The conversation around solar power is evolving. Generating your own electricity is a powerful first step, but the rules governing how you are compensated for surplus energy are changing. Many regions are moving away from simple net metering towards time-varying export tariffs. This raises a critical question for every solar homeowner, or 'prosumer': do these new rules diminish the value of your solar investment?

The answer is complex. For some, these tariffs represent a financial hurdle. For others, they unlock new opportunities for significant savings and even profit. The difference often comes down to one key component: energy storage.

The Shift in Export Compensation Rules

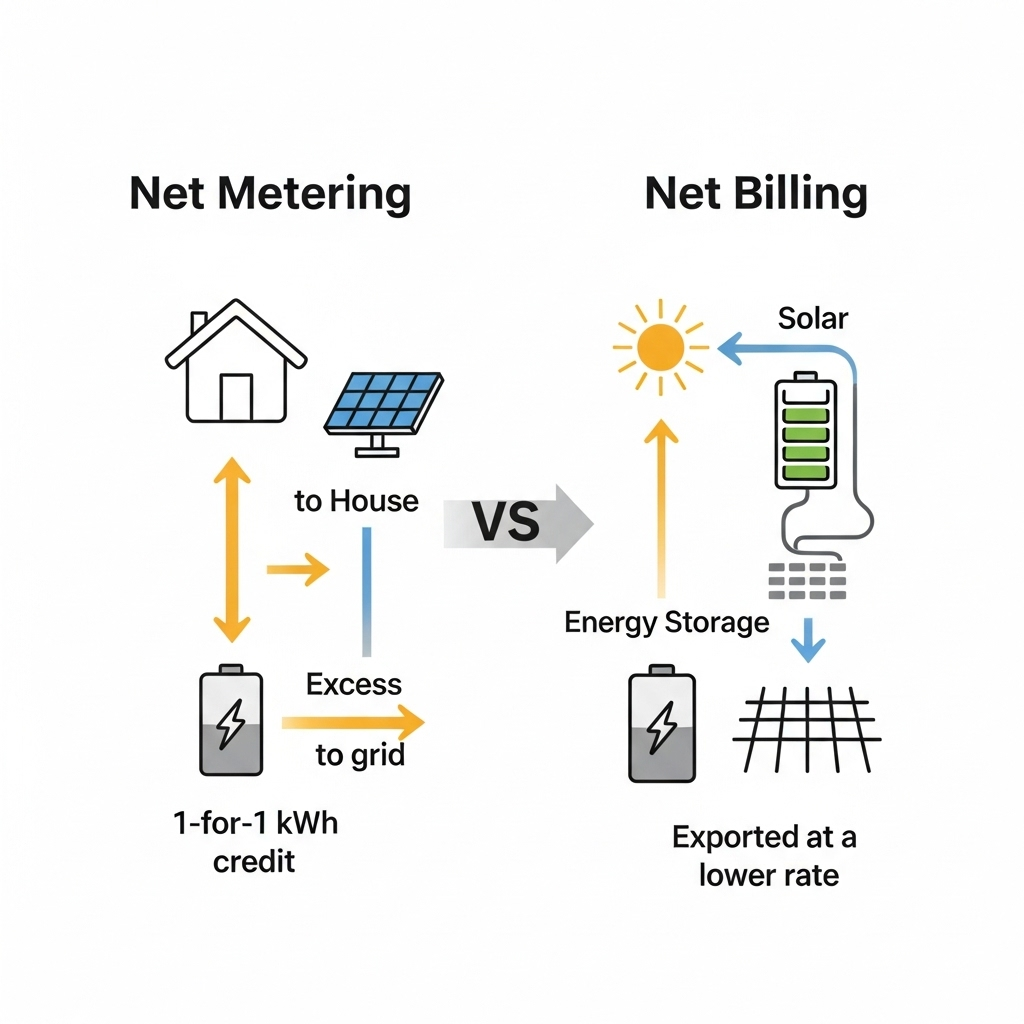

For years, net metering was the standard. It allowed homeowners to receive a one-for-one credit for every kilowatt-hour (kWh) of solar energy they sent to the grid. This model was instrumental in driving early solar adoption. However, as solar penetration has grown, this simple system has created new challenges for grid operators.

From Flat Rates to Dynamic Pricing

A flood of solar energy onto the grid during sunny midday hours can cause grid instability. According to a report from the International Energy Agency, Unlocking the Economic Potential of Rooftop Solar PV in India, this mismatch between peak solar generation and residential demand can strain local distribution networks and impact utility revenues. In response, utilities are implementing time-varying export tariffs, also known as Time-of-Use (TOU) export rates.

This model moves away from a flat credit. Instead, the price you receive for your exported energy changes throughout the day. You earn a higher rate when the grid needs power most (typically during evening peak demand) and a much lower rate when the grid is saturated with solar energy (during midday).

Why Utilities Are Making This Change

The primary motivation for this shift is to create a more stable and balanced electrical grid. Dynamic pricing encourages prosumers to use their energy when it's generated or to export it during periods of high system-wide demand. This helps utilities manage load and can delay or avoid costly investments in new power plants and grid infrastructure. Furthermore, it addresses concerns about fairness, ensuring that the costs of maintaining the grid are distributed more equitably among all customers, not just those without solar panels.

The Prosumer's Dilemma: Impact on Solar-Only Systems

For a prosumer with a traditional rooftop PV system and no battery, time-varying export tariffs can present a significant financial challenge. The core issue lies in a fundamental mismatch of timing.

The Midday Export Trap

A standard solar panel system generates the most power around noon, when the sun is at its highest point. Under a time-varying tariff, this is precisely when export compensation rates are at their lowest. Your system is exporting the most energy at the moment it is valued the least. This can dramatically reduce the income you generate from your solar array compared to what you would have earned under a traditional net metering policy. The global energy market is also in flux, with trade policies and supply chain dynamics influencing costs, as noted by the IEA's Renewables 2024 analysis.

A Look at the Financials

Consider a typical 5 kW solar system that generates 10 kWh of excess energy on a sunny day. Under a flat net metering rate of $0.15/kWh, exporting that energy would earn you $1.50. However, with a time-varying tariff, that same 10 kWh exported midday might only earn a rate of $0.04/kWh, netting you just $0.40. This stark difference can extend the payback period of a solar-only investment.

The Solution: How Battery Storage Changes the Game

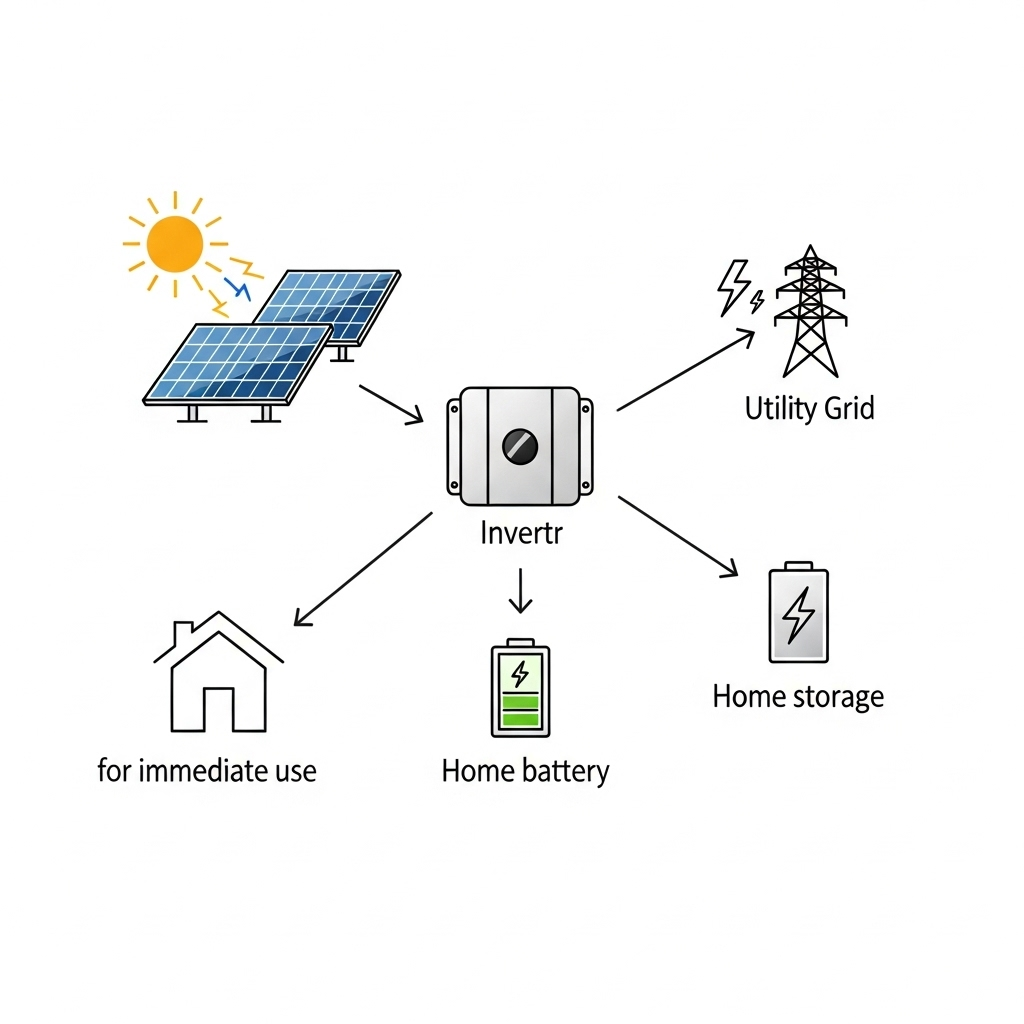

The introduction of a home battery storage system completely changes this dynamic. It transforms the challenge of low midday export rates into a strategic financial opportunity. Instead of being a passive generator, you become an active manager of your energy assets.

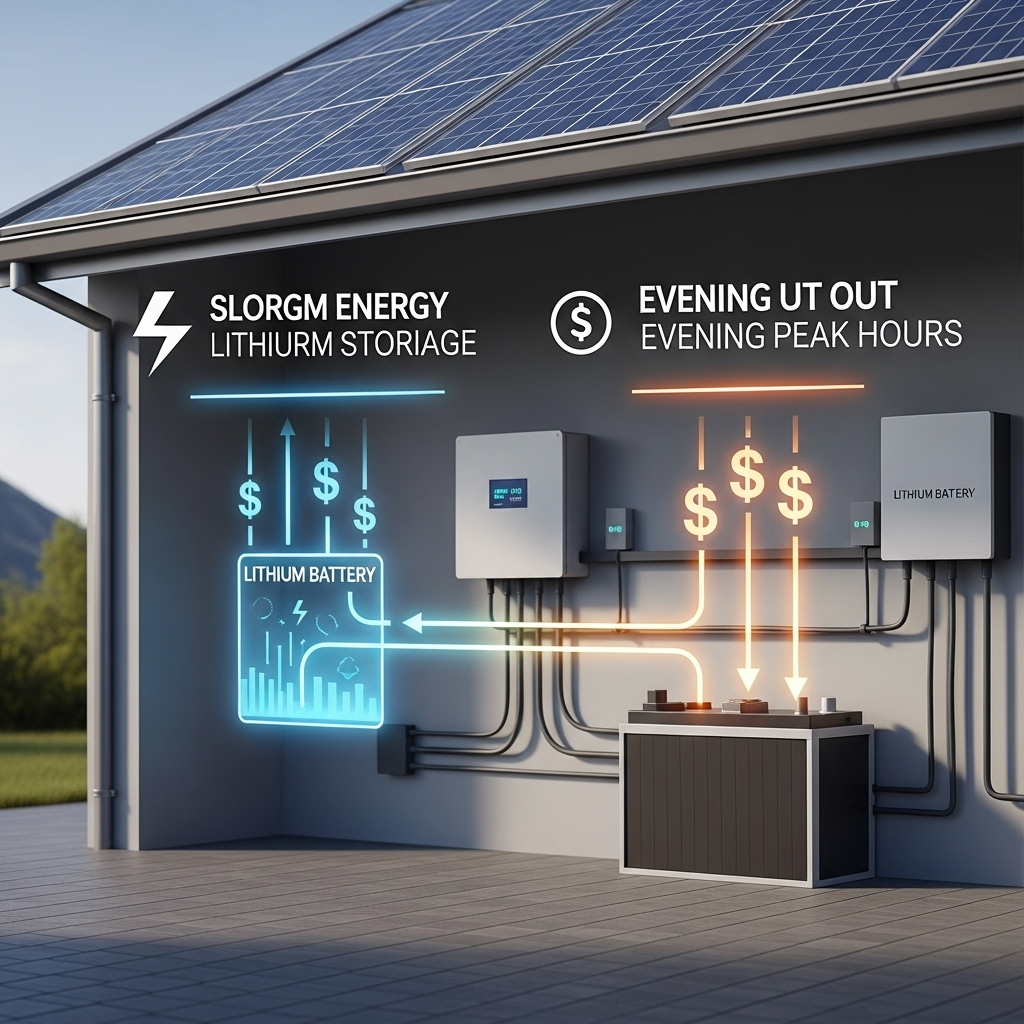

Unlocking Energy Arbitrage

Energy arbitrage is the core strategy. You use your battery to store the cheap, abundant solar energy you generate at midday instead of exporting it for a low price. Then, in the evening when grid demand and export prices are high, you can sell that stored energy back to the grid for a premium. You are effectively buying low (by storing your own solar) and selling high. This turns your battery into a revenue-generating tool.

Maximizing Self-Consumption and Savings

Beyond selling energy, a battery's primary benefit is maximizing self-consumption. The energy stored during the day can power your home through the evening and night. This allows you to avoid purchasing expensive electricity from the utility during peak-rate hours. For most homeowners, the savings from avoiding high-cost grid power are even more substantial than the revenue from exporting it.

A New Financial Model with Storage

Let's revisit our financial example, but this time with a battery. The 10 kWh of excess midday solar is now stored instead of exported. In the evening, you use 4 kWh of that stored energy to power your home, avoiding a peak purchase rate of $0.30/kWh (a saving of $1.20). You then export the remaining 6 kWh to the grid during the peak export window at a rate of $0.20/kWh (earning $1.20). Your total daily benefit is now $2.40—significantly more than the $0.40 without a battery and even better than the $1.50 from old-school net metering.

| Scenario | Midday Export (10 kWh) | Evening Savings/Earnings | Total Daily Value |

|---|---|---|---|

| Net Metering (Flat Rate) | Earns $1.50 (@ $0.15/kWh) | $0 | $1.50 |

| Time-Varying Tariff (No Battery) | Earns $0.40 (@ $0.04/kWh) | $0 | $0.40 |

| Time-Varying Tariff (With Battery) | $0 (Energy Stored) | Saves $1.20 + Earns $1.20 | $2.40 |

Building a System for a Dynamic Tariff World

Success in this new energy landscape requires a smart approach to system design. It's not just about adding a battery; it's about creating an integrated system that works intelligently to maximize your financial returns.

The Importance of Smart Components

Your system's performance depends on the quality of its parts. High-performance Lithium Iron Phosphate (LiFePO4) batteries are an excellent choice due to their long cycle life, inherent safety, and high efficiency. The hybrid inverter acts as the brain of the operation, directing the flow of electricity between your solar panels, battery, home, and the grid. A sophisticated inverter is required to execute the energy arbitrage strategies that make a battery profitable. For a detailed analysis of how these components contribute to system output, a complete reference on solar and storage performance metrics can provide crucial insights into maximizing your returns.

Sizing Your System Correctly

Properly sizing your solar array and battery is critical. An undersized battery won't capture enough midday energy to shift your consumption or profit from peak export rates. An oversized system might not provide a cost-effective return. A thorough analysis of your home's energy consumption patterns, known as a load profile, is the first step in designing a system that is perfectly tailored to your needs and the specific tariff structure in your area.

A New Era for Prosumers

Time-varying export tariffs are not a death knell for residential solar. Instead, they signal a maturation of the market. These policies challenge the viability of simple, passive solar-only systems but create powerful incentives for prosumers who embrace solar-plus-storage solutions. As the Energy Technology Perspectives 2024 report from the IEA points out, the global trade in clean energy technologies is growing rapidly, reflecting a move towards more sophisticated and interconnected energy systems.

By adding a battery, you transform your home from a simple power generator into an active, intelligent participant in the grid. You gain greater energy independence, reduce your electricity bills more effectively, and position yourself to profit from the grid of the future.

Disclaimer: The information provided is for educational purposes only and does not constitute financial or investment advice. Tariff structures and regulations vary by location. Please consult with a qualified professional before making any investment decisions.

Frequently Asked Questions

Do time-varying export tariffs make solar panels a bad investment?

Not necessarily. While they can reduce returns for systems without storage, they create new revenue opportunities for systems equipped with a battery. The key is to adapt your system to the new rules by storing energy for personal use or for export during high-rate periods.

What is 'energy arbitrage' for a solar prosumer?

Energy arbitrage is the strategy of storing solar energy when generation is high and electricity costs or export rates are low (typically midday), and then either using it or selling it back to the grid when costs or export rates are high (typically in the evening). A home battery system makes this possible.

How do I know if a battery is right for me under these tariffs?

It depends on the specific rates offered by your utility, your daily energy consumption patterns, and the size of your solar PV system. A professional solar installer can perform an analysis to calculate the potential return on investment for adding a battery to your system.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.