Pairing a rooftop solar PV system with battery storage unlocks significant potential for energy independence and savings. But to truly understand the financial benefits, you need to model how you will be compensated for the excess energy you send to the grid. Export compensation rules are evolving, and the presence of a battery adds a new layer of strategic decision-making. This analysis provides a clear framework for calculating the financial returns of a solar-plus-storage system in today's energy landscape.

Understanding the Core Compensation Models

The way your utility credits you for exported solar power is the single most important factor in your system's payback period. The policies generally fall into three main categories, each with different implications for battery storage owners.

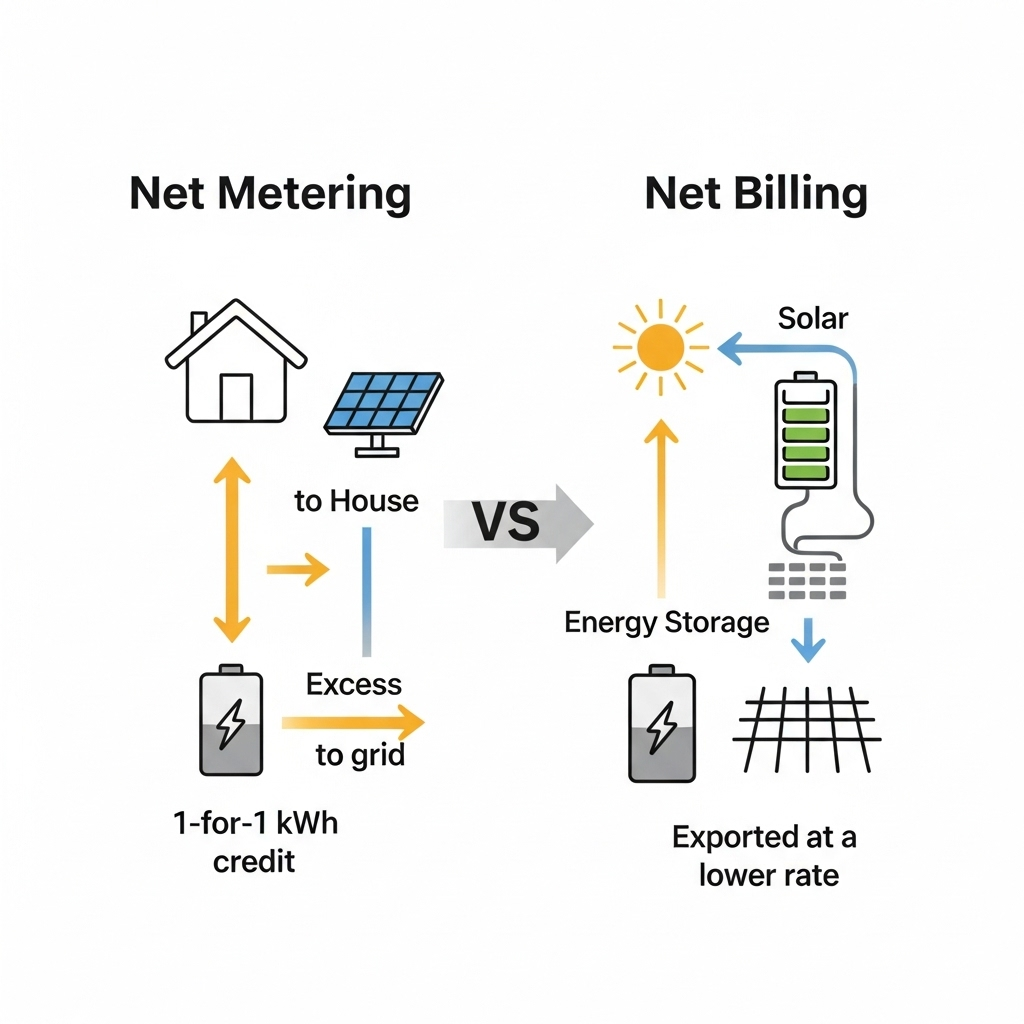

Net Metering: The Traditional Approach

Net metering has been the standard for years. In this model, your utility meter spins backward when you export excess solar energy. You receive a credit for each kilowatt-hour (kWh) exported, typically at the full retail rate you pay for electricity. At the end of the billing period, you only pay for your 'net' consumption. While simple, this 1-to-1 credit system has faced scrutiny. As a report from the International Energy Agency (IEA) notes, traditional net metering does not inherently encourage real-time self-consumption, as surplus power can be 'stored' on the grid for later use without penalty, which can create challenges for utility operators.

Net Billing: The Evolving Standard

Many regions are transitioning to net billing. Under this structure, the value of your exported energy is different from the price of the energy you import. You still buy electricity from the grid at the standard retail rate, but you sell your excess solar power back at a lower rate, often called an avoided-cost rate or wholesale rate. This change fundamentally increases the value of self-consumption. Instead of exporting a kWh for a low credit, it becomes more profitable to store that kWh in your battery and use it later, avoiding the need to purchase a kWh at the higher retail price.

Gross Metering: A Different Paradigm

Less common for residential systems, gross metering treats your solar PV system like a small power plant. All the electricity you generate is sold directly to the grid at a predetermined feed-in tariff. Simultaneously, you purchase all the electricity your home needs from the grid. This 'buy-all, sell-all' approach decouples your energy generation from your consumption, making on-site storage for self-consumption irrelevant unless the battery is used for other purposes like energy arbitrage.

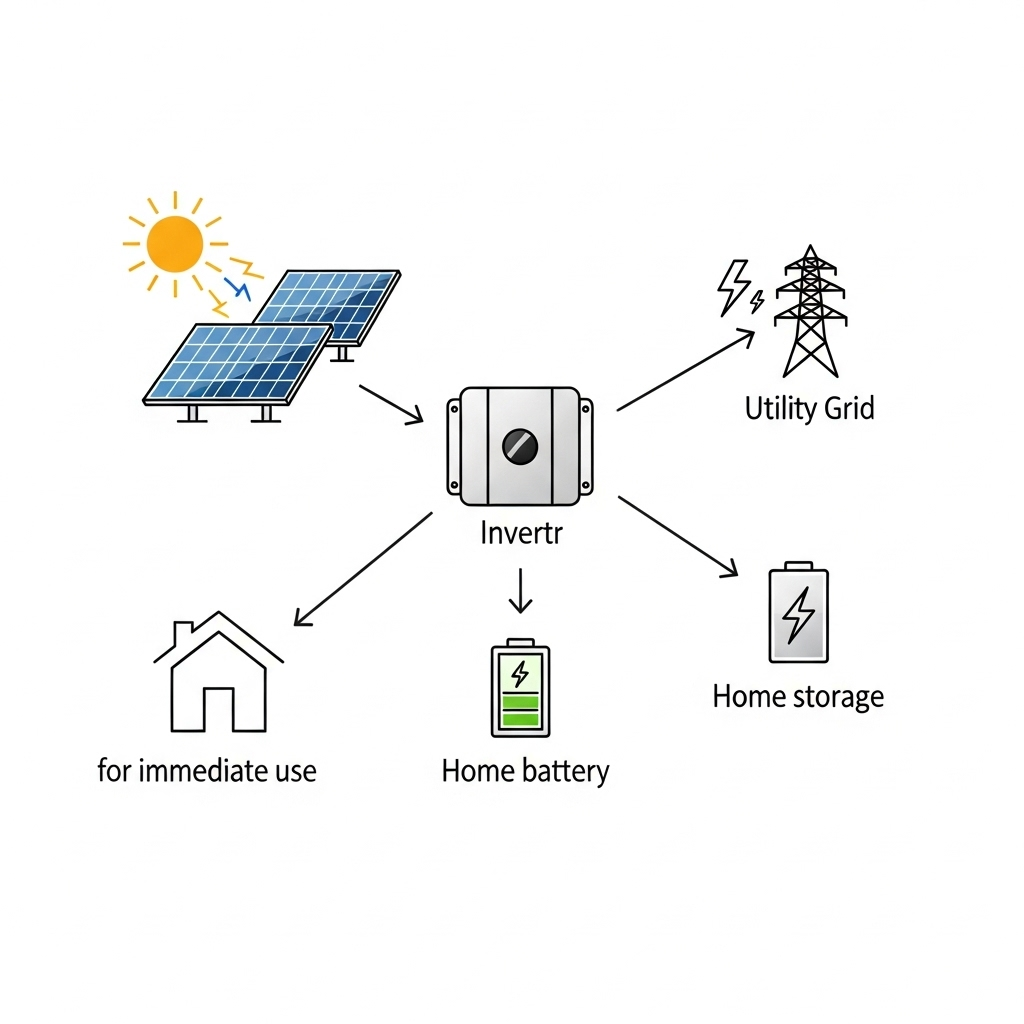

The Role of Battery Storage in Export Strategies

A battery storage system transforms your rooftop solar from a simple generator into a manageable energy asset. It gives you control over when you use, store, or sell your solar power, allowing you to optimize your financial returns based on the prevailing compensation rules.

Maximizing Self-Consumption

The primary strategy in a net billing environment is to maximize self-consumption. Your solar panels generate the most power in the middle of the day, when household energy demand is often low. Instead of exporting this cheap power, a battery stores it. In the evening, when the sun goes down and electricity rates may be higher, you can discharge the battery to power your home. This directly reduces your reliance on the grid and minimizes the amount of electricity you need to buy at retail prices.

Energy Arbitrage: Buying Low, Selling High

With a Time-of-Use (TOU) rate plan, the price of electricity changes throughout the day. Energy arbitrage is the practice of charging your battery when electricity is cheap and discharging it when it's expensive. This can involve storing your own solar power for use during peak-price hours or even charging the battery from the grid during super off-peak hours to sell back during peak times. As noted in an IEA report on power system transformation, arbitrage opportunities have been a significant driver for storage deployment globally.

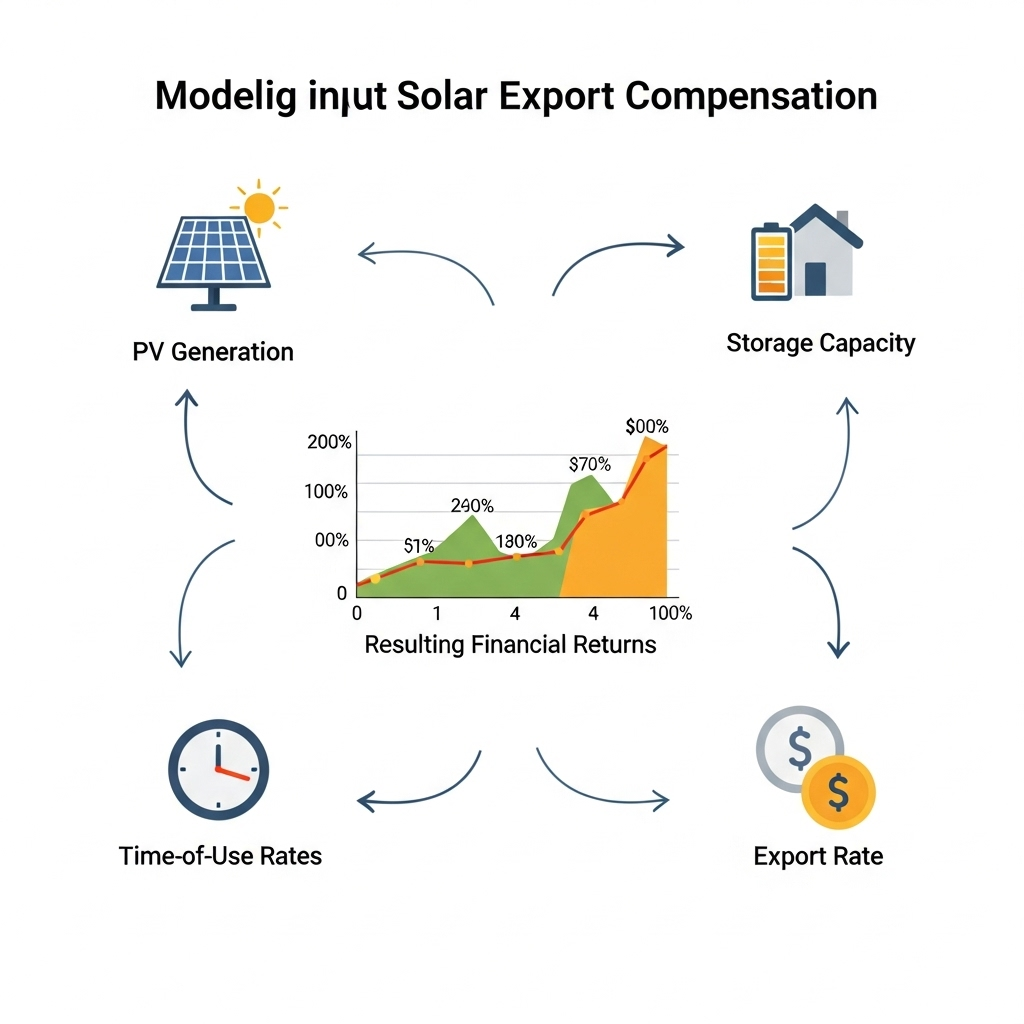

Building Your Financial Model: Key Variables to Consider

Accurately forecasting your savings requires a model that accounts for several key variables. Getting these inputs right is critical for a realistic projection of your system's performance and return on investment.

Your Energy Consumption Profile (Load Profile)

First, you need to understand your own energy usage. A load profile details how much electricity you use and, more importantly, *when* you use it. An electricity bill gives you monthly totals, but for accurate modeling with storage, you need hourly data. Many utilities can provide this information. This profile will show your daily peaks and troughs in consumption, revealing the best opportunities for battery dispatch.

PV System Generation

Next is the supply side: how much energy will your solar panels produce? This depends on your system's size (in kilowatts), panel efficiency, geographic location, panel orientation and tilt, and any potential shading from trees or nearby buildings. Solar modeling software uses local weather data to create an accurate hour-by-hour generation forecast for a typical year.

Battery System Parameters

Your battery's specifications are crucial. The main figures are its capacity (in kWh), power rating (in kW), and round-trip efficiency. Capacity determines how much energy you can store, while the power rating dictates how quickly you can charge or discharge it. Round-trip efficiency accounts for the small amount of energy lost during the charge-and-discharge cycle. For a detailed analysis of these metrics, you can review this ultimate reference on solar storage performance, which explains how they impact overall system value.

Utility Rate Structure and Export Rates

Finally, you need the details of your electricity tariff. This includes the price you pay per kWh (which may vary by time of day or season), any fixed monthly charges, and the specific rate you will be paid for exported energy. The spread between your import price and export price is the key driver of a battery's value.

A Simplified Modeling Walkthrough

Let's illustrate how these variables interact in a net billing scenario with a TOU rate structure. The goal is to use stored battery energy to avoid buying expensive peak-hour electricity.

| Time of Day | Period | Grid Price (Import) | Export Rate | PV Generation | Home Load | Battery Action | Grid Interaction |

|---|---|---|---|---|---|---|---|

| 8 AM - 4 PM | Off-Peak | $0.15/kWh | $0.05/kWh | High | Low | Power home + Charge | Export surplus at $0.05/kWh |

| 4 PM - 9 PM | On-Peak | $0.35/kWh | $0.05/kWh | Low/None | High | Discharge | None (Battery covers load) |

| 9 PM - 8 AM | Off-Peak | $0.15/kWh | $0.05/kWh | None | Low | Idle | Import from grid at $0.15/kWh |

In this example, the battery is programmed to store solar energy during the day when export rates are low. During the expensive evening peak, the battery discharges to power the home, completely avoiding the $0.35/kWh grid price. This strategic use of the battery generates far more value than simply exporting all excess solar power at the low $0.05/kWh rate.

Looking Ahead: The Future of Export Compensation

The trend across global energy markets is clear: compensation policies are moving away from simple net metering toward more dynamic structures that reflect the real-time value of energy. This shift makes battery storage an increasingly vital component for any new rooftop solar installation. It moves the system owner from being a passive generator to an active participant in energy management. A framework developed by IRENA highlights the need for policies that properly compensate storage for the value it provides to the grid. By building a robust financial model, you can make an informed investment decision, tailor your system to your specific needs, and take a major step toward securing your energy future.

Frequently Asked Questions

Can I still benefit from solar if my utility offers low export rates?

Yes. With low export rates, the financial strategy shifts from exporting energy to maximizing self-consumption. A battery storage system is the key to this strategy. It allows you to store your excess solar energy for your own use later, such as during the evening or on cloudy days. This directly reduces the amount of expensive electricity you need to purchase from the grid, generating significant savings.

How does round-trip efficiency affect my savings?

Round-trip efficiency is the percentage of energy you get out of a battery compared to the amount of energy you put into it. For instance, a system with 90% round-trip efficiency will provide 9 kWh of usable energy for every 10 kWh used to charge it. This energy loss, though small, impacts the total energy available for self-consumption or export. A higher efficiency rating means less wasted energy and better overall financial returns over the life of the system.

What is the difference between net metering and net billing?

Under net metering, you typically receive a credit for exported energy at the same retail rate you pay for electricity, creating a simple 1-for-1 exchange. Under net billing, you are paid a lower rate for your exported energy, which is often based on the utility's 'avoided cost' or the wholesale price of electricity. This financial difference makes storing your own solar energy in a battery more valuable than exporting it to the grid.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.