As the solar industry continues its expansion, the focus sharpens on maximizing the energy output of every installed panel. Ground mount solar trackers are central to this effort, shifting from a niche upgrade to a standard component for large-scale projects. These systems optimize panel orientation to follow the sun, boosting energy generation. For 2025, the key considerations for adopting this technology revolve around a careful balance of cost, the risk of mechanical failure, and the overall bankability of the investment. The global solar tracker market is projected to grow significantly, reflecting its increasing importance in achieving renewable energy goals.

The Evolving Cost Equation of Solar Trackers

Evaluating solar trackers requires looking beyond the initial price tag. The true financial picture emerges from a lifetime analysis of investment versus performance gains. This calculation is becoming more favorable as technology advances and energy yields increase.

Upfront Investment vs. Long-Term Gains

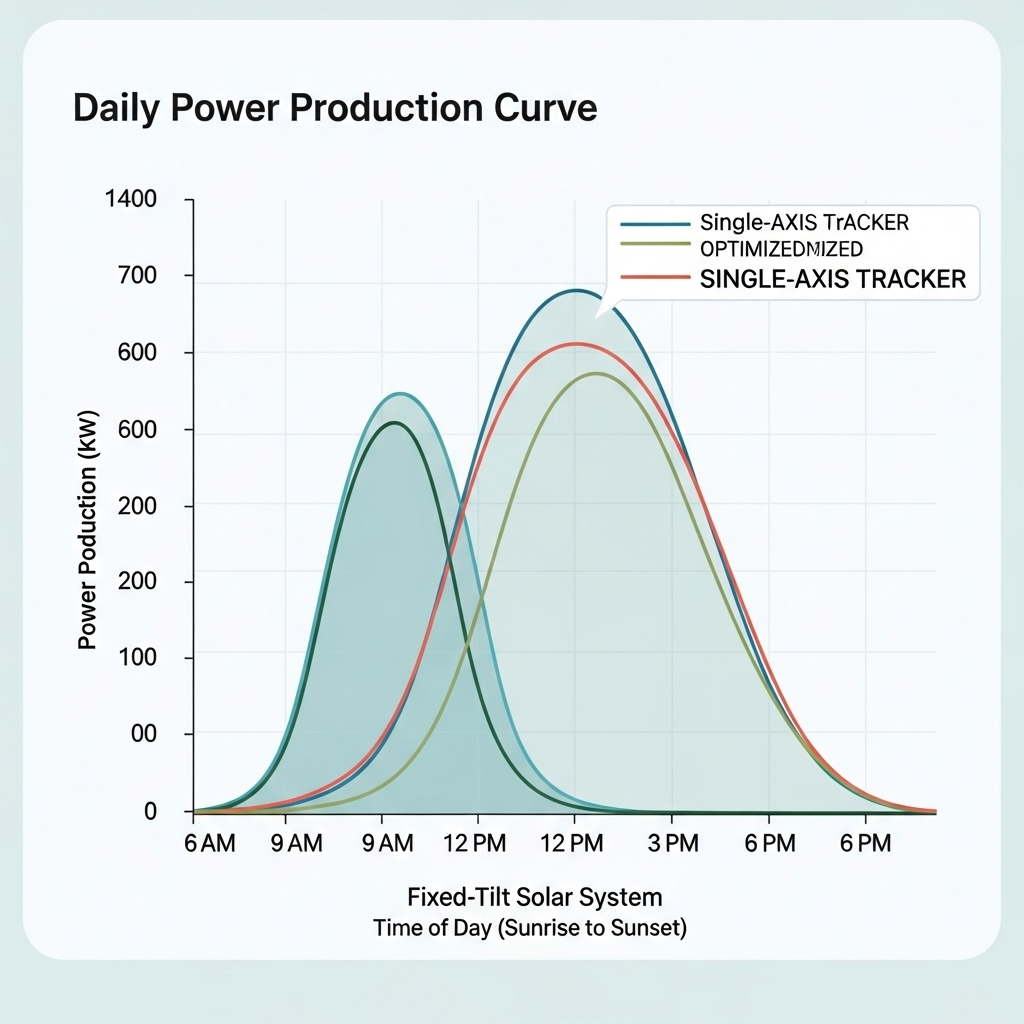

Ground mount trackers carry a higher initial capital cost compared to traditional fixed-tilt systems. This investment, however, unlocks substantial long-term value. A single-axis tracker can increase a solar plant’s energy output by a significant margin. According to a report from the Next Generation Wind and Solar Power, single-axis trackers may generate 12-25% more electricity than fixed systems. More recent analyses suggest this gain can be as high as 25-35% in optimal conditions. This increased production directly lowers the Levelized Cost of Electricity (LCOE), a critical metric for project viability. The synergy with bifacial modules, which capture reflected light from the ground, further amplifies these gains and strengthens the return on investment.

Operations and Maintenance (O&M) Considerations

Because trackers contain motors, gears, and control systems, their maintenance requirements are inherently more complex than static racking. These O&M activities can include periodic lubrication, software checks, and component calibration. While this adds to the operational budget, the costs are often offset by the increased energy revenue. When analyzed on a per-kilowatt-hour basis, the maintenance cost for a tracker system can be lower than that of a fixed system because of the superior energy production. It is also important to note that tracker O&M typically represents a small fraction of a plant’s total maintenance budget, often less than expenses related to inverters. Properly pairing trackers with a robust energy storage system is crucial for maximizing self-consumption and ensuring a stable power supply. As detailed in the Ultimate Reference for Solar Storage Performance, understanding your system's performance metrics is key to optimizing long-term financial returns.

Navigating Tracker Failures and Reliability

The long-term performance of a solar asset depends on the durability of its components. For trackers, this means designing systems that can withstand decades of continuous operation in harsh outdoor environments. Understanding potential failure points is the first step toward mitigating risk.

Common Points of Failure

Tracker failures generally fall into three categories: mechanical, electrical, and structural. Mechanical wear affects components like motors, bearings, and drive shafts. Electrical issues can arise in controllers, sensors, or the wiring that connects them. Structurally, the entire system must be engineered to handle extreme weather, particularly high wind loads. Some designs rely on moving to a safe 'stow' position during high winds, which introduces a point of failure if the control system or motor is unresponsive. Environmental factors like dust, ice, and extreme temperatures can also degrade components and impede movement over time.

Mitigating Risks Through Technology and Design

Modern tracker design incorporates advanced technology to enhance reliability. The integration of IoT and AI allows for predictive maintenance, where sensors and algorithms detect potential issues before they cause downtime. The fundamental design philosophy also plays a major role. For instance, a linked-row architecture that uses a single motor to drive multiple rows can have significantly fewer potential failure points than designs that use individual motors for each row. Advances in material science, such as the use of high-strength, corrosion-resistant steel and aluminum alloys, also contribute to a longer operational life. Rigorous third-party testing and certification provide an additional layer of assurance that a system can perform as specified.

The Pillars of Tracker Project Bankability

For any large-scale solar project to move from concept to reality, it must be 'bankable.' This term signifies that a project is sufficiently low-risk and financially attractive to secure financing from banks and investors. The choice of tracker technology is a critical component of this evaluation.

What Makes a Project 'Bankable'?

Bankability is a measure of confidence. It confirms that a project is built on proven technology from a reputable supplier, has a sound financial structure, and has thoroughly accounted for potential risks. Lenders and investors conduct extensive due diligence, scrutinizing everything from the equipment warranties to the projected energy yield data. A project is deemed bankable when financiers are confident in its ability to generate predictable returns over its entire lifespan, which can be 25 years or more.

How Trackers Influence Investment Decisions

Trackers directly impact a project's financial model and risk profile. The enhanced energy yield they provide is the primary driver of revenue, so financiers require high-confidence production estimates backed by validated, long-term solar data. The manufacturer's reputation, financial stability, and product warranty are heavily scrutinized. Independent engineering reports, such as a bankability study from a firm like DNV, are often required to validate the technology's long-term performance and reliability. Furthermore, investors need to see a comprehensive O&M plan that details how the trackers will be maintained to ensure they meet performance targets for the life of the project. The foundation and structural elements, including the piles for ground mounts, are equally critical; a structural failure compromises the entire investment.

A Forward Look: The Future of Ground Mount Trackers

The adoption of solar trackers is set to continue its upward trajectory, solidifying their role as a cornerstone of utility-scale solar development. The technology is no longer a question of 'if' but 'how' it can be further optimized. Future advancements will likely focus on deeper integration of smart technology, using AI to adjust panel orientation based on weather forecasts and grid demands. Innovations in materials will yield lighter yet stronger designs, simplifying logistics and reducing installation time. As the energy landscape evolves, the pairing of trackers with battery storage will become even more crucial, transforming intermittent solar farms into dispatchable power plants. While the initial costs and operational complexities demand careful planning, the path to developing bankable, high-performing solar assets in 2025 and beyond is clearly aligned with advanced tracking technology.

Frequently Asked Questions

Are solar trackers worth the additional cost in 2025?

For large-scale commercial and utility projects, the increased energy generation (25-35% for single-axis) typically justifies the higher upfront cost, leading to a lower LCOE and better long-term returns. For smaller residential systems, the economics may be less favorable.

What is the primary cause of solar tracker failures?

Failures can be both mechanical and electrical. Mechanical issues often involve motors and gears subject to wear, while electrical failures can affect controllers and sensors. Environmental stress from wind and extreme temperatures is also a significant factor.

How do solar trackers improve the bankability of a solar project?

Trackers improve bankability by significantly boosting a project's energy output and, therefore, its revenue potential. When backed by a reliable manufacturer with a proven track record and a solid O&M plan, the higher return on investment makes the project more attractive to lenders and investors.

Leave a comment

All comments are moderated before being published.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.