Investing in a solar energy system is a significant financial decision that affects not only your monthly electricity bill but also your long-term energy independence. When you consider turning sunlight into electricity, you’ll encounter several financing options—the most common are an outright cash purchase, loan financing, and a Power Purchase Agreement (PPA). Each option follows a distinct financial path with different return on investment (ROI) potential and payback timelines. Understanding these differences will help you choose the path that best fits your financial situation and energy goals.

Cash Purchase: Immediate Ownership & Maximized Long-Term Returns

Opting to buy a solar system with cash means paying the full upfront installation cost. This approach gives you immediate ownership and delivers the most direct financial benefits.

Upfront Investment & Immediate Benefits

Although a cash purchase requires a higher initial outlay, it lets you immediately claim available incentives, such as the federal solar tax credit. These incentives can significantly reduce your total investment. Once the system is up and running, you’ll see an immediate drop in your electricity bills—and in some cases, you may even reach a zero-bill scenario.

With a cash purchase, you retain full control over the system, including the freedom to choose high-quality components. For example, selecting high-performance, safe, and reliable lithium iron phosphate (LiFePO4) batteries as the storage core can extend system lifespan and improve efficiency, thereby maximizing long-term ROI.

Calculating ROI and Payback Period

Calculating ROI for a cash purchase is relatively straightforward. The typical formula is:

ROI = (Total Returns − Total Cost) / Total Cost × 100%

Here, “Total Returns” include lifetime electricity bill savings, potential income from net metering, and any increase in property value attributable to the system.

The payback period is the time it takes to recover your initial investment through savings and incentives. The formula is:

Payback Period = Initial Investment Cost / Average Annual Electricity Bill Savings

Cash purchases usually offer the shortest payback period and the highest long-term ROI because you pay no interest or service fees.

Loan Financing: Lower Barrier & Gradual Returns

For households that want solar without a large upfront cash outlay, solar loans provide a practical pathway and make adoption more accessible.

Types of Solar Loans & Interest Rates

Solar loans come in various forms, including secured loans (e.g., backed by home equity) and unsecured personal loans. The interest rate, term, and conditions directly affect your monthly payment and total costs. Choosing the right loan helps you progress toward energy independence without straining your monthly budget.

According to Solar Energy Perspectives, renewable technologies are inherently capital-intensive, requiring significant upfront investment and offering returns over time; the cost of capital accounts for a large share of levelized costs. Financing addresses this by spreading a large upfront investment into manageable monthly payments.

Clean Energy Investment Trends 2019 also emphasizes that fluctuations in benchmark lending rates influence the overall cost of capital for clean-energy projects—reminding you to consider rate structures and market trends carefully when selecting a loan.

Payback Period & Financial Considerations

With a loan, you still own the system and can claim tax credits and other incentives. However, interest payments increase your total expenditure, extending the payback period and slightly reducing overall ROI. Even so, monthly bill savings often offset—or partially offset—loan payments, delivering immediate financial benefits.

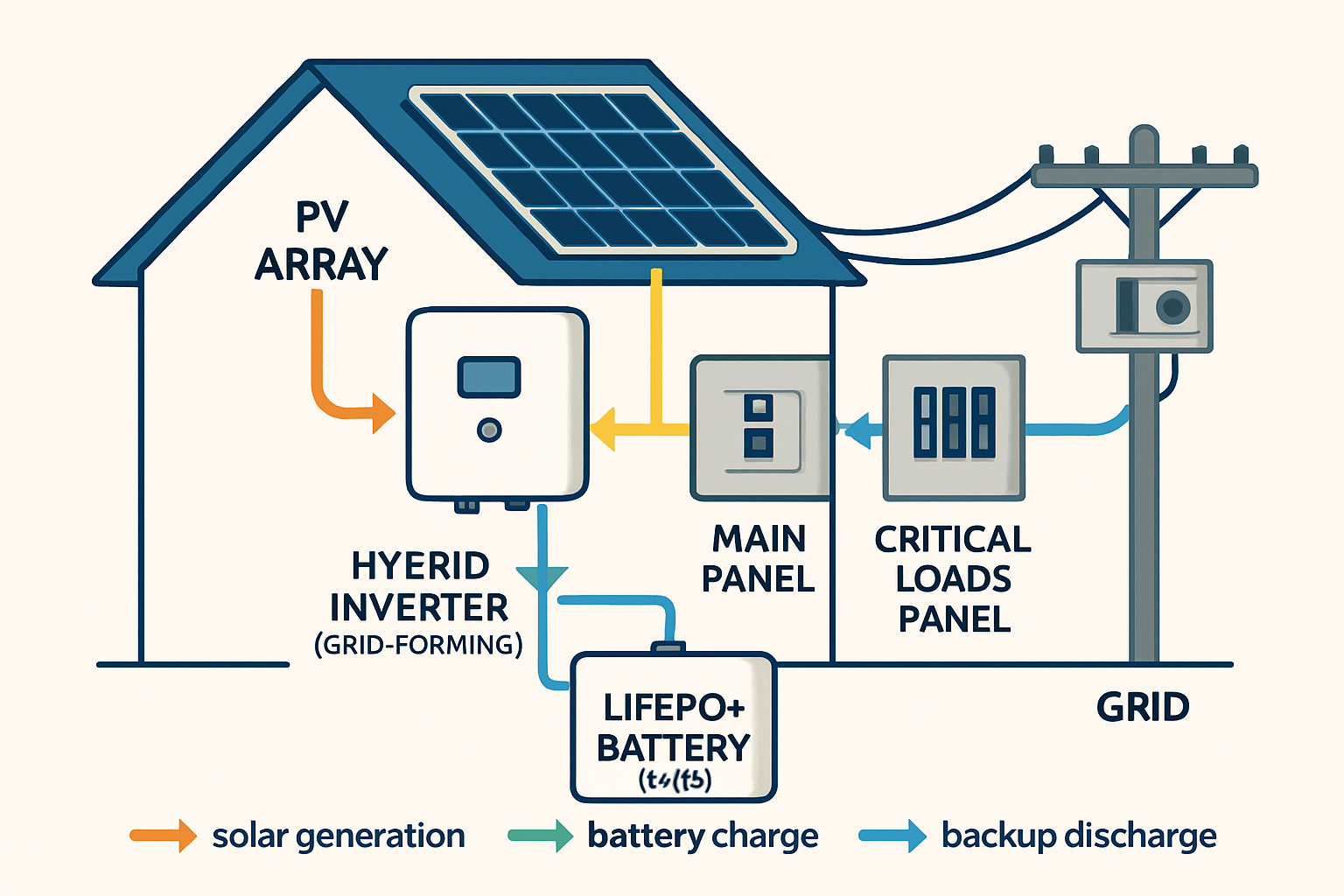

When evaluating a loan, weigh the interest rate, loan term, monthly payment, and expected bill savings. A comprehensive home energy storage setup—integrating lithium batteries, a hybrid inverter, and solar panels—can maximize energy efficiency and accelerate your real-world payback.

Power Purchase Agreement (PPA): Zero Upfront Cost & Predictable Savings

A PPA is a distinctive solar financing model that requires no upfront payment. Under this arrangement, a third-party provider owns, installs, and maintains the system, and you purchase the electricity it produces at a fixed or variable rate as specified in the contract.

How a PPA Works

The core of a PPA is “pay-as-you-go.” You do not bear the purchase, installation, or maintenance costs; the PPA provider handles those and ensures proper operation. You simply pay for the electricity generated—typically at a price lower than local utility rates. This model removes investment risk and maintenance burdens, letting you enjoy clean energy with ease.

Wider deployment of solar technology—especially across more countries and regions—helps reduce costs and drive sustained growth, ultimately enhancing competitiveness. By lowering the financial barrier for users, PPAs promote broader adoption and contribute to industry-wide cost declines.

PPA ROI & Long-Term Value

A PPA does not involve a direct ROI or payback calculation because you are not investing capital in the system. Your benefit comes from monthly bill savings. With a PPA, you gain predictable electricity—often priced below market—resulting in ongoing cost savings over the contract term.

While a PPA does not grant system ownership or direct access to tax credits (these typically accrue to the provider), it offers a low-risk, hassle-free energy solution. For customers with tight budgets or those who prefer not to assume ownership responsibilities, a PPA can be very appealing.

Comparing Options & Making a Smart Choice

After understanding the different financing paths, compare them against your own situation to make the best decision. The table below summarizes the key features of cash purchase, loan financing, and PPAs:

| Feature | Cash Purchase | Loan Financing | Power Purchase Agreement (PPA) |

|---|---|---|---|

| Upfront Cost | High | Low to none | None |

| System Ownership | Immediate, full ownership | Ownership after loan payoff | Owned by third party |

| Maintenance Responsibility | Homeowner | Homeowner | PPA provider |

| Tax Credits & Incentives | All benefits to homeowner | All benefits to homeowner | Generally claimed by provider |

| Long-Term ROI | Highest | Strong | Indirect savings; no direct ROI |

| Payback Period | Shortest | Longer (interest impact) | No direct payback; ongoing savings |

| Monthly Electricity Bill | Significantly reduced or zero | Savings offset part of loan payment | Pay contracted rate, typically below market |

Factors That Influence Your Decision

- Financial Position: Do you have sufficient liquidity for a cash purchase? Is your credit score strong enough to secure a favorable loan rate?

- Desire for Ownership: Do you want full ownership and control of your energy system?

- Risk Tolerance: Are you comfortable taking responsibility for system maintenance and performance?

- Long-Term Energy Goals: Are you aiming to maximize long-term financial returns, or do you prioritize zero upfront cost and risk avoidance?

We offer reliable, scalable energy solutions designed to help you achieve energy independence. Whatever financing route you choose, our products—including high-efficiency solar inverters, durable LiFePO4 batteries, and comprehensive off-grid solar solutions—provide a solid foundation. Purpose-built for homes, farms, cabins, and more, they deliver stable, dependable power so you can make the most of your solar investment.

Moving Toward Energy Independence

Selecting the financing option that fits you best is a key step toward energy independence. Whether you opt for the maximum long-term benefits of a cash purchase, the lower initial barrier of a loan, or the worry-free clean energy of a PPA, each path can help reduce your carbon footprint and your electricity costs. By carefully assessing your personal circumstances and goals, you’ll find the solar investment pathway that meets your needs.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.