Investing in a solar energy storage solution is a significant step towards energy independence. Lithium Iron Phosphate (LiFePO4) batteries have become a leading choice for home energy storage systems due to their safety, longevity, and performance. Before committing to this technology, it's practical to conduct a cost-benefit analysis. Calculating the Return on Investment (ROI) provides a clear financial picture, helping you assess the long-term value of a LiFePO4 battery system.

Understanding the Core Components of Your Investment

A complete ROI calculation begins with a thorough understanding of all upfront costs. These initial expenses are the foundation of your investment and are critical for an accurate financial assessment. Beyond the hardware, the inherent qualities of LiFePO4 technology contribute significantly to its long-term value.

Initial Costs Breakdown

The total investment for a solar battery storage system extends beyond the price of the battery itself. Several components contribute to the final cost. A comprehensive list includes:

- Battery Unit: The cost varies based on capacity, such as 100Ah or 200Ah models.

- Solar Inverter: A hybrid inverter is often necessary to manage energy flow between solar panels, the battery, and the grid.

- Balance of System (BOS): This category includes all necessary wiring, mounting hardware, and safety components.

- Installation Labor: Professional installation ensures the system is set up safely and correctly, but adds to the upfront cost.

- Permits and Fees: Local authorities often require permits and inspections, which have associated costs.

| Component | Estimated Cost Percentage | Notes |

|---|---|---|

| LiFePO4 Battery Pack | 40-50% | The primary component, cost varies with kWh capacity. |

| Inverter / Power Conversion System | 15-20% | Manages DC to AC conversion and energy flow. |

| Installation & Labor | 15-20% | Varies by location and complexity of the installation. |

| Balance of System (BOS) | 10-15% | Includes wiring, conduits, safety disconnects, etc. |

| Permits & Inspection | 5-10% | Local administrative fees. |

The Role of LiFePO4 Technology in Long-Term Value

LiFePO4 batteries offer distinct advantages that enhance their ROI over time. Their chemistry is known for thermal stability and a long cycle life, often exceeding thousands of charge-discharge cycles while retaining high capacity. This durability means the battery will perform reliably for many years, extending the period over which you can generate savings. As noted in a report from Quality infrastructure for smart mini-grids, the reliability of lithium iron phosphate batteries makes them suitable for demanding applications like portable mini-grids. This resilience translates directly to better long-term financial returns for homeowners.

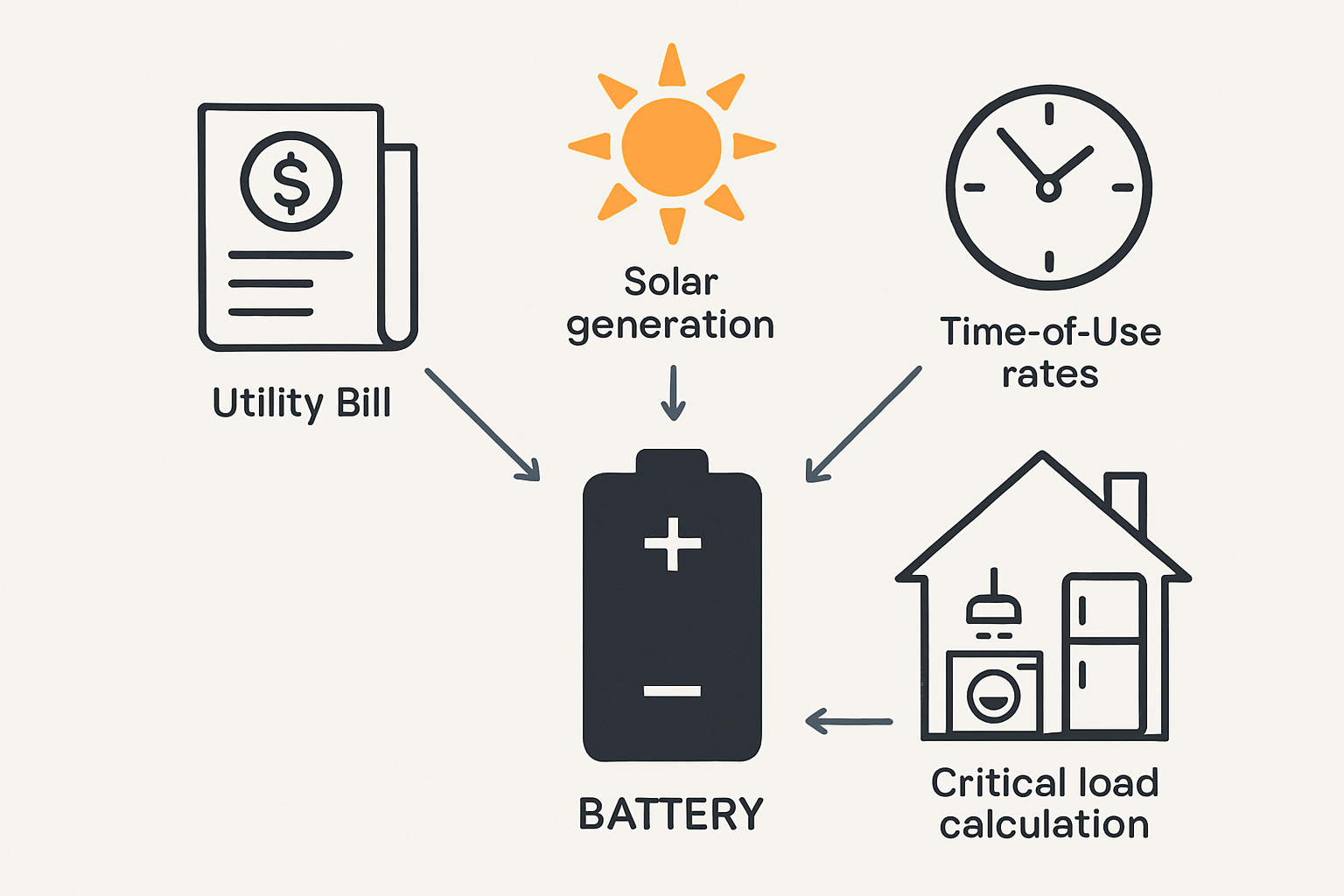

Identifying Your Revenue Streams and Savings

The financial return from a LiFePO4 battery system comes from several sources. These are not direct payments but rather savings and optimized energy use that reduce your expenditures and, in some cases, generate credits.

Direct Savings on Electricity Bills

The most immediate financial benefit is a reduction in your monthly utility bills. By storing excess solar energy generated during the day, you can power your home at night or on cloudy days instead of purchasing electricity from the grid. This practice, known as self-consumption, directly reduces your reliance on your utility provider and protects you from fluctuating energy prices. The greater the difference between what your utility charges for electricity and what they pay for exported solar energy, the more valuable a battery becomes.

Maximizing Gains with Time-of-Use (TOU) Rates

Many utility companies have Time-of-Use (TOU) rate plans, where the price of electricity changes throughout the day. Electricity is typically most expensive during peak demand hours, such as late afternoons and early evenings. A battery system allows you to engage in energy arbitrage: you store energy when it's cheap (either from solar or off-peak grid power) and use it during these expensive peak hours. This strategy can lead to significant savings and accelerate your ROI.

Incentives, Tax Credits, and Rebates

Government incentives can substantially lower the net cost of your system. In the United States, the federal Residential Clean Energy Credit provides a significant tax credit on the total cost of a solar and battery storage installation. As highlighted in the World Energy Investment 2023 report, policies like the Inflation Reduction Act have bolstered financial support for clean energy technologies, including battery storage. Additionally, many states and local utilities offer their own rebates and incentives that can be stacked with federal credits, further reducing your initial investment.

The Step-by-Step ROI Calculation

Calculating the ROI involves a straightforward formula, but requires gathering accurate data about your costs and projected savings. A detailed analysis will provide the clearest picture of your investment's financial performance over time.

The ROI Formula Explained

The basic formula for ROI is:

ROI (%) = (Total Net Savings / Net System Cost) * 100

Where:

- Net System Cost: This is your total upfront cost minus any rebates, tax credits, or incentives you receive.

- Total Net Savings: This is the cumulative financial benefit over the battery's lifespan, primarily from reduced electricity bills.

Another useful metric is the payback period, which tells you how long it will take for the system to pay for itself. You can calculate it by dividing the Net System Cost by your Annual Savings. A typical payback period for a solar battery system is often between 7 and 10 years.

A Practical Calculation Example

Let's consider a hypothetical home energy storage system:

- Total Initial Cost: $18,000

- Federal Tax Credit (30%): $5,400

- Net System Cost: $18,000 - $5,400 = $12,600

- Average Annual Electricity Savings: $1,500 (from self-consumption and TOU optimization)

Payback Period Calculation:

$12,600 (Net System Cost) / $1,500 (Annual Savings) = 8.4 years

ROI Calculation over 15 years:

- Total Savings over 15 years: $1,500 * 15 = $22,500

- Total Net Savings: $22,500 - $12,600 = $9,900

- ROI: ($9,900 / $12,600) * 100 = 78.6%

Factors That Influence Your ROI

Your specific ROI will depend on several variables. Key factors include your local electricity rates, your household's daily energy consumption patterns, and the amount of sunlight your location receives. The system's design also plays a crucial role. Properly sizing your battery and understanding its capabilities are essential for maximizing returns. For a deeper dive into system specifications, an ultimate reference on solar storage performance can help clarify how metrics like depth of discharge and round-trip efficiency directly impact your savings potential.

Beyond the Numbers: The Intangible Benefits

While financial metrics are important, the value of a LiFePO4 battery system isn't purely monetary. There are several non-financial benefits that add to its overall appeal.

Energy Independence and Security

A home battery storage system provides a reliable source of backup power during grid outages. This energy resilience ensures that your essential appliances, like refrigerators and medical devices, remain operational. The peace of mind that comes with knowing your home is protected from blackouts is a significant, though unquantifiable, return.

Environmental Impact

By storing and using your own solar energy, you reduce your household's reliance on fossil fuels. This contributes to a smaller carbon footprint and supports the transition to a cleaner energy grid. According to a study by the IEA on Next Generation Wind and Solar Power, distributed energy assets like home batteries can improve grid stability by minimizing the amount of electricity fed back into the grid, making renewable energy more manageable at a larger scale.

A Forward-Looking Investment

Calculating the ROI for a Lithium Iron Phosphate battery system reveals it as more than just a purchase; it's a long-term investment in your financial and energy future. By carefully analyzing initial costs, potential savings, and available incentives, you can make an informed decision. The combination of direct bill savings, energy independence, and environmental benefits makes a compelling case for adopting this reliable and scalable energy solution.

Disclaimer: This information is for educational purposes only and does not constitute financial or legal advice. Consult with a qualified professional before making any investment decisions.

Frequently Asked Questions

What is a good ROI for a solar battery system?

A favorable ROI often corresponds to a payback period of 7 to 10 years, though this can vary widely based on local electricity costs, system price, and available incentives. After the payback period, the energy savings represent a direct return on your investment for the remaining life of the system.

How long do Lithium Iron Phosphate batteries last?

High-quality LiFePO4 batteries are known for their longevity. They can typically endure 3,000 to 6,000 charge cycles and can last for 10 to 15 years or more, often retaining 70-80% of their original capacity at the end of their warrantied life.

Can I add a battery to my existing solar panel system?

Yes, you can add a battery to an existing solar PV system. This process, often called AC coupling, involves installing a battery and a compatible multi-mode inverter that works alongside your current solar setup to store excess energy.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.