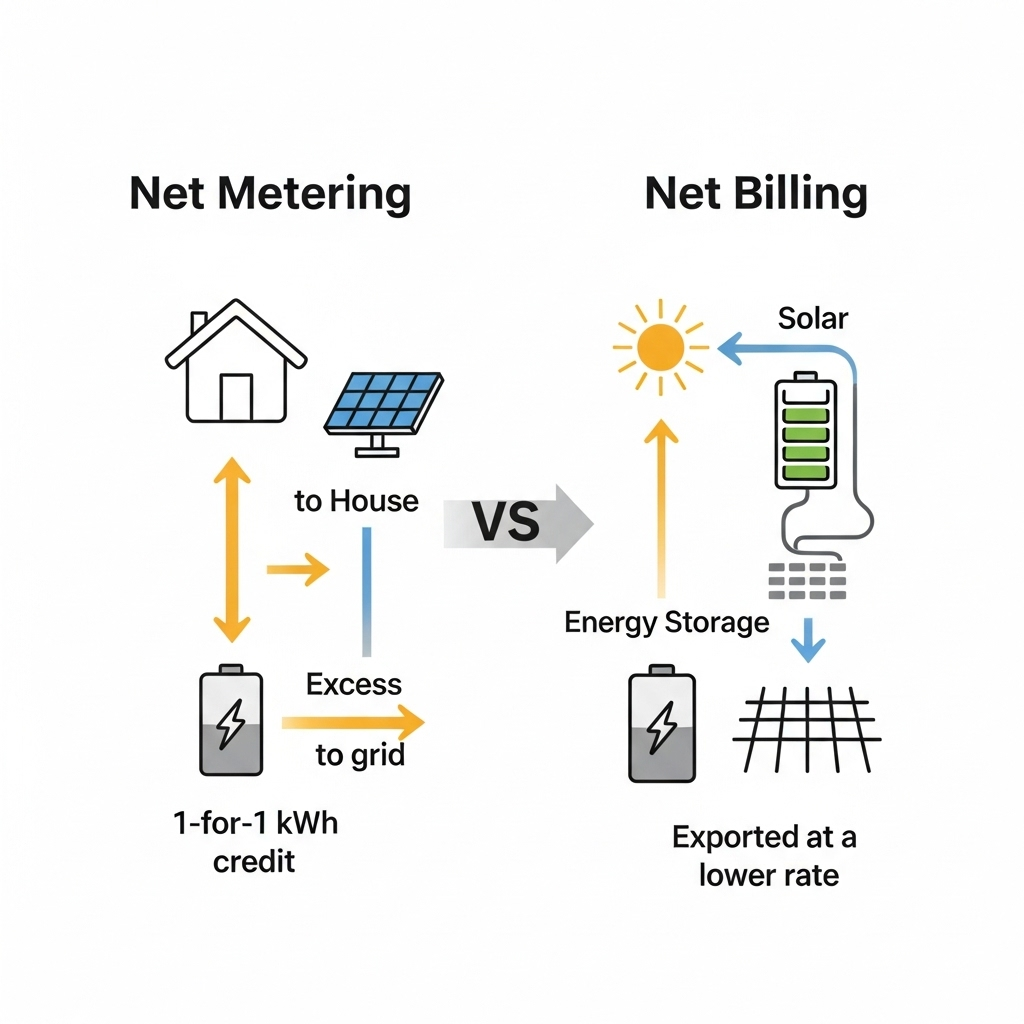

Export compensation policies generally fall into two main categories. Net metering allows you to trade surplus solar energy for credits, which are often valued at the full retail rate of electricity. You use these credits to offset the cost of electricity you draw from the grid at night or on cloudy days. In contrast, net billing compensates you for exported energy at a lower rate, typically based on the wholesale price of electricity. This rate is almost always less than the retail price you pay.

Many regions are shifting from generous net metering policies to net billing structures. According to a report by the IEA, both net and gross metering schemes have successfully propelled dynamic growth in many markets. However, the financial implications for system owners change dramatically with the policy details.

The Financial Gap: Retail Rate vs. Export Rate

The core issue is the 'financial gap'—the difference between the high price you pay for grid electricity and the low price you receive for your exported solar energy. Under net billing, this gap can be substantial. For example, you might pay $0.30 per kWh for electricity but only receive $0.05 per kWh for your exports. Exporting 20 kWh a day under this scenario earns you just $1, while using that same energy to power your home would save you $6. This is the opportunity that a well-configured ESS can capture.

Your ESS: More Than Just a Backup Battery

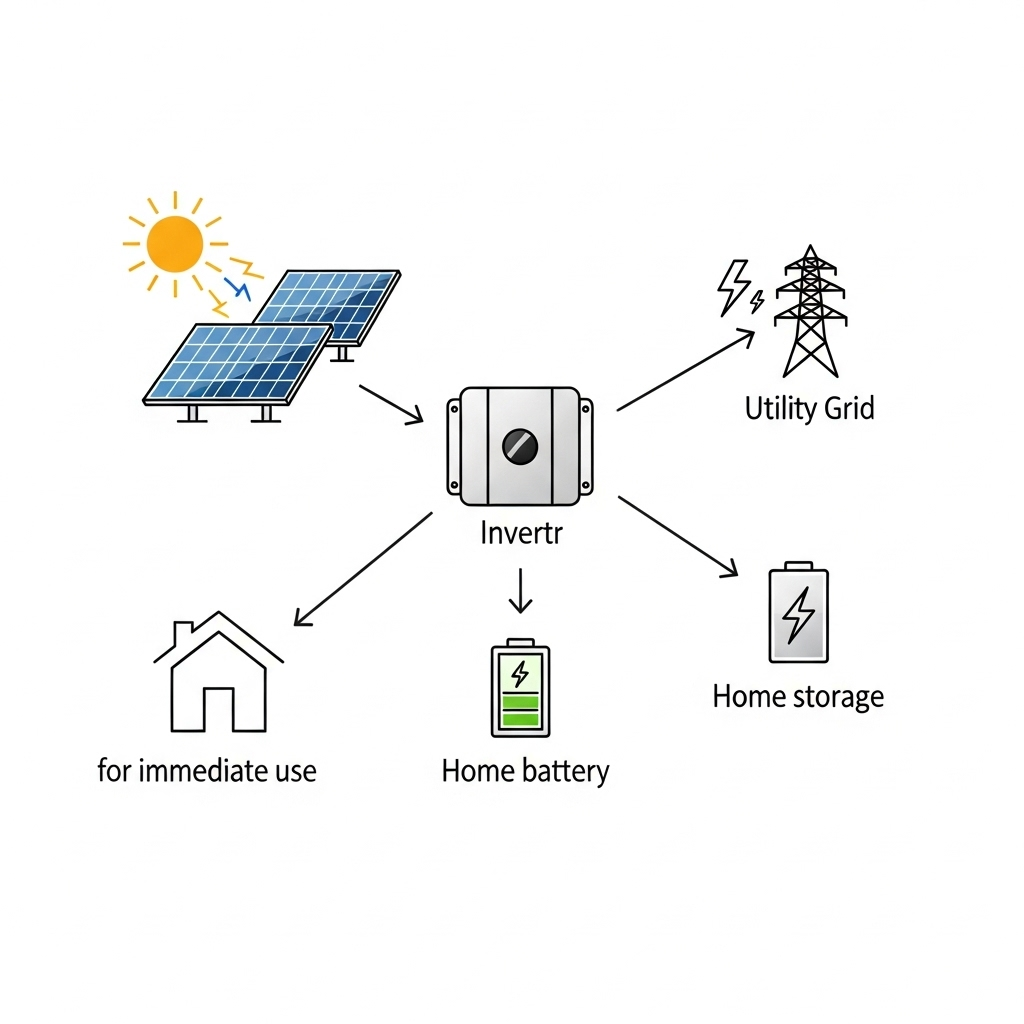

A modern energy storage system is a programmable device that gives you control over your energy. Instead of being a passive backup power source, it can be an active tool for financial optimization. The key is to use smart strategies that respond to your local utility's pricing structure.

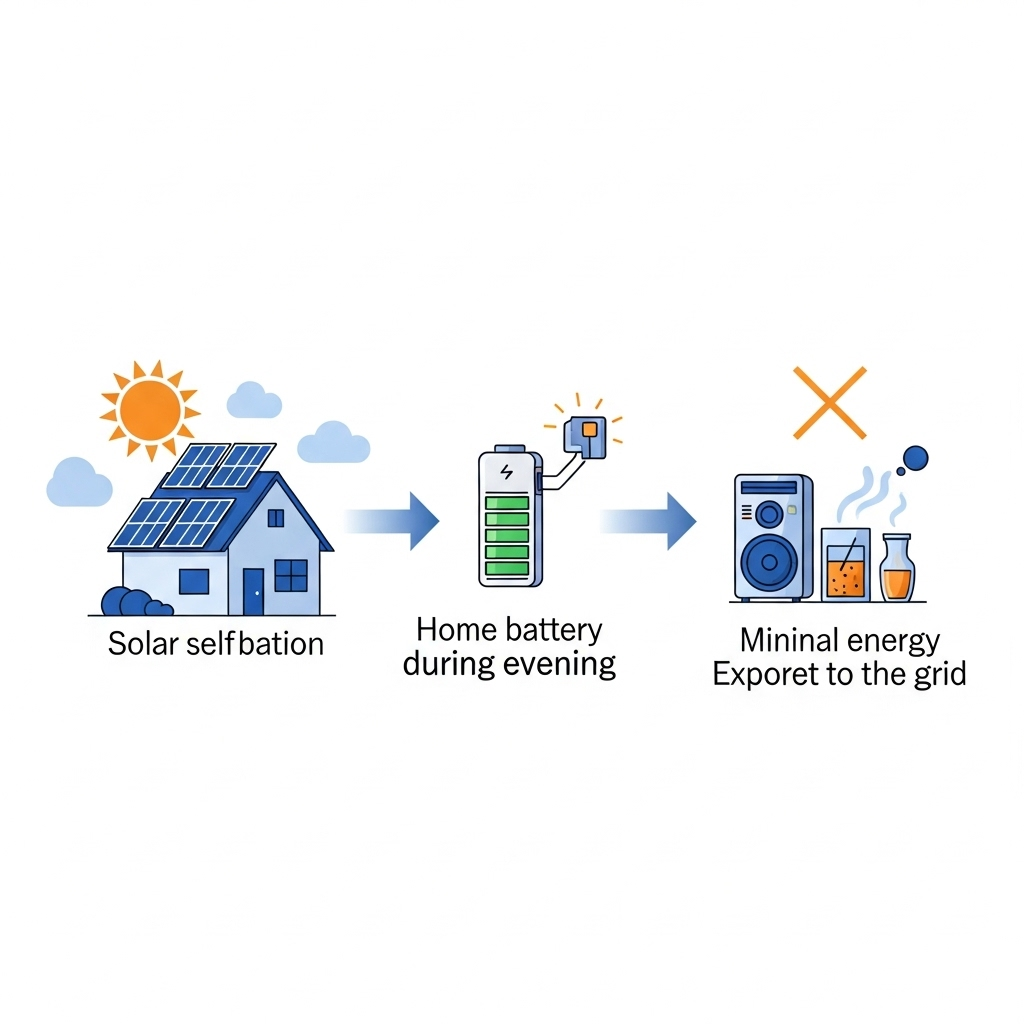

The Self-Consumption Strategy: Your First Priority

The most effective strategy in a net billing environment is self-consumption. Instead of exporting your excess solar power for a low credit, you program your ESS to store it. Your system's hybrid inverter directs the surplus energy into your LiFePO4 battery. When the sun goes down, your home automatically draws from the battery instead of the grid. This allows you to use your own clean energy and avoid paying high retail rates for electricity. You effectively pay yourself first, capturing the full value of your solar generation.

Time-of-Use (TOU) Arbitrage: Advanced Profit-Making

Many utilities use Time-of-Use (TOU) rates, where electricity prices change throughout the day. Prices are typically highest during 'peak' hours (e.g., 4-9 PM) and lowest during 'off-peak' hours. This pricing structure creates an opportunity for energy arbitrage. You can program your ESS to:

- Store solar energy during the day when generation is high.

- Discharge the battery to power your home during expensive peak hours.

- In some cases, if export rates are also high during peak hours, you can even sell your stored energy to the grid for a profit.

This strategy turns your battery into a small-scale energy trading tool, actively working to reduce your bills and, in some markets, even generate income.

Tailoring Your Strategy to Local Regulations

A one-size-fits-all approach does not work. The optimal ESS configuration depends entirely on your local utility's rules. A strategy that is profitable in one area may be ineffective in another.

Optimizing for Net Metering Environments

If you are fortunate enough to have a 1:1 net metering policy, the financial incentive for daily energy storage is reduced. Since the grid acts like a battery, storing and returning energy at the same value, the primary role of your ESS shifts. In this scenario, your battery's main value comes from providing backup power during grid outages, ensuring your lights and essential appliances stay on.

Maximizing Returns Under Net Billing

Net billing is where an ESS truly proves its worth. The lower the export compensation rate, the more valuable self-consumption becomes. A properly sized and configured battery allows you to use nearly 100% of the solar energy you generate, drastically reducing your reliance on the grid and maximizing your savings.

| Scenario | Value of 10 kWh Exported Energy | Value of 10 kWh Stored & Self-Consumed | Net Benefit of Storing |

|---|---|---|---|

| Net Metering (Retail Rate: $0.30/kWh) | $3.00 | $3.00 | $0.00 |

| Net Billing (Export Rate: $0.05/kWh) | $0.50 | $3.00 | $2.50 |

Navigating Complex Tariffs and Rules

Some utilities employ even more complex rules, such as demand charges or Value of Solar (VOS) tariffs. An ESS can help here too. For instance, it can be programmed for 'peak shaving' to reduce high demand charges, which are based on your highest power usage in a billing period. As regulatory frameworks evolve, having a flexible ESS is key. The IEA highlights that inconsistency in regulatory rules across states is a significant challenge, making adaptable technology even more critical for consumers.

The Technology Behind Smart Energy Management

Executing these strategies requires sophisticated, reliable hardware. The intelligence of your system lies in how its core components work together.

The Role of the Hybrid Inverter and BMS

The hybrid inverter is the brain of your solar-plus-storage system. It is a powerful device that directs the flow of energy between your solar panels, battery, home, and the grid. It executes the commands for self-consumption or TOU arbitrage. Working alongside it is the Battery Management System (BMS), which protects your battery by monitoring its state of charge, temperature, and overall health, ensuring safe and long-lasting operation.

Monitoring and Performance Metrics

You cannot manage what you cannot measure. A quality ESS comes with a monitoring platform that shows you exactly where your energy is coming from and going to in real-time. Understanding this data is the first step to optimization. To make informed decisions, it is helpful to be familiar with key metrics. For a detailed breakdown of the technical indicators that define system efficiency, you can review this reference on solar storage performance. Factors like Round-Trip Efficiency (RTE) directly influence how much stored energy is available for you to use, impacting your financial returns.

The Importance of Reliable Hardware

Your ability to save money for the next decade or more depends on the durability of your equipment. A high-performance system built with a quality LiFePO4 battery and a robust hybrid inverter is essential. These components must be able to withstand daily charge and discharge cycles for years. As noted in The Role of Critical Minerals in Clean Energy Transitions by the IEA, the integrity of the supply chain for materials like lithium is fundamental to the long-term reliability of clean energy technologies.

Putting Your Energy to Work for You

Your energy storage system is far more than just a battery; it is a dynamic financial tool. By moving beyond a passive 'set-it-and-forget-it' mindset, you can unlock its full potential. The key is to understand your local export compensation rules and program your system to respond intelligently.

Whether through maximizing self-consumption under net billing or leveraging TOU rates for arbitrage, aligning your ESS with policy is the definitive step toward maximizing your solar investment. Take a moment to review your utility bill, identify your export rate, and ensure your system is configured to stop leaving money on the table.

Disclaimer: This article is for informational purposes only and does not constitute financial or legal advice. Consult with a qualified professional and your utility provider to understand the specific rules and financial implications for your situation.

Frequently Asked Questions

What is the main difference in ESS strategy between net metering and net billing?

Under net metering, where export credits are high, the primary ESS strategy is often backup power. Under net billing, with its lower export credits, the primary strategy shifts to maximizing self-consumption to avoid selling your solar energy to the grid for a low price.

Can I really make money with my battery?

In some regions with favorable Time-of-Use (TOU) rates and high peak export prices, it is possible to profit through energy arbitrage. For most homeowners, however, the primary financial benefit comes from cost avoidance—using your own stored energy instead of buying expensive grid power.

How do I know what my local export rules are?

Your utility company's website is the most reliable source. Look for documents or web pages with terms like 'Net Energy Metering (NEM),' 'Net Billing,' 'Export Credit Rate,' or 'Feed-in Tariff.' Your solar installation contract should also specify the agreement you are on.

Do I need a special kind of ESS to do this?

You need an energy storage system that includes a programmable hybrid inverter. Most modern home energy storage solutions are designed with these capabilities, allowing you to easily select operating modes like 'Self-Consumption,' 'Time-of-Use,' or 'Backup Power' through a user-friendly app or interface.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.