Choosing a battery for your energy storage system often starts with a look at the price tag. Yet, this initial number rarely tells the whole story. A lower upfront cost can conceal higher long-term expenses, including frequent replacements and lower efficiency. This analysis focuses on the financial differences between LiFePO4 (Lithium Iron Phosphate) and other lithium-ion batteries, shifting the perspective from initial price to the more crucial metric: total cost of ownership.

The Initial Price Tag: A Deceptive First Impression

At first glance, LiFePO4 batteries often appear more expensive than other lithium-ion chemistries like Nickel Manganese Cobalt (NMC). This difference can lead buyers to choose the seemingly more affordable option without understanding the underlying reasons for the price gap and its long-term implications.

Why LiFePO4 Batteries Can Cost More Upfront

The initial cost of a battery is influenced by raw material sourcing, manufacturing complexity, and the inclusion of an advanced Battery Management System (BMS). While the core materials for LiFePO4—phosphate and iron—are abundant and less volatile in price than cobalt, the production of high-purity, high-performance cells requires sophisticated processes. A robust BMS, which is critical for safety and longevity, also contributes to the upfront cost. This investment in quality manufacturing and safety features is what sets the stage for a lower total cost over the battery's life.

Comparing Initial Costs: A Sample Scenario

Consider a typical 12V 100Ah lithium battery. An NMC or similar lithium-ion variant might be priced lower than a LiFePO4 battery with the same specifications. For a large-scale home battery storage system requiring multiple units, this initial price difference can seem substantial. However, this simple comparison overlooks the most important factors that determine a battery's true value: how long it lasts and how much energy it delivers during its lifetime.

Calculating the Total Cost of Ownership (TCO)

Total Cost of Ownership (TCO) is a more accurate way to assess a battery's financial value. It considers not just the purchase price but also its lifespan, efficiency, and replacement frequency. When these factors are included, the LiFePO4 battery price reveals a much different picture.

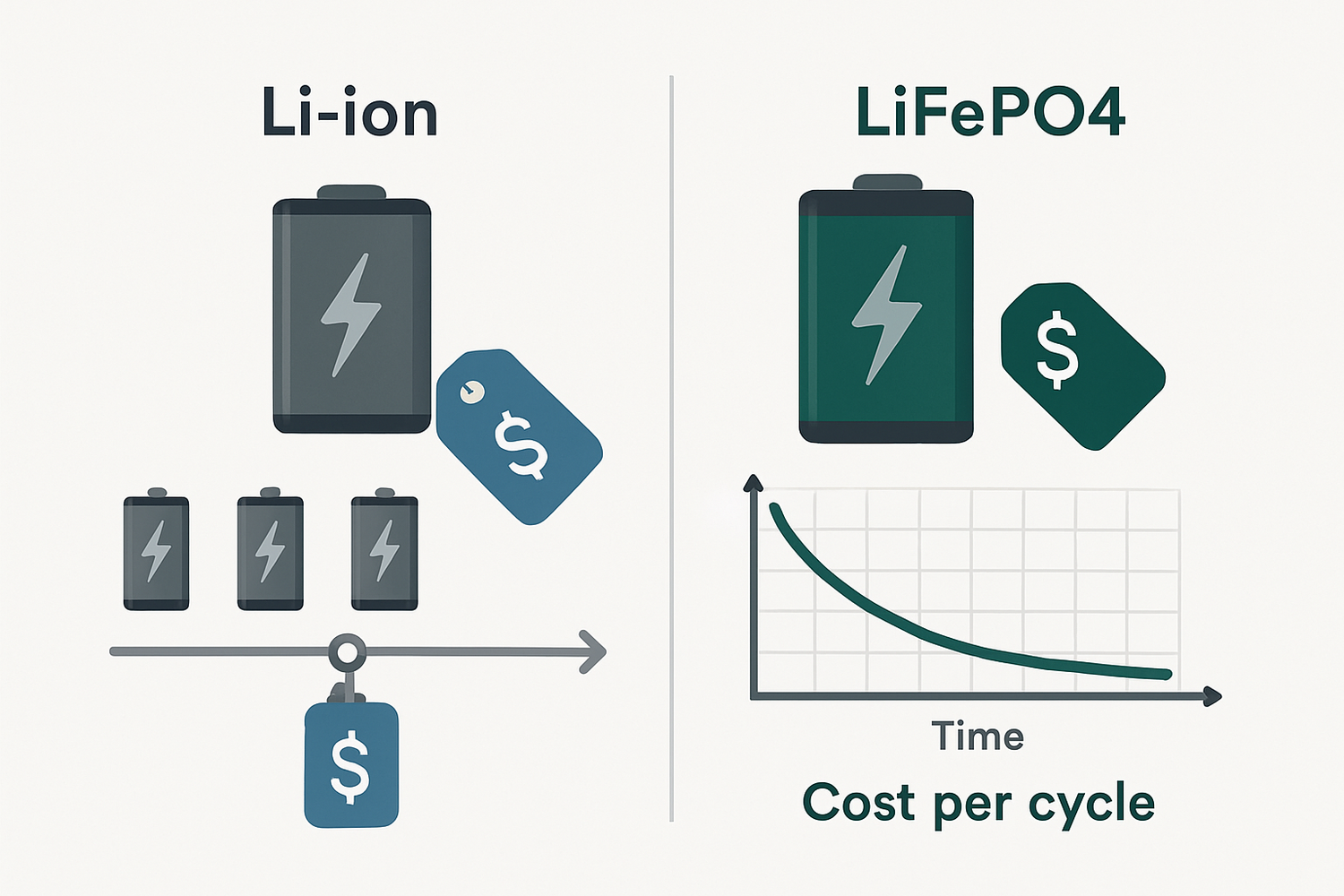

The Power of Cycle Life: Cost Per Kilowatt-Hour

Cycle life refers to the number of full charge and discharge cycles a battery can endure before its capacity significantly degrades. LiFePO4 batteries excel in this area, typically offering between 4,000 and 8,000 cycles. In contrast, many other lithium-ion chemistries provide 500 to 1,500 cycles. This dramatic difference in longevity directly impacts the cost per kWh delivered. For example, a LiFePO4 battery may have a levelized cost of storage (LCOS) that is two to four times lower than its counterparts. According to the International Renewable Energy Agency (IRENA), advancements in battery technology are driving down costs, but longevity remains a key differentiator for TCO.

Efficiency and Depth of Discharge: Hidden Savings

A battery's performance is critical for calculating its long-term value. As explained in the ultimate reference on solar storage performance, metrics like round-trip efficiency and Depth of Discharge (DoD) are vital. LiFePO4 batteries maintain high efficiency throughout their life and can be safely discharged up to 100% without significant degradation. Many other li-ion types recommend a lower DoD to preserve their lifespan, which means you can't use their full rated capacity. Higher efficiency and a greater usable capacity translate into more usable energy and better value from your solar energy storage system.

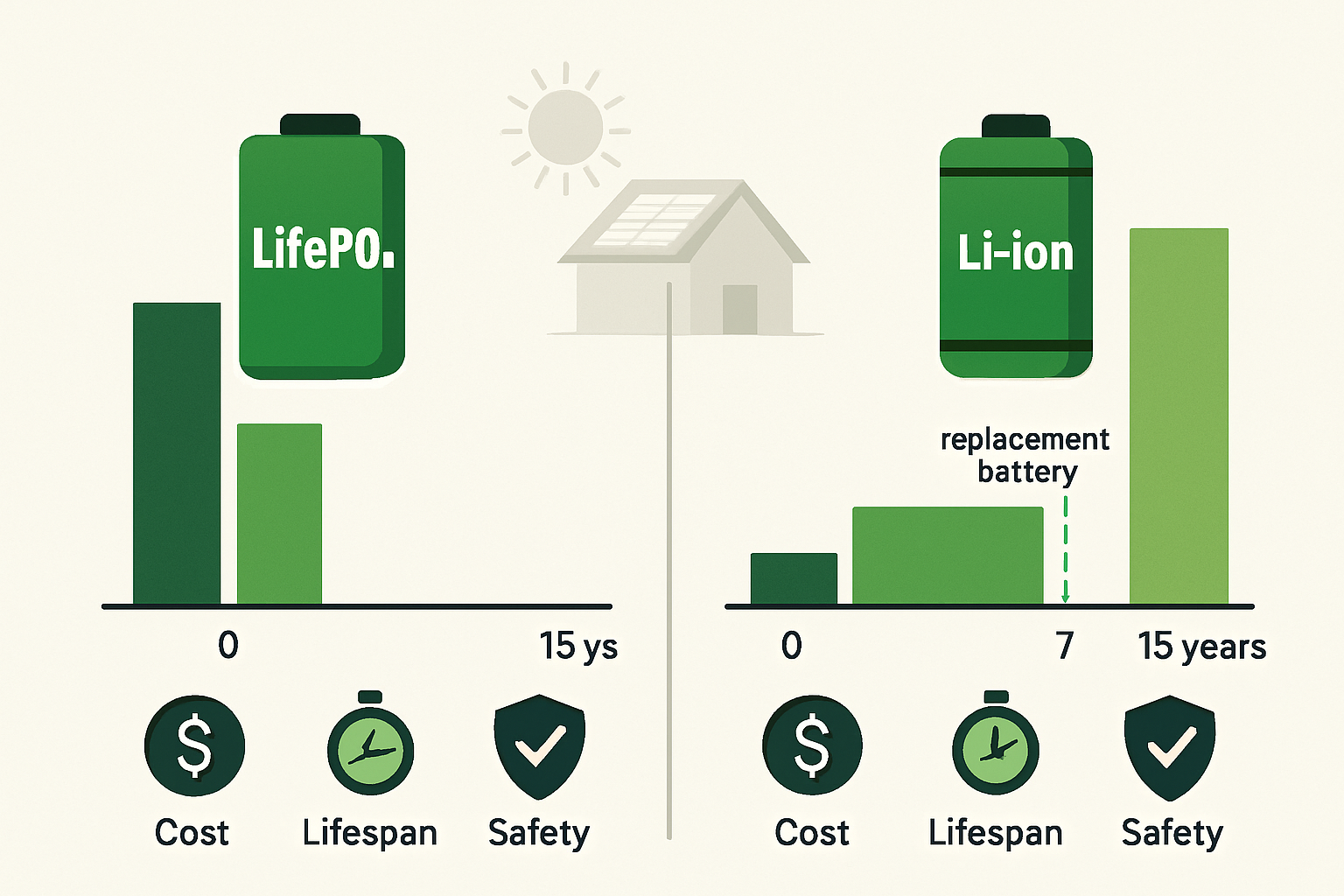

Replacement Costs: The Long-Term Financial Drain

A battery with a shorter cycle life requires more frequent replacement. If a standard lithium-ion battery lasts for 1,500 cycles in a daily-use application, it will need to be replaced in about four years. A LiFePO4 battery in the same application could last for over 15 years. The cost of purchasing and installing replacement batteries multiple times will quickly surpass the initial savings of the cheaper option, making it the more expensive choice in the long run.

LiFePO4 vs. Other Li-ion: A Financial Breakdown

To illustrate the TCO difference, a direct comparison is helpful. By analyzing the numbers, you can see how the higher upfront LiFePO4 battery price leads to superior long-term savings.

A Comparative Table: Price vs. Value

| Metric | LiFePO4 Battery | Standard Li-ion (NMC) |

|---|---|---|

| Initial Cost (Example) | $400 | $250 |

| Cycle Life (at 80% DoD) | ~6,000 cycles | ~1,000 cycles |

| Total Energy Delivered | ~6,144 kWh | ~1,024 kWh |

| Cost per kWh (Lifetime) | ~$0.065 | ~$0.244 |

| Replacements over 15 years | 0 | 3-4 |

Disclaimer: These figures are illustrative estimates. Actual costs and performance may vary based on specific products, usage patterns, and operating conditions. This content is for informational purposes and does not constitute financial advice.

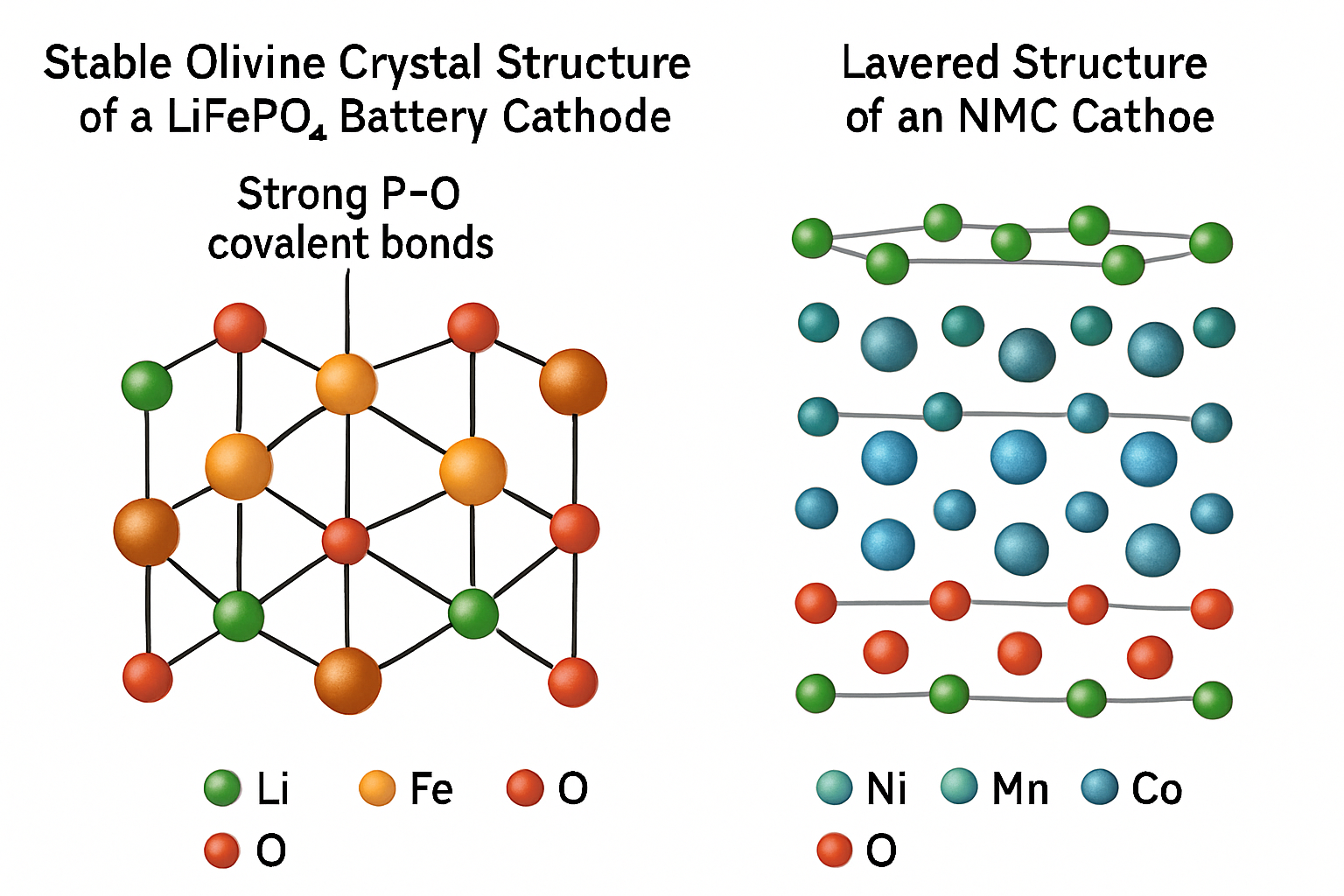

Safety's Financial Impact: Avoiding Catastrophic Costs

The chemical structure of LiFePO4 is inherently more stable than that of many other lithium-ion chemistries. It has a much higher thermal runaway threshold, making it far less susceptible to overheating and fire. The U.S. Department of Energy has highlighted the importance of thermal stability in stationary energy storage for preventing hazardous events. A battery failure can lead to catastrophic financial losses, including damage to your property and other components of your energy system. The superior safety profile of a LiFePO4 battery is a form of financial protection that is difficult to quantify but immensely valuable.

Making a Financially Sound Decision for Your Energy System

Selecting the right battery is about securing long-term energy independence, not just finding the lowest initial price. A reliable and long-lasting battery is the cornerstone of any high-performance solar or off-grid solution.

Aligning Battery Choice with Application Needs

For stationary applications like a home battery storage system or an off-grid solar setup, longevity and safety are paramount. In these scenarios, the benefits of a LiFePO4 battery—long cycle life, high efficiency, and thermal stability—directly align with the goal of creating a dependable, long-term energy solution. The higher upfront cost is an investment in reliability and lower lifetime expenses.

Future-Proofing Your Investment

An energy storage system is a significant investment. Choosing a battery technology that is built to last ensures you get the most out of that investment. A LiFePO4 battery's extended lifespan means you can enjoy clean, reliable power for years to come without worrying about imminent replacement costs. This long-term perspective is essential for achieving true energy independence and a positive return on your investment.

A Smarter Investment for Energy Independence

While the initial LiFePO4 battery price may be higher, a thorough analysis of the total cost of ownership proves it is the more economical and reliable choice for long-term energy storage. Its extended cycle life, superior safety, and high efficiency deliver far greater value over time. By looking beyond the sticker price, you can make a smarter financial decision that supports your energy goals for more than a decade.

Frequently Asked Questions

Is a higher upfront cost for a LiFePO4 battery always justified?

For applications requiring daily cycling and a long service life, such as solar energy storage or off-grid living, the higher initial cost is almost always justified by a significantly lower total cost of ownership. Its superior cycle life and safety provide better long-term value. For short-term or low-use applications, other chemistries might be considered, but safety should always be a primary factor.

How do I calculate the cost per cycle for a battery?

A simple way to estimate this is to divide the battery's initial purchase price by its expected number of cycles. For example, a $400 battery with a 6,000-cycle life has a cost of approximately 6.7 cents per cycle. A more detailed calculation would factor in the battery's capacity and depth of discharge to find the cost per kilowatt-hour delivered over its lifetime.

Does temperature affect the long-term cost of a battery?

Yes, operating temperature significantly impacts battery health and longevity. Extreme heat or cold can accelerate degradation and reduce cycle life. LiFePO4 batteries generally have a wider operating temperature range and better thermal stability than many other lithium-ion types, which contributes to their longer lifespan and lower long-term cost, especially in demanding environments.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.